SNX rose by about 40% within a week, reaching a maximum of $8.13. According to the latest data, the price of SNX was US$6.82, compared to US$5.28 a week ago.

Behind the increase is the announcement of the listing of SNX on the 15th Coinbase. Although Coinbase has listed tokens such as Compound and Uniswap, it is not a favorite project of many people in this field. That is, users and investors who want to benefit from the centralized exchange hope that Coinbase can be listed on the well-known DeFi and Synthetix Network Tokens.

But this day will soon come, just last week Coinbase supported Coinbase customers in Coinbase.com and Coinbase Android and iOS apps, which can buy, sell, convert, send, receive or store AAVE, BNT and SNX. At the same time, the price of SNX and other tokens on Coinbase immediately soared.

The greed of the market has also caused varying degrees of concern. After a brief rise in SNX, will it immediately fall? Because last week, someone heard rumors that the U.S. Treasury Department and Secretary Mnuchin plan to introduce new rules for self-custodial crypto wallets before the end of their term. Then the introduction of new regulations will definitely have a negative impact on the market.

There is no specific news from the U.S. Treasury Department, although the voices of regulation are one after another. But as technology is widely adopted both inside and outside the traditional financial system, it should be possible to find a way to support innovative technology. As for the derivatives track in the DeFi field, it will still be a track that is enthusiastic for coin lovers.

Just as Mable, the executive director of Multicoin Capital, said, the application side will continue to explode next year , and there will also be many opportunities for synthesizing assets on the derivatives track in the DeFi field.

SNX is considered to be the leader of synthetic asset trading. Through proper use of cryptography, consensus mechanism, peer-to-peer network, incentive mechanism, etc., it completes value transfer without the participation of a third party. The issued synthetic assets that map real assets are also regarded as representatives of the DeFi era , and the surprises that bring us far exceed this.

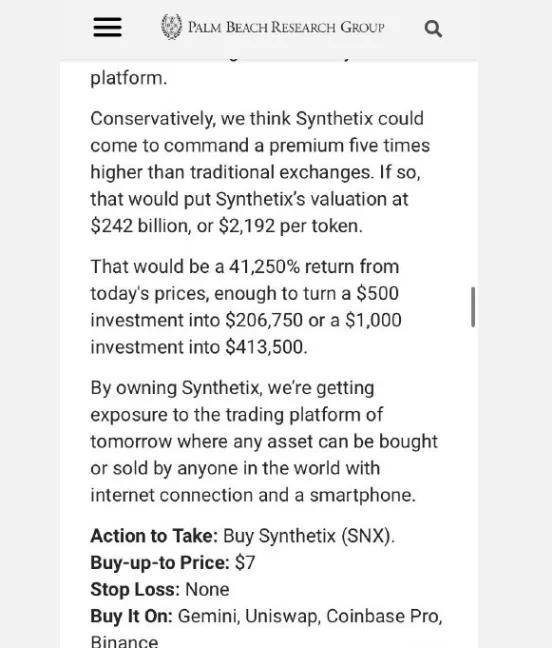

Previously, the PBC report stated that "Synthetix's valuation will reach 242 billion U.S. dollars." By then, the price of Synthetix will be 2,192 U.S. dollars per token. Crazy SNX has not stopped. In his speech on "Blockchain 3.0: From Asset On-chain to Asset Mapping", Changzheng stated that "the scale of synthetic assets and the scale of mortgaged assets will exceed one trillion US dollars."

Previously, the PBC report stated that "Synthetix's valuation will reach 242 billion U.S. dollars." By then, the price of Synthetix will be 2,192 U.S. dollars per token. Crazy SNX has not stopped. In his speech on "Blockchain 3.0: From Asset On-chain to Asset Mapping", Changzheng stated that "the scale of synthetic assets and the scale of mortgaged assets will exceed one trillion US dollars."

The seemingly absurd remarks have also exposed more people's optimism about the DEFi derivatives track. Blockchain has been in development for more than ten years. In addition to Bitcoin's groundbreaking, the latest real turning point of blockchain is the birth of the smart contract platform, and DeFi is regarded as the second breakthrough in the history of encryption.

Not only that, DeFi truly achieves the matching of products and markets . So far, there have been two matches between products and markets in the history of encryption, one is Bitcoin and the other is DeFi. Although DeFi is still small, it is trying to build a field parallel to traditional finance, and is also trying to combine with traditional finance to achieve new features. This is a very interesting field worthy of in-depth exploration.