Silvergate got pounded by the FTX collapse for being overleveraged, and now we are here, the contagion has finally reached the traditional financial system.

Now how long does it take for the contagion to work its way through multiple bank balance sheets? We're about to find out.

SVB is one of 6 banking partners connected to circle, and we've seen USDC lose its peg. At this point I think most believe that it will regain its peg, but you never know. Leveraged long on USD anyone, don't lie, I know you thought about it.

I personally don't think we'll see bank runs on Monday.

But apparently there may have been lineups outside of The First Republic Bank in California, but I can't verify that's actually what's happened or if these picks are even recent.

The media does a good job at pacifying the masses. No doubt the institutions will go to work tomorrow and point the finger at SVB,.. bad SVB! Followed by bailouts, and money printing and more bailouts, and more rate hikes later this year.

Contagion List

Roku reported to have 26% of its cash with SVB.

Etsy - Not sure exactly to what level of exposure Etsy has to SVB but its reported that they're having trouble paying their sellers!

BlockFi 220M in unprotected funds in SBV. Not good.

Roblox - 5% of its 3B cash and securities balance held at SBV.

These institutions are often highly leverages so loosing even a small percentage of cash can mean trouble.

DNA Ginkobioworks, RocketLab USA, and loads of other starts up have lost access to their cash. Are startups doomed in 2023, could debt become even more expensive this year?

But don't let a good crisis go to waste!

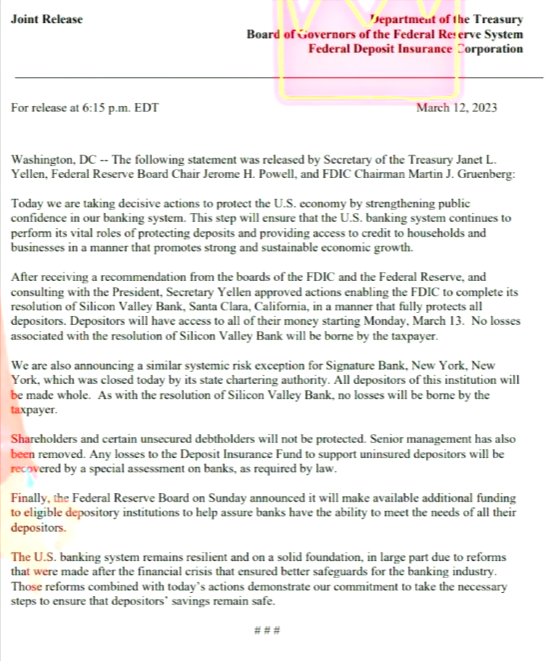

Bailouts incoming? We'll see how far this contagion runs but the government is likely going to step in quick, and then continue to raise rates.

How to capitalize on this mess! Totally expecting the bank to print money again like crazy and buy all your stuff in a year or two from now. That's how the system is designed right? wrong? and that's how they'll try and rob the common man.

But cash is king, and those that are patient may be able to scoop up assets on the cheap in the not too distant future.

Give it a year or two and we just might see a flood of foreclosures. Mortgages have gotten really expensive, points have been added, and fees are up. Give it time. Property, Stocks, Equities, Gold, GOOOOOLD. I only see gold continuing its climb as the banking system continues to show weakness.

Don't keep your coins on exchanges, diversify your exchanges if you can. Multiple streams of income but also multiple banks and ways to move cash out and pay yourself! Keep on rocking in the free world and stay blessed, stay decentralized!

Update

The Fed has stepped in to bail out SVB and potentially other non SIB banks in the future. Inflationary...

Posted Using LeoFinance Beta

Gold will continue its rise over time, and silver will rise later. Just like cryptocurrency has Bitcoin rising followed by its alt-season, it will be similar for gold and silver.

I was going through my list of followers and I wanted to see how things are going. It's been a while since we last communicated; I hope things are OK at your end.

If you want to reply and keep the Comments section in this post for post comments, feel free to drop me a message at my Message Board

It's too late for me to upvote this post, so please accept this slice of !PIZZA, a bit of !LUV, and and an !LOL / !LOLZ instead.

$PIZZA slices delivered:

@magnacarta(2/5) tipped @agr8buzz

https://leofinance.io/threads/@magnacarta/re-leothreads-2asmyapkm

The rewards earned on this comment will go directly to the people ( magnacarta ) sharing the post on LeoThreads,LikeTu,dBuzz.

Hive gaming community is getting beat up with the @battlegames collapse, maybe you would consider giving it to the hive gaming community or a gaming guild like Pizza to take over?