I Asked ChatGPT: What's KYC?

Answer:

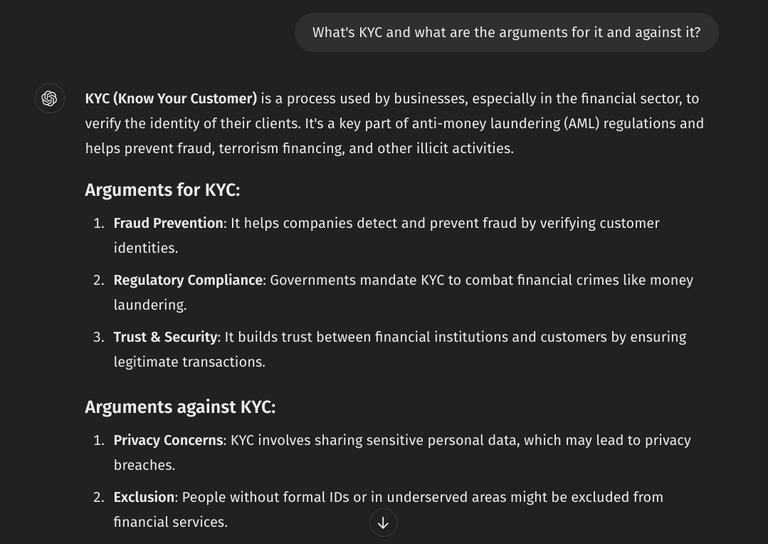

KYC (Know Your Customer) is a process used by businesses, especially in the financial sector, to verify the identity of their clients. It's a key part of anti-money laundering (AML) regulations and helps prevent fraud, terrorism financing, and other illicit activities.

Arguments for KYC:

Arguments against KYC:

Both sides balance between security and privacy concerns.