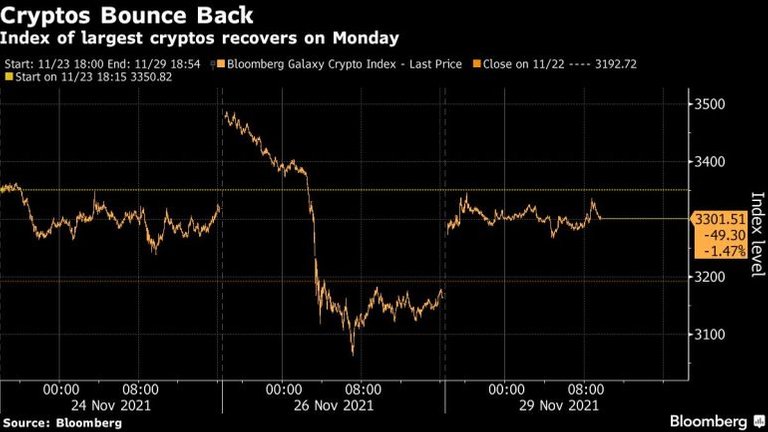

Last week, cryptocurrencies had their first Black Friday in two months, when Bitcoin experienced its worst day in two months. But by Monday, things were beginning to look up.

On Monday, Bitcoin, along with other riskier assets, is making a recovery from its Black Friday lows.

During the day, the largest digital asset increased as high as 3.4 percent to $58,266. Other coins experienced a rebound as well, with the Bloomberg Galaxy Crypto Index rising 5.5 percent at one point. Alternative coins like Polkadot and Dogecoin also grew in popularity.

Investors fled a range of risky assets, including cryptocurrencies, in a violent selloff on Friday, with Bitcoin marking its worst day in over two months. The thrashing came after the discovery of a novel coronavirus type known as omicron in southern Africa, which specialists are still attempting to figure out. Bitcoin fell 20% below a record high set earlier in November during the session, demonstrating the coin's proclivity to closely track stock market movements, according to several strategists.

"It emphasizes Bitcoin's risk-on/risk-off nature," said Matt Maley, chief market strategist at Miller Tabak + Co.

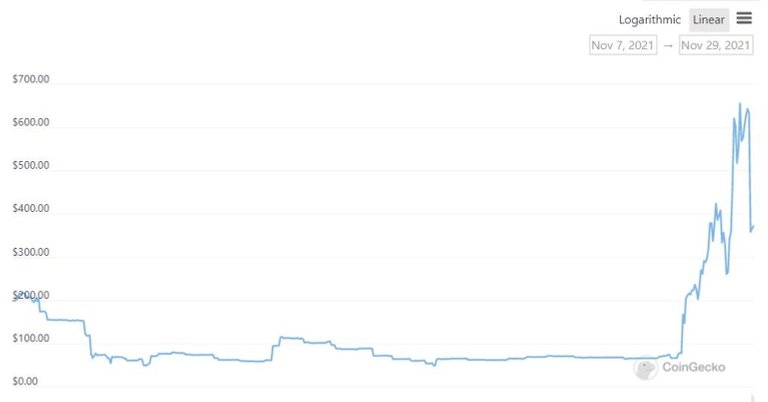

Meanwhile, in a truly cryptonian occurrence, knowledge of the eponymous version spread, and a coin called Omicron fell and then recovered. Though nothing is known about the coin thus far, it has been in existence for a few weeks and has a market worth of roughly $370 million, according to CoinGecko.com.

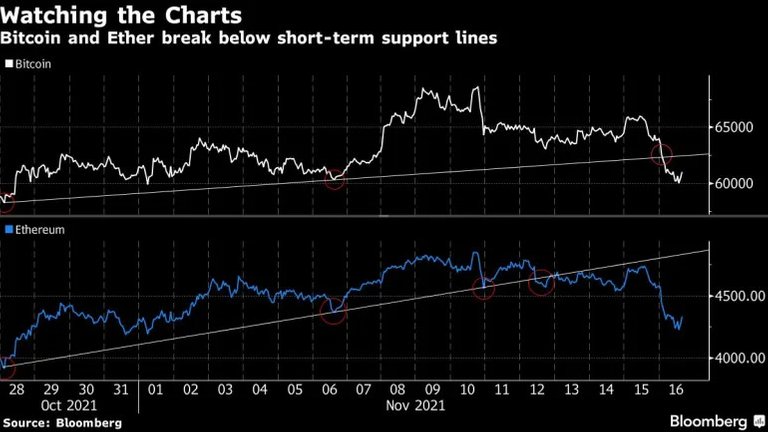

Bitcoin has been struggling after hitting a high of about $69,000 on November 10 as investors flocked to the primary U.S. exchange-traded fund connected to bitcoin futures. However, since then, variety of things have weighed on returns, including increased regulatory risks and also the indisputable fact that many tokens have skyrocketed in value during a short period of your time. Bitcoin's recent swings, in line with Maley, demonstrate that cryptos might be vulnerable if the Fed withdraws its stimulus during a more aggressive manner next year.

Bitcoin, according to Fiona Cincotta, senior financial markets analyst at City Index, behaves like a risky asset that monitors stock market movements, although there are periods when that relationship isn't as strong.— for example, when higher inflation prints are higher than expected, Bitcoin can hold up well.

"There are instances when I feel Bitcoin operates as a riskier asset and rises with the stock market, but that isn't always the case," she says as she explained over the phone.

Now, worried traders are looking to technical indicators for signs as to where specific cryptocurrencies may go next. Bitcoin bounced off its intermediate-term trendline, the 100-day moving average, on Sunday. Meanwhile, Ether broke through its 50-day moving average on Monday, which many chart-watchers regard as a bullish sign.

Despite this, Academy Securities Inc.'s head of macro strategy, Peter Tchir, says the coronavirus news startled him during Bitcoin's Friday selloff. According to him, there appears to be a group of strong risk-takers who buy crypto and, more than likely, some high-flying tech companies.

"If they go in lockstep, they may be obliged to sell one or the other," Tchir added. "Bitcoin's rise reduces that stress. We'll see if it lasts now that we've had what appeared to be a likely rally — everyone discounting omicron fears."

Source of plagiarism

There is reasonable evidence that this article has been spun, rewritten, or reworded. Posting such content is considered plagiarism and/or fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

If you believe this comment is in error, please contact us in #appeals in Discord.

Congratulations @aghamienoghogho! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 100 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: