Bitcoin has experienced a significant surge in the past 24 hours, approaching the $37,000 mark, amid predictions from Bloomberg analysts that a Spot Bitcoin ETF is on the verge of SEC approval.

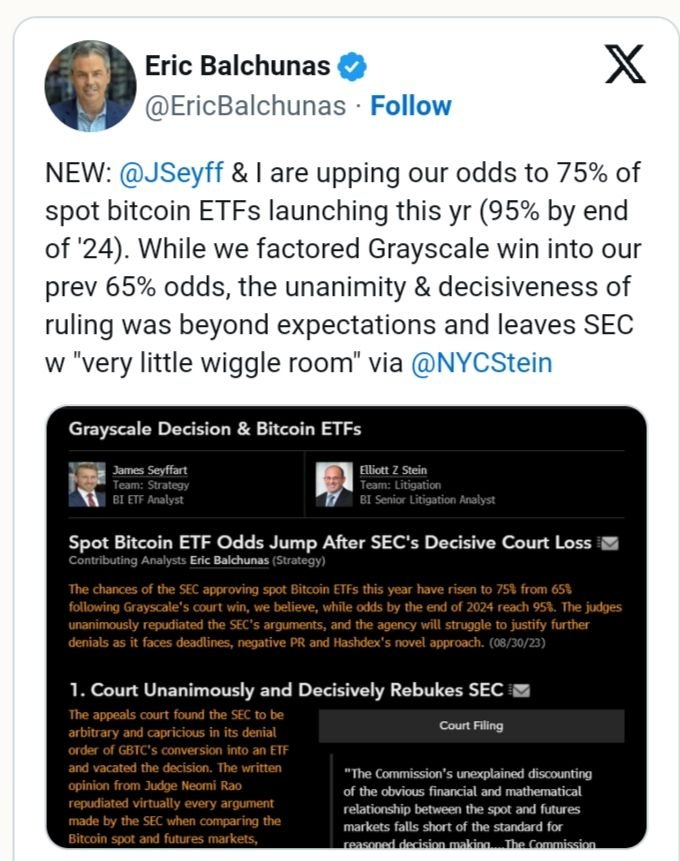

Bitcoin's ascent continues, now surpassing $36,000 with its sights set on $37,000, fueled by the optimism of Bloomberg analysts Eric Balchunas and James Seyffart. The due rekindles hopes for a Spot Bitcoin ETF approval this year, maintaining a strong 90% conviction that any of these funds could gain approval by January 2024.

Seyffart took to X (formerly Twitter) to share a recent research note, unveiling a pivotal insight. The research suggests a "brief window" in which the US Securities and Exchange Commission (SEC) could greenlight all 12 Spot Bitcoin ETF applications simultaneously. This window, opening on November 9 and lasting a minimum of eight days, provides a unique opportunity for the SEC to process approvals before the year's end.

The rationale behind this lies in the SEC's inability to approve applications in the comment stage. Notably, the comment stage for the delayed applications concludes on November 8, paving the way for the highlighted window starting on November 9.

The analysts shed light on the ephemeral nature of this eight-day window, emphasizing the upcoming decision on Hashdex and Franklin's application on November 17. Anticipating a potential delay, they foresee both applicants entering the comment stage, prompted by the SEC seeking public input on their decisions.

It's crucial to note that this window specifically pertains to the scenario where the SEC greenlights all 12 applications concurrently. The analysts clarify that, theoretically, the Commission could decide on the remaining applications between now and January 10, 2024, even if it opts to delay the decision on Hashdex and Franklin's application on November 17.

Regardless of the unfolding events, the analysts maintain their strong conviction, projecting a 90% likelihood of any of these funds gaining approval by January 10 next year.

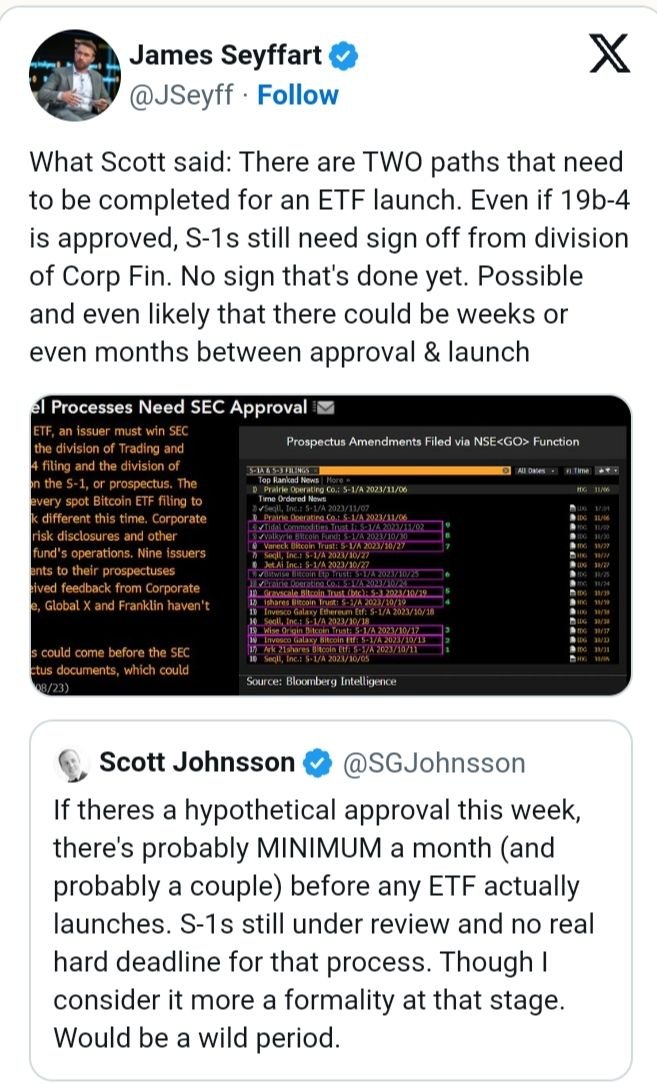

Launching a Spot Bitcoin ETF is not a straightforward process, as highlighted by Bloomberg analysts Balchunas and Seyffart. Balchunas, responding in an X post, anticipates the approval of "19b-4s" applications in the "not so distant future." However, he notes that the journey doesn't end there; the SEC's approval of "S-1s" is the subsequent step, likely leading to a launch in a matter of days.

Seyffart mirrors these sentiments, outlining the two essential steps preceding an ETF launch. Firstly, the 19b-4 approval is required, followed by the necessity for the SEC's Division of Corporation Finance to give the green light to the S-1s.

Despite the anticipation, there's no indication that these steps have been completed yet. Consequently, there could be a considerable lag—potentially "weeks or even months"—between approval and the actual launch of the ETF.

Nevertheless, the cryptocurrency market, particularly Bitcoin, has seized upon the prospect of Spot Bitcoin ETF approval this month. This optimism has propelled Bitcoin's value beyond $36,000, registering a notable uptick of over 4% in the last 24 hours, with the current trading value standing at approximately $36,700, as per CoinMarketCap data.