If you want to talk about the Defi market this year, you have to mention Compound, because its slogan "borrowing is mining" has become the starting point for the explosion of liquid mining. Its significance is as important as the first shot of an armed revolutionary uprising.

When its token COMP turned out, the pattern of the market also quietly changed.

1. The founder who focused on market interest rates switched from traditional finance to the crypto world

Compound founder Robert Leshner was originally a bond geek and rating expert in the traditional financial market, and later became a software founder and product manager.

He participated in Bitcoin mining in 2013, but failed to continue. Since then, has been concerned about the world of encryption. In 2017, Ethereum enabled smart contracts to program assets. In response, he sighed: "Wow! This is like a brand new opportunity that hasn't really been touched yet."

At that time, more people's attention was on ICO and currency issuance, and there were too many new projects and currencies emerging on the market. But what he wants is to unlock this great technology and go all out to enter this new market. Of course, he did it later.

In October 2017, he and his partners began to study different methods to solve the problem of idling and inefficiency of most assets in the crypto market.

After research, they officially launched Compound in September 2018. It is an intermediary in the crypto world, matching asset providers and borrowers, where the interest rate generated is determined by the supply and demand of each cryptocurrency asset. This operating model is similar to traditional banks.

The tokens lent by Compound are related to the deposited assets. Its mechanism is to deposit Token, then generate the corresponding cToken to lend, and finally use cToken to repay the loan and get back their Token. The cToken currently on the platform belongs to ERC20 tokens.

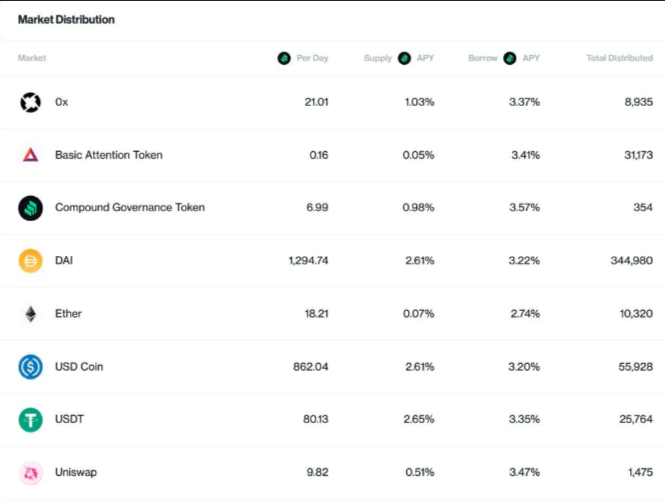

Data source official website

The platform now accepts a variety of tokens as collateral, such as Dai, ETH, and WBTC, and customers can also provide loans or loans within the time they want, so its market and user population are also quite good.

Robert has said that the main competitor is margin trading on centralized exchanges, but Compound can review the balance and check the health of the market. He hopes that as time goes by, more and more real-world assets will eventually appear on the blockchain, especially on Ethereum, and Compound can create an interest rate market for these assets.

With the popularity of Defi, Ethereum has indeed gained more and more attention. Maybe someday in the future will really be what he wants. However, before that, Compound's current development is also very good. So far, it has taken two rounds of financing, the seed round of 8.2 million US dollars, and the A round of 25 million US dollars. The latter is jointly completed by venture capital companies such as Andreessen Horowitz and Bain Capital Ventures.

Although the concept of Defi has been around for a long time and Compound was founded in 2018, MakerDAO has always been at the forefront in the lending field. It was not until Compound proposed that "borrowing is mining", which brought new changes to the market structure.

2. "Lending is mining" opens the prelude to liquid mining

Throughout this year's Defi market, I have to mention Compound. In June, its slogan allowed liquid mining to enter the circle of "common people's homes."

"Lending is mining" is like a sudden spark falling into a pile of fireworks and igniting the fuze instantly, causing the sky to be filled with all kinds of fireworks, which are eye-catching and gorgeous, and at the same time, it is a bit at a loss.

Prior to this, MakerDAO and Aave issued coins in lending projects, while Compound and dYdX had not issued coins. Since calling out "borrowing is mining", Compound also has its own token, COMP, which is used to incentivize users who provide liquidity to the platform.

Cao Yin once said in the show that we cannot call it "borrowing mining", but should call it liquidity incentives. He believes that this is a reasonable incentive, and the market is in an upswing period, with flexibility and room for upside. At the same time, this also means that the market space is not yet saturated.

24 hours after the launch of COMP, it rose by 124%, and on June 22, it rose to 366 US dollars, and its price was once more than 200 US dollars of ETH.

As of July 17, the total market value of Defi market tokens reached 8 billion US dollars, an increase of 800% in three months. The amount of locked tokens reached 2.58 billion, and Compound accounted for 26.94%.

This development trend is gratifying, but also frightening. After all, there was also an exchange that called out the transaction to be mining, and many big coffees endorsed it, but then there were many accidents and finally "failed" completely this year.

However, Compound is still slightly different. At least there will be no problems with the principal and interest involved in the loan, and if it is not for hacker attacks and the project party's withdrawal of funds, the fund pool will most likely be fine.

When users are attracted by "borrowing is mining", because of the income, users in the circle begin to enter the field of liquid mining on a large scale. This move not only brought large-scale funds, but also allowed more people to see the popularity of Defi for project development and related field development.

In liquid mining, for users, where is the money to go. The most important thing for users and capital flows is the rate of return.

Although God V once said, decentralized finance should not be just for maximizing returns. But people are greedy, but capital is profit-seeking.

3. Its era significance

The founder of the platform, Robert, stated on Twitter on December 18 that the vision of the Compound Chain is not to create a Compound on all L1s, but to connect a single global liquidity network. He has his great vision and expectations.

But for users, it may be more of an arbitrage tool. Despite the issued COMP, more than 50% of the tokens are allocated to platform users, and the rest are allocated to the team and shareholders. Although it is not used as a financing method or investment tool, it appears to improve the community governance of the platform. In any case, the platform and users are mutually beneficial.

Although mortgage lending is not new, and Compound is not the first to start this business, but it proposed that "borrowing is mining" has injected vitality into the market, activated the market, and opened the prelude to liquid mining. Unique existence. Originally, everyone was immersed in the "312" waterfall market and the expected low of the Bitcoin halving market. However, fortunately, the Defi market has driven the market, so that everyone can look forward to the rich game.

It is the first innovator to distribute tokens in the form of "borrowing and mining", which is a new attempt for the entire Defi market. Of course, it may also have unknown risks. V God also said that if Defi can provide much higher interest rates than traditional financial markets, there will either be unsustainable arbitrage behavior or ulterior risks behind it. There are risks, but the prospects are huge.

It may be the first shot in the liquid mining market, not its original intention. It is just to increase the platform's revenue, establish a "decentralized" governance structure, and a fairer token distribution model. It is ranked ninth in the total market value of Defi, at least giving the crypto market a little confidence and experimentation.