Yesterday, bitcoin's price recovered around 3%, after dropping significantly during the weekend.

At the time of this writing, BTC/USD is attempting to find support above an important resistance level at $59,000. Additionally, bitcoin’s price was trading above $58,600, according to CoinGecko.

After the latest correction, we now think bitcoin’s price is poised to start a brand new rally, that could perhaps take BTC/USD above $62,000.

An extremely bullish sign is that bitcoin's price has been holding well above both the 21-day Modified Moving Average (MMA) near $53,800 (red) and the 21-day Simple Moving Average (light blue) around $57,000. Not only that, but after this recent drop, BTC/USD found support above the 21-day SMA. Hence, it appears there’s not many sellers left to dump bitcoin’s price.

Adding to that, looking at the Volume Profile Visible Range (VPVR) on the left of the chart, it shows BTC/USD is entering a low order volume price range, which means that if buyers come in full force, bitcoin’s price may start to pick-up pace.

In terms of news, Forbes’ Billy Bambrough wrote that

“Wall Street giant BNY Mellon has called the controversial bitcoin stock-to-flow model that predicts bitcoin hitting $100,000 in July "worth understanding" in a new report.”

This is epic news since PlanB’s stock-to-flow model predicts a bitcoin’s price above $200,000, at the peak of the current bull-run.

To conclude, we believe bitcoin's price will soon reach a fresh, all-time high, and we remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA

(blue). - BTC/USD doesn't drop below $57,000.

- BTC/USD daily volume goes above its 21-day MMA soon.

Traders Thoughts

Today’s first tweet comes from Dylan-BTCization, a writer at Bitcoin Magazine.

In his post, Dylan-BTCization shares the “Bitcoin: Purpose Bitcoin ETF Flows'', that contains the data of Canda’s Purpose Bitcoin ETF. Dylan-BTCization also wrote that

“Canada's Purpose Bitcoin ETF has not had one single day of outflows. A net buyer every single day.”

Essentially, since the ETF was opened there hasn’t been a day where sellers are in control. This shows how bullish the market is on the short-term bitcoin’s price. Dylan-BTCization speculated that

“When the U.S. ETF gets approved, this bull market is going to get crazy.”

We think the writer is correct in his assessment and that when a bitcoin ETF opens up in the U.S., buy orders will skyrocket.

The following post comes from Lex Moskovski, whose Twitter profile describes him as the CIO of Moskovski Capital.

In the post, Moskovski shared the “Bitcoin: Number of Accumulation Addresses” and according to Glassnode, “Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds.

The data above shows that since mid-January 2021, a growing number of people who are buying bitcoin are not selling, a critical ingredient for bitcoin’s price appreciation. We believe that the more people that hold bitcoin and do not sell it, the more pressure there will be on bitcoin’s price to move to higher price ranges.

Therefore, while the trend continues we think bitcoin’s price will most likely continue to move up.

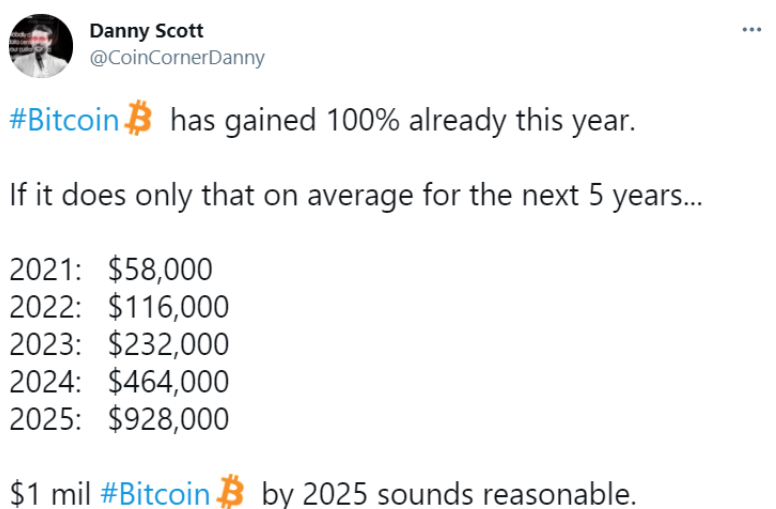

The following tweet comes from Danny Scott, the CEO of CoinCorner.

Scott wrote that “#Bitcoin has gained 100% already this year.” and speculated on what bitcoin’s price could be in the next five years, in case the trend ensued.

He wrote that in case bitcoin followed its current annual trajectory its price could reach:

“2021: $58,000

2022: $116,000

2023: $232,000

2024: $464,000

2025: $928,000”

Essentially, if bitcoin grows 100% on average per year, it will reach close to $1,000,000 in 2025.

The last post of the day comes from Mati Greenspan, who is a well-known investor and trader, as well as the founder of cryptocurrency research firm Quantum Economics.

In this post, Greenspan wrote “The hype will die, the tech will live.”, that we believe it refers to the cryptocurrency asset prices bubble that we’re currently experiencing.

Greenspan highlighted how, even though a bubble might occur around a specific technology - like bitcoin - the most adopted technology will continue to exist even after the bubble fades.

Hence, that’s one of the reasons why we’re so bullish on the long-term adoption of

cryptocurrencies.

Price Prediction

At the time of this writing, bitcoin is trading close to $58,600, according to CoinGecko. Since yesterday, BTC/USD has gained north of 1.5%. We think bitcoin’s price is now starting the next rally that could potentially break its prior record price.

As we wrote in the introduction, we remain incredibly bullish on bitcoin's short-term price if the cryptocurrency holds above $57,000 a critical resistance level that has turned into support — close to the 21-day SMA.

Adding to that, most analysts are pretty bullish on bitcoin due to a series of on-chain indicators that point out buyers are hodling bitcoin, and taking it out of exchanges.

Therefore, how do we think the price will trade today and during the week? As shown in the above chart, we believe that bitcoin could approach $61,000 in the next few days, as long as buyers return to the bitcoin space. There's a chance the digital currency breaks this level by the end of the week, but buying volume would need to grow substantially for this to happen.

On the other hand, we don't expect the cryptocurrency to drop much below $58,000 above the 21-day Simple Moving Average. If it fails to hold this level, then we think a drop toward $55,000 could play out; however, this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000. It also indicates that there are almost no sellers left above $62,000.

Posted Using LeoFinance Beta