Bitcoin's price resumed its uptrend with a brand new rally that began on Saturday. In the past 24 hours, BTC/USD gained north of 7% and was trading around $50,500, according to CoinGecko, at the time of this writing.

As we wrote on Friday, we would remain bullish on the short-term price action as long as BTC/USD held above $48,000. That's precisely what happened. We think there is a strong possibility bitcoin's price attempts to move above $60,000. Let's see if enough buyers continue to arrive at the market.

Bitcoin's price was held quite nicely above the 20-day Modified Moving Average (MMA) in terms of technical analysis. Looking at the Volume Profile Visible Range (VPVR) on the left, we think bitcoin's price found strong support above $48,000. This price range served as support for bitcoin's price during the weekend and never went below $47,000.

In terms of news, some bullish news, we found this particularly interesting. According to CoinDesk's Kevin Reynolds,

"Hong Kong-listed Meitu Inc., which makes image and video processing software, said it had purchased $22 million in ether (ETH) and $17.9 million of bitcoin (BTC)."

This news shows how corporations continue to accumulate bitcoin and add cryptocurrency to their balance sheets. And ether has been added as well as bitcoin.

In summary, bitcoin's price traded within the predicted range (blue), and as we expected, found strong support above $48,000. Therefore, the current week will most likely be extremely positive for the short-term price of bitcoin.

We remain bullish on BTC/USD as long as:

- BTC/USD remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA

(blue). - BTC/USD doesn't drop below $50,000.

- BTC/USD daily volume goes above its 21-day Moving Average soon.

What Do Traders Think?

Today’s first tweet comes from Pomp (Anthony Pompliano), co-founder of Morgan Creek Digital and The Pomp Letter writer.

According to Pomp,

“While the academics and elites are debating whether bitcoin has value, the market is adopting it at a staggering rate.”

We agree with Pomp, and according to Quandl, he’s correct in his claim that

“There was $8 billion of on-chain transaction volume in the bitcoin payment system over the last 24 hours.“

Essentially, bitcoin is proving to the market that it can work as an effective means of payment since it could potentially settle "$2+ trillion of annualized payment volume" if we extrapolate from the past 24 hours the amount of bitcoin that could be settled in one year.

In our opinion, this data is quite astonishing, and it proves just how much bitcoin is growing worldwide as a valuable asset.

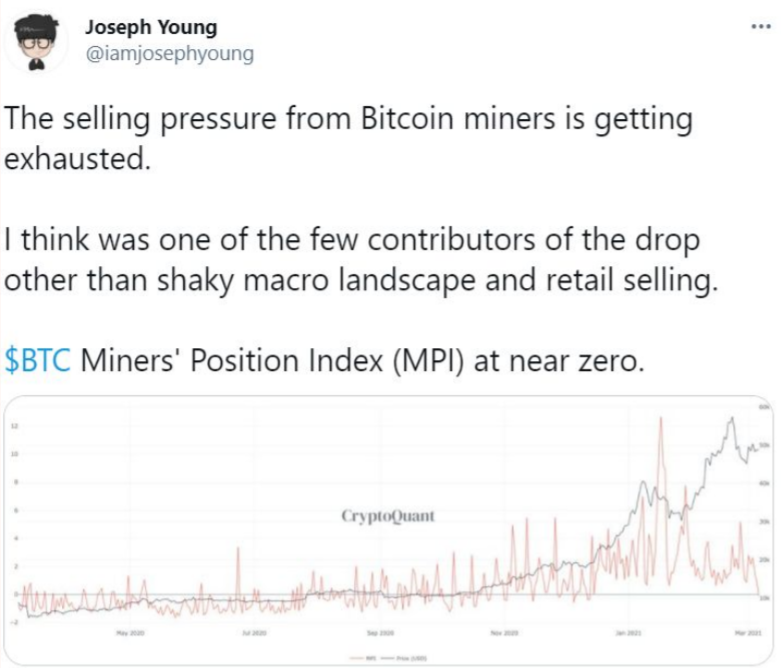

The next post comes from Joseph Young, whose Twitter profile describes him as an analyst and investor with more than 127,000 Twitter followers.

In his post, Young discusses the "BTC: Miners' Position Index (MPI),

"that according to CryptoQuant, represents "The ratio of BTC leaving all miners wallets to its 1-year moving average. Values above 2 indicate most miners are selling."

Young argues that "The selling pressure from Bitcoin miners is getting exhausted" since the chart shows the MPI near zero. Adding to that, notice how each time there is a rise and a new peak in the MPI, bitcoin's price drops. Hence, when we combine both data points we think Young is correct in his analysis.

We think this may be one of the main reasons for the recent bitcoin's price drop; however, we believe the uptrend has ensued. At the time of this writing, BTC/USD was already trading above the critical $50,000 level, a sign the bull run may continue.

The next tweet comes from Charles Edwards, whose Twitter profile describes him as founder of Capriole Investments.

In his post, Edwards shares a bitcoin price chart since late 2013, and he adds the volatility indicator at the bottom. He argues that

"We are in one of the most overextended, rapid Bitcoin run-ups ever. Every time we have extended this far in the past, we have corrected much more."

Therefore, the price could suffer another significant correction that may take BTC/USD towards $40,000. On the other hand, bitcoin's price continues to move up due to "More institutional buys/stimulus." Also, Edwards questions if the continuous money printing hasn't "changed the game," which we interpret as the price going up with no significant corrections insight.

In our opinion, we think this bull run has enough fuel to continue for a little while longer. We agree that while institutions, corporations, and wealthy individuals continue to accumulate, a significant 40% or 50% correction has very little chance of happening.

The last post of the day comes from the legendary macro analyst and futures trader, Peter Brandt, author and publisher of the Factor Report.

Brandt explains the leading cause for the continuous asset appreciation of the past few decades in his tweet. He wrote that

“The devaluation of the purchasing power of the U.S. Dollar has only just begun. This is why Bitcoin $BTC, real estate, U.S. equities and commodities will continue to trend higher when expressed in $USD fiat terms.”

His argument goes along with our line of thought that while money printing and quantitative easing measures are put in place, we don't see a chance for asset prices, namely bitcoin, to have a significant drop. When an asset is limited in quantities and sought by wealthy individuals, it will most likely enjoy a rise in demand and its long-term price.

Nevertheless, we firmly believe that short-term corrections between 10% and 30% will always have a seat at the table. Markets, like most things in life, are a mirror of human psychology. Hence, we find it hard to believe boom/bust cycles are a thing of the past.

Bitcoin Price Prediction

During the weekend, bitcoin's price found strong support above $48,000, and at the time of this writing, it was trading close to $50,500.

Due to the cryptocurrency trading within the predicted range, we now think there's an open road to $55,000 ahead of us. This means the time for corrections and consolidation is over.

Two of the main reasons for this strong belief are both the high number of institutional investors purchasing bitcoin and the low number of miners selling coins being mined. If we mix both ingredients, a supply crisis might be on the horizon.

How do we think the price will trade today and throughout the week? As shown in the above chart, we believe that bitcoin could top around $55,000 in the next few days, assuming buyers continue to enter the space.

On the other hand, we don't expect the cryptocurrency to drop much below $50,000. If it falls, then $48,000 will most likely be the next healthy level of support for bitcoin's price.

To finalize, the Volume Profile Visible Range (VPVR) shows a high number of buy orders between $47,000 and $48,000, which means BTC/USD should not go much below this range even if the trend suddenly reverses - something we don't think will happen anytime soon.

Posted Using LeoFinance Beta

I think bitcoin is only warming up. The USA benefit funds is here and that should pump BTC for the next leg up.

Posted Using LeoFinance Beta