Today, bitcoin's price stalled. During the weekend, Bitcoin rallied around 3% and is now still trading above $60,000, according to CoinGecko. While bitcoin's price holds above this critical level, we remain bullish since it's a critical level of support for the cryptocurrency.

While today has been a minor sell-off and selling volume has increased, BTC/USD remained within the predicted trading range, pointing to a continuation of the uptrend, most likely toward its prior all-time high, which is close to $62,000.

Adding to the above, bitcoin's price held the 21-day Simple Moving Average (light blue), which shows buyers could still be in control of the short-term price.

The Volume Profile Visible Range (VPVR) on the left of the chart shows BTC/USD is near the end of the high-order volume price range, where it's currently stuck. Once it moves closer to its prior all-time high, bitcoin's price should enjoy sudden swings as volatility rises.

We think the recent sell-off might have been kicked off by investors and traders selling bitcoin for altcoins since the altcoin market is currently scorching.

Nevertheless, we believe soon, the flow of money will come back to bitcoin.

To conclude, we think BTC/USD will soon break its record price, perhaps in a couple of days. We remain bullish on BTC/USD while:

- BTC/USD remains above its 21-day SMA.

- BTC/USD doesn't move below $59,000.

- Buying volume goes above its 21-day SMA.

What Do Traders Think?

Today's first tweetstorm comes dave the wave, one of our favourite chartists and a bitcoin trader.

Dave the wave shared a weekly chart of bitcoin's price and added two trendlines, one showing resistance at the top and the other support at the bottom. He also added the 200-day Simple Moving Average (SMA), which according to Investopedia,

"calculates the average of a selected range of prices, usually closing prices, by the number of periods in that range."

Dave also wrote that

"A rendezvous with the 4 year moving average would have price correcting to the previous peak, support at the top of the buy zone, another near year-long correction setting up for another run, reducing volatility and increasing price stabilization."

Therefore, the trader thinks it's possible bitcoin's price drops towards $29,000, consolidate around this price range for about a year and then start another exponential move higher.

Dave also argues that this move would diminish volatility - which we think is already substantially low - and set the stage for a brand new bull cycle.

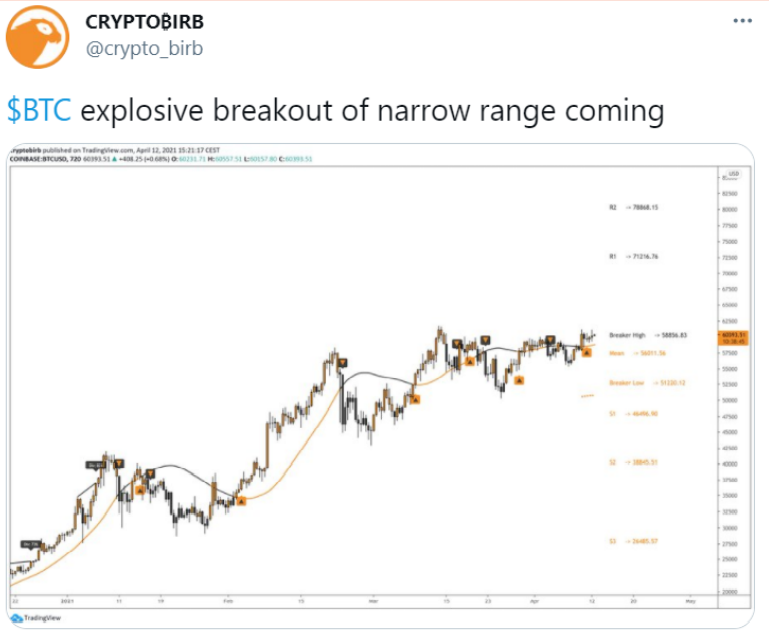

The following post comes from CryptoBirb, a well-known trader and Certified Technical Analyst.

CryptoBirb shared a 12-hour chart of bitcoins price in the post, and he added a few price levels on the chart that represent both a bullish and bearish scenario.

He wrote that “$BTC explosive breakout of narrow range coming.” referring to where bitcoin’s price might move to.

Essentially, CryptoBirb believes that if bitcoin holds above $58,900, it could make a move towards $72,000 and $78,000. Oppositely, if bitcoin’s price goes below $51,800, he thinks it could then drop further towards $46,400, $38,800 and, finally, $26,400.

Hence, we think that CryptoBirb is also playing on the defensive and waiting for bitcoin’s price to make a rapid move and confirms either a breakout towards $62,000 or a drop towards the low $50,000s.

The following tweet comes from Josh Olszewicz, who describes himself as a “professional critical thinker” and has over 129,000 Twitter followers.

Olszewicz shared three charts of bitcoin that show just how bullish the bitcoin market is. First, Olszewicz shares the “BTC: All Exchanges Reserve” that, according to CryptoQuant, shows the total bitcoin sitting at exchanges. Looking at the data, it offers a significant drop since 2020.

Adding to that, he shares the Hodl Waves chart, which according to Unchained Capital, shows

“the relative fraction of Bitcoin in existence that was last transacted. The bottom, warmer colors (reds, oranges) represent Bitcoin transacting very recently while the top, cooler colors (greens, blues) represent Bitcoin that hasn’t transacted in a long time.”

The data present on this chart indicates more holders are keeping coins than selling them, even among recent bitcoin hodlers.

Finally, the last chart containing the “BTC: All Miners Outflow” that, according to CryptoQuant, shows the total flow of bitcoin out of miners addresses and points to a sharp decline of bitcoin being sent out of these addresses.

Hence, according to Olszewicz, on-chain data analytics point to a precise bullish scenario to play out shortly.

The last post of the day comes from William Clemente III, a cryptocurrency writer who works for Bitcoin Magazine. His position builds on what Bluntz wrote.

In this post, he shared Glassnode’s “Bitcoin: Realized HODL Ratio” that according to the on-chain analytics platform “, Ratio is a market indicator that uses a ratio of the Realized Cap HODL Waves.” so it measures when coins were sold and took into consideration the age of said coins.

As Clemente wrote: “If history repeats, this would entail another 6.5x from here, or ~$400,000 per BTC. This #Bitcoin Bull Run still has a long way to go.” referring to the fact that the “Realized HODL Ratio is still sub-$3k in 2017 levels.”

Essentially, if bitcoin’s Realized HODL Ratio follows the same trajectory, bitcoin’s price could still enjoy a massive upside. Let’s hope Clement is correct.

Bitcoin Price Prediction

At the time of this writing, bitcoin is trading close to $60,000, according to CoinGecko. Since yesterday, BTC/USD has remained mostly flat and has increased less than 1%.

As we wrote in the introduction, we'll remain bullish on bitcoin's short-term price action while it trades above its 21-day SMA and buying volume remains strong. We think bitcoin will hit a fresh, all-time high soon enough.

How do we think the price will trade today? As shown in the above chart, we believe that bitcoin could approach $62,000 in the next few days, as long as buyers return to the bitcoin space. There's a chance the digital currency breaks this level by the end of the week, but buying volume would need to grow substantially for this to happen.

On the other hand, we don't expect the cryptocurrency to drop much below $58,000. If it fails to hold this level, we think a drop toward $54,000 near the 21-day MMA could occur. However, we should note that this is highly unlikely.

To finalize, the VPVR shows a high number of buy orders between $46,500 and $50,000. It also indicates that there are almost no sellers left above $62,000.

Hence, once BTC/USD breaks away from this price range, it should pick up the pace and reach $68,000 in no time.

Posted Using LeoFinance Beta