Still on our way to make our crypto work at their best for us, last time we talked about DeFi and how we can earn high APYs by participating in it.

If you start exploring this world, you will notice soon enough that some new platform is born every other day, making it sometimes hard to differentiate the good and legit ones from the fraudulent ones.

Also, as we already said, some platforms require you to still do some constant work to manually compound your assets, carefully calculating if your interest minus the transaction fee is worth the hassle at all.

What if I told you that there’s a way to avoid all this, by relying on the carefully picked projects and hard compounding work of a yield optimizer?

You really don't want to do any work, do you?

Well, personally, I enjoy checking the yield of my investments quite often, but I don't enjoy constantly having to decide if and when should I withdraw and compound my interest.

And speaking of hard work... don't you think a farmer might know a thing or two about that? Well, that's why today I would like to talk to you about Harvest.Finance!

Got some spare EGGs?

Harvest.Finance works as a yield optimizer and aggregator. This means it works as a collection of pools and farms coming from different DeFi projects, and handles by itself all the compounding work, giving back to you a higher interest than the one you would have gained from the original platform involved.

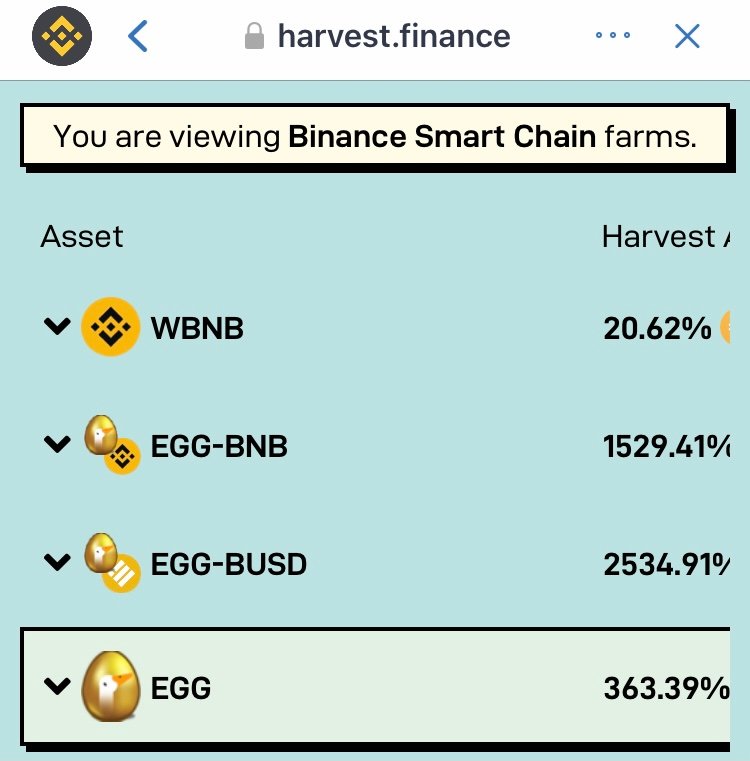

Historically, it aggregated projects on the Ethereum network, so I never had the courage to try it due to the high fees. Luckily for us, now it’s also available on the Binance Smart Chain, so I thought it was finally worth a try!

I had a few EGGs laying around in my TrustWallet that I wasn’t able to stake again on GooseDefi due to a bug with the connection with this particular wallet. Well, what a wonderful discovery was to find out that an EGG farm was available on Harvest!

I opened their website from the Browser tab of my TrustWallet, connected it using the designated button and deposited my EGGs. I have to warn you that multiple transactions are involved to complete this operation (4 to be precise), but the full amount wasn’t that bad as it amounted to a whole total of about 0.00265 BNB (or 1.23 Euros at the time of the transaction).

After confirming the 4 transactions, you’re all set.

Yep, that’s it! You don’t need to do anything else unless you want to unstake. You will find a token called pbfEGG in your wallet, in the same amount of the EGGs you staked. This will be used to redeem your EGGs.

Performance anyone?

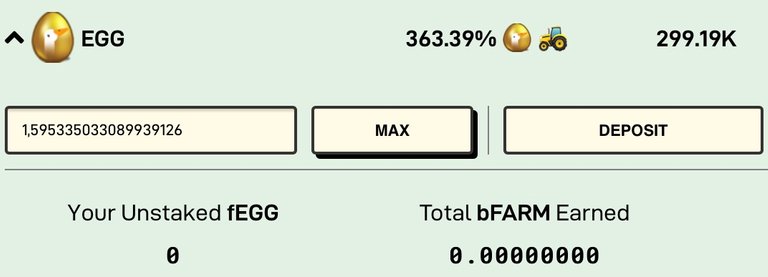

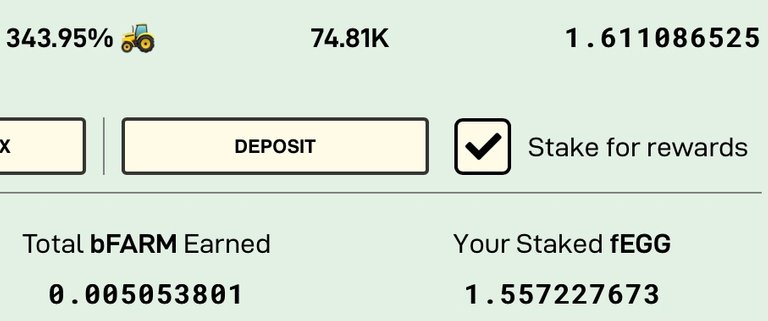

If you're curious, this was the situation after 1 day:

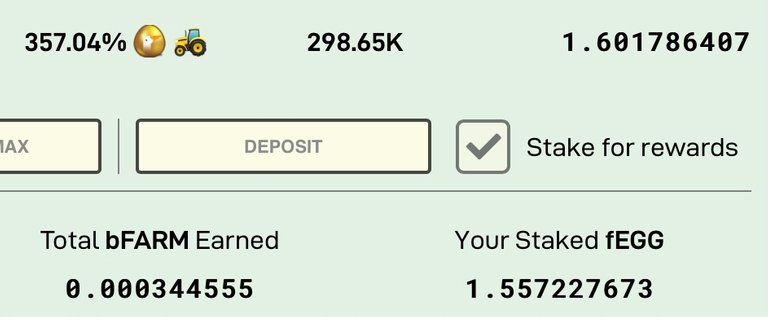

And this was after 1 week:

Time to FARM

As you may have noticed, your gains will not be 100% in the token you invested, but a slice will be paid in bFARM tokens.

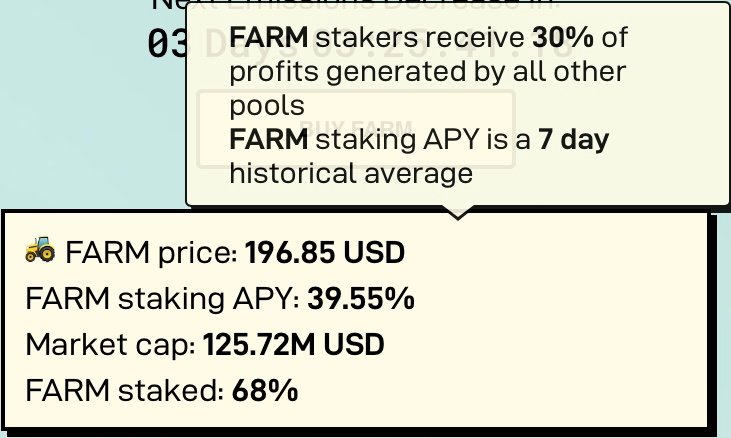

bFARM are the BSC version of the regular FARM tokens (which are ERC20 tokens that run on the Ethereum blockchain).

What can you do with these? Unfortunately, on the BSC blockchain, you can’t do anything at the moment! Anyway, you could wait until you accumulate a reasonable amount and then use a bridge (for example AnySwap] to move them to the Ethereum network, obtaining regular FARM tokens. These can then be staked on Harvest on the dedicated farm. At the moment I don’t have a sufficient amount for it to be worth it, so let’s keep this as a potential topic for a future article ;)

So, any downsides?

I was quite happy when I found out I could make use of my EGGs even if I wasn’t able to use Goose anymore. Unfortunately, in the meanwhile Goose discontinued their EGG Nest and, as a consequence, EGG yield stopped on the farm I was using. At the moment, I’m earning the full APY in bFARM tokens, that of course are growing faster so it’s not totally bad, but still...

I’m still trying to find out if this farm will continue to exist (maybe migrating the underlying strategy to invest in Goose Vaults) or if at some point will be discontinued as well. Please leave a comment if you know anything about this!

I also have one main complaint, but this comes from my specific situation: the interface is not 100% mobile optimized, so it’s usable but not ideal for TrustWallet users that are unable to connect from a desktop browser.

Also, an integration on Yieldwatch would make me very happy :)

Spread the word

This article was originally published on Publish0x during the #BinanceFARMer Writing Contest!

If you don't have an account, feel free to join! ;)

Posted Using LeoFinance Beta

You can stake your bFARM in a liquidity pool with BNB on ValueDefi. This pool in turn pays out in vBSWAP which then can be staked for a greater return. APY is currently 265.43% on the liquidity pool and 169.66% on the vBSWAP pool (payable in BNB and BUSD).

Posted Using LeoFinance Beta

This is very useful information, thank you!

Posted Using LeoFinance Beta

And they also have bFARM staking. Just go to the liquidity pair I previously told you and right above it click individual.

Posted Using LeoFinance Beta

Congratulations @aerith! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!