During the weekend, bitcoin's price dropped around 5%, but at the time of this writing, it had recovered over 2% over the last 24 hours. BTC/USD has risen significantly over the past seven days, climbing more than 11%, and was attempting to break a critical resistance level of $59,000.

However, sellers came into the market, and bitcoin couldn't find support above this critical price range. At the time of this writing, BTC/USD was trading around $58,100, according to CoinGecko.

Once bitcoin's price recovers, we think it will start a rally toward a new record price. We think after this latest correction, bitcoin's price is ready for another strong upward move. For that to happen, buyers will need to return in full force; otherwise, we'll be forced to update our current view.

Conversely, a meaningful bullish sign is that bitcoin's price has been holding well above both the 21-day Modified Moving Average (MMA) near $52,500 (red) and the 21-day Simple Moving Average (light blue) around $57,000. Not only that, but after this recent drop, BTC/USD found support above the 21-day SMA.

In terms of news, we're pretty excited that the cryptocurrency market keeps experiencing growing adoption. Recently, Jamie Redman wrote in Bitcoin.com that

"a monster.com query shows there are 1,970 jobs available under the search term ‘bitcoin.’ The number of employment opportunities increases to 2,989 jobs if the individual uses the term ‘blockchain.’”

The more jobs and openings there are that require cryptocurrency knowledge, the greater the incentive for individuals to learn these new skill sets. Additionally, the article notes that

“The term ‘bitcoin jobs’ on Google gives around 93,600,000 results, while ‘blockchain jobs’ show around 151,000,000 results.”

To conclude, we believe bitcoin's price will soon reach a fresh, all-time high, and we remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA (blue).

- BTC/USD doesn't drop below $55,000.

- BTC/USD daily volume goes above its 21-day MMA soon.

What Do Traders Think?

This week’s first tweet comes from dave the wave, one of our favourite chartists and a bitcoin trader.

In his post, dave the wave shared a daily chart of bitcoin’s price, adding a few trend lines showing support and resistance and the Moving Average Convergence Divergence (MACD) at the bottom.

According to Investopedia, the MACD indicator

“triggers technical signals when it crosses above (to buy) or below (to sell) its signal line.”

He also tweeted that “Not so hidden divergences.... The MACD on the daily,” referring to the fact that bitcoin’s price continues to rise while the MACD trends down.

According to Investopedia,

“Divergence can occur between the price of an asset and almost any technical or fundamental indicator or data. Though, divergence is typically used by technical traders when the price is moving in the opposite direction of a technical indicator.”

Additionally,

“Negative divergence.occurs when the price is moving higher, but a technical indicator is moving lower or showing bearish signals,”

which could indicate bitcoin’s price is about to drop even further.

The following post comes from Bluntz, a cryptocurrency trader with close to 120,000 followers on Twitter.

In the post, Bluntz shared a daily price chart of bitcoin’s price and added two trend lines that show resistance and support converging on each other. He wrote that

“running triangle forming on #btc imo. this should be the (e) wave and final contraction before the push up to 70keks.”

The trader identified the most recent tops and bottoms with letters and believes that after bitcoin drops, moving toward $55,000, it will rally toward $70,000.

Therefore, Bluntz is quite bullish on the medium-term view for bitcoin.

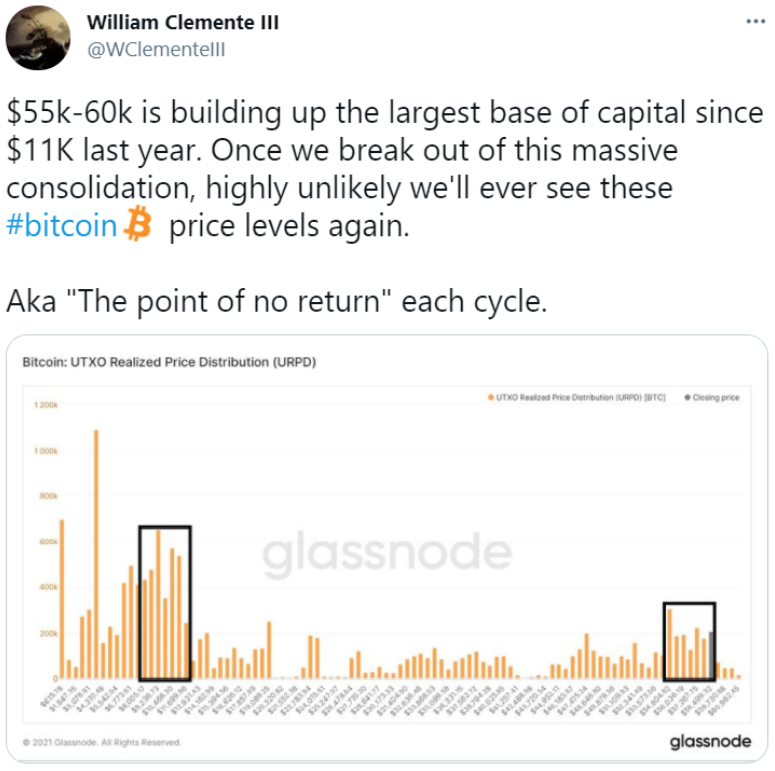

The following tweet comes from William Clemente III, a cryptocurrency writer who works for Bitcoin Magazine. His post builds on what Bluntz wrote.

Clemente shared the "Bitcoin: UTXO Realized Price Distribution (URPD)" that, according to Glassnode Academy, "shows the realized price of all UTXOs on any given day."

The analyst wrote an exceptionally bullish comment that

"$55k-60k is building up the largest base of capital since $11K last year."

Just like Bluntz, Clemente thinks bitcoin is building a solid base for a massive upward move. He even adds that

"Once we break out of this massive consolidation, highly unlikely we'll ever see these #bitcoin price levels again."

Hence, both analysts are confident that bitcoin's price will enjoy a rapid move upward once buyers return to the market.

The last post of the day comes from CryptoBirb, a well-known trader and Certified Technical Analyst.

In this post, CryptoBirb shared the “Bitcoin: Net Unrealized Profit/Loss (NUPL)”, which according to Glassnode Academy,

“looks at the difference between Unrealized Profit and Unrealized Loss to determine whether the network as a whole is currently in a state of profit or loss,”

making it one of the most accurate indicators for the top of a bull-cycle.

CryptoBirb also wrote that

“$BTC 90-120k targets are quite reasonable imo.”

We believe this relates to where bitcoin’s price is on the NUPL chart—in the “Belief - Denial” stage, before reaching the final stage of “Euphoria - Greed.”

If CryptoBirb is right in his analysis, and the NUPL chart correctly identifies the next top, bitcoin could go above $100,000.

Bitcoin Price Prediction

At the time of this writing, bitcoin is trading close to $58,100, according to CoinGecko. Over the weekend, bitcoin's price dropped 3%; however, we think BTC/USD will soon start a new rally sometime in the coming weeks. We hope to witness a brand-new record price soon.

As we wrote in the introduction, we remain incredibly bullish on bitcoin's short-term price if the cryptocurrency holds above $57,000, a critical resistance level that has turned into support — close to the 21-day SMA.

Adding to that, most analysts are pretty bullish on bitcoin due to a significant number of indicators pointing to a sudden upswing once buyers return in full force. Glassnode data shows a substantial number of buyers at the current price ranges, and the NUPL indicator shows room for another move up.

Therefore, how do we think the price will trade today and during the week? As shown in the above chart, we believe that bitcoin could approach $60,500 in the next few days, as long as buyers return to the bitcoin space. There's a chance the digital currency breaks this level by the end of the week, but buying volume would need to grow substantially for this to happen.

On the other hand, we don't expect the cryptocurrency to drop much below $57,000, above the 21-day Simple Moving Average. If it fails to hold this level, then we think a drop toward $55,000 could play out; however, this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000. It also indicates that there are almost no sellers left above $62,000.

Posted Using LeoFinance Beta