.jpeg)

(Source: Cointelegraph)

A few days ago, a friend complained that in addition to buying mainstream assets, the remaining part of USDT in the MXC matcha account has shrunk a lot since July.

My friend and I suggested to pay more attention to the big economic fundamentals. The Fed has planned to devalue the U.S. dollar since March of this year. It is strange that USDT does not shrink.

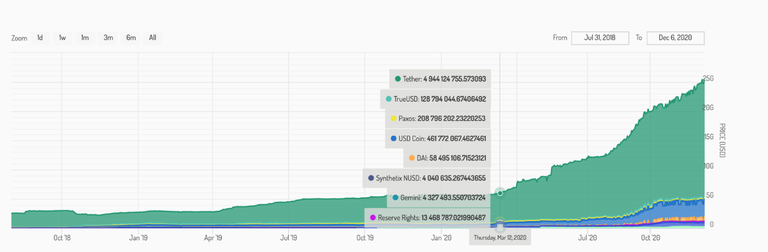

Let us first review the entire 2020 USDT issuance situation.

In 2020, the issuance and destruction of stablecoins occur frequently. Especially in March, when the market was the most volatile, the number of additional issuances and destructions was the most, and the amount of additional issuance reached the highest in that month.

Taking USDT as an example, according to the data on the tokenview chain, as of December 7, 2020, USDT has issued a total of 6,892 times, and the total amount of additional issuance is 19.67 billion U.S. dollars (1USDT=1 U.S. dollar).

Among them, a total of 3466 additional issuances were issued in 2020, accounting for 50.29% of the total number of additional issuances; the total additional issuance was US$15.563 billion, accounting for 79.12% of the total additional issuance, which was a 7-fold increase compared with the total amount of additional issuance in 2019.

At the same time, the overall market value of stablecoins has continued to surge since March. According to stablecoinindex data, as of December 7, the total market value of stablecoins has exceeded US$23.4 billion.

(Source: stablecoinindex)

Let us review the situation of the additional issuance of US dollars in 2020. Here is a related statistics:

As of December 2020, the additional issuance of US dollars in the past 8 months accounted for 40% of the total US dollar supply. According to previous media reports, throughout 2020, in order to stimulate economic growth, the United States issued large-scale additional US dollars and bonds, and released a total of 18 trillion US dollars of base currency liquidity and economic stimulus plans in the past 34 weeks. As of the fiscal year of September this year, the US fiscal deficit has tripled to more than $3 trillion.

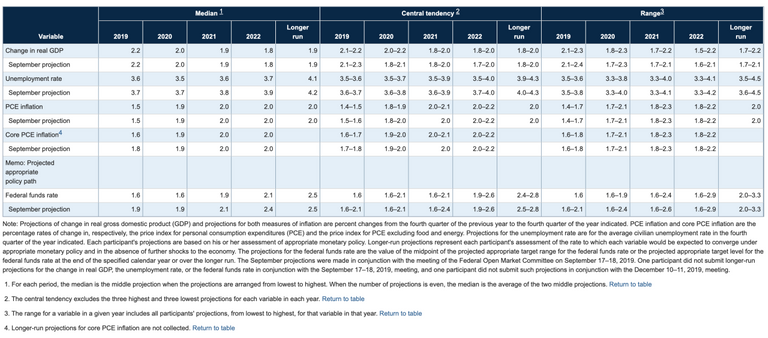

According to the Federal Open Market Committee meeting minutes released by the Federal Reserve, almost all participants believe that the expected inflation rate of the US dollar will reach or slightly exceed the 2% target set by the committee in 2021-2022, and there are more participants. It is predicted that the inflation rate will exceed 2% at some point during the forecast period.

Data source: Federal Reserve Monetary Policy Report 2020

The U.S. dollar index also fell sharply from March, from 102.99 to the lowest of 89.73, a drop of about 14.78%. And the ratio of USDT to US dollar has always been maintained between 1.02-0.998, and it is not surprising that USDT is issued and depreciated.

Which assets can realize asset preservation?

There is no doubt that Bitcoin has become the most effective means of asset preservation under the economic stimulus environment in the United States. According to BNBC reports, late on the 27th local time, Trump signed a US$2.3 trillion COVID-19 bailout and federal government comprehensive spending bundle bill, including US$900 billion of COVID-19 bailout funds and 1.4 trillion government. Expenditure funds.

As soon as the news came out, Bitcoin rose accordingly. According to data from the MXC Matcha trading platform, 24939USDT directly rushed to 28409USDT, an intraday increase of 13.91%.

Data source: MXC matcha trading platform

At the beginning of March this year, although the stock market experienced a meltdown, gold (London Gold CFD) fell to 1451.55, but then began to rise, reaching 2074.71 on August 14, an increase of 42.93%. As the U.S. dollar continues to be issued, USDT bears the liquidity demand of the crypto market, but from the current economic background, it is expected that USDT will continue to be issued with the additional issuance of the U.S. dollar to maintain a stable exchange ratio. Therefore, USDT is suitable for trading as a medium. , Not suitable for long-term storage in the wallet.

In the context of the Fed’s inflation, companies, institutions, or individuals with natural resources, labor, and hard assets must be able to retreat. For institutions and individuals, holding Bitcoin and gold is undoubtedly the best way to achieve asset preservation. Compared with gold, Bitcoin has the advantages of trustlessness, super-sovereignty, sufficient security and convenience, and its limited output, the advantages are undoubtedly far better than gold.

Since the halving of Bitcoin production on May 12, only 210,000 Bitcoins have been dug up in 7 months, and the Grayscale company alone bought more than 250,000 Bitcoins. The output is far from satisfying the needs of the "giant whales". Purchasing needs. (Note: The output during this time period is not equal to the supply)

"Currency Wars" author James Ricards once wrote: "If the United States prints a lot of money and another country tries to peg its currency to the U.S. dollar, that country can only print money to maintain the peg, which leads to the country’s Inflation."

As for how long the Fed’s economic stimulus plan will last, we cannot know, but if the Fed continues to print money to have a greater impact on other countries (the country whose currency is pegged to the US dollar), it will inevitably cause a chain of “devaluations”. As long as the Fed’s economic stimulus plan continues, the rise in bitcoin prices will not end.