Sorry for not having published the analysis for 03/18/2021 but due to personal issues I was not able to share the analysis with you.

In the past 24 hours, bitcoin's price grew north of 8%. As we anticipated yesterday, due to the slow-selling volume and an apparent increase in the number of buyers, there was a high probability bitcoin's price would start a brand new rally. Not only did that happen, but bitcoin moved towards $60,000 precisely as we wrote.

Last week, bitcoin reached a new all-time high close to $62,000, but earlier this week, there was a massive 10% drop. At the time of this writing, BTC/BTC is trading around $59,300 according to CoinGecko, much closer to its record price.

Bitcoin's price continues to trade within the predicted range (blue), and we're now anticipating BTC/BTC will find a new record price sometime during the weekend. The Volume Profile Visible Range (VPVR) on the left shows buyers are in control until $55,000, which indicates that bitcoin won't likely drop below this price range, even if the trend suddenly shifts.

The reason for our bullishness? Not only most analysts think that bitcoin's price will attempt to break $70,000 soon, but the entire cryptocurrency market continues to grow and to reach new customers. Nina Bambysheva wrote in Forbes that

"Crypto.com announced a global partnership with Visa that also includes principal membership in Visa's network in Australia. The company also plans to roll out fiat lending against bitcoin and other cryptocurrencies as collateral via the Crypto.com Visa Card."

This is excellent news because it shows cryptocurrencies will be available for new merchants - a sign of global adoption, and we believe that the more people who buy and use cryptocurrencies for payments, the larger the total cryptocurrency market can grow.

Therefore, we think this recent price retrace was a buying opportunity, and we hope you've taken advantage of it. We expect that by Monday, bitcoin will achieve a new record price and go above $65,000.

We remain bullish on BTC/BTC as long as:

- BTC/BTC remains above its 20-day MMA (red), 50-day MMA (green), and 200-day MMA

(blue). - BTC/BTC doesn't drop below $55,000.

- BTC/BTC daily volume goes above its 21-day Modified Moving Average soon.

Traders’ Food For Thoughts

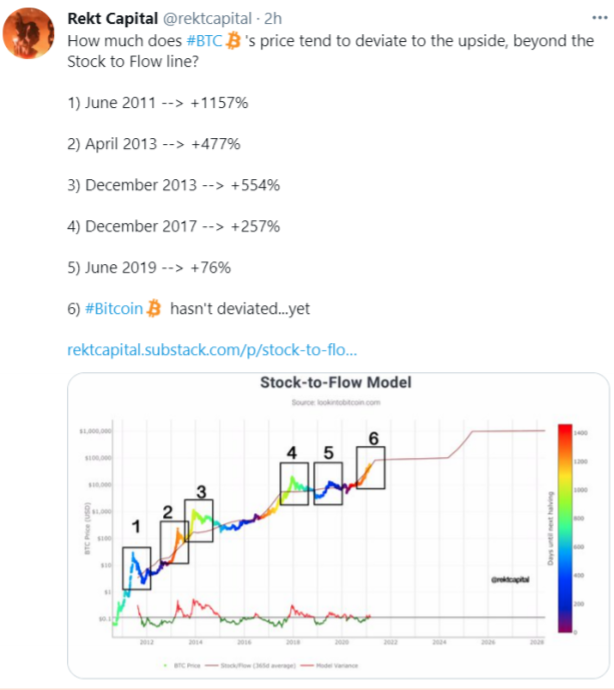

Today's first tweet comes from Rekt Capital, whose Twitter profile describes him as a

cryptocurrency trader and analyst and the author of the Rekt Capital Newsletter.

In his post, Rekt Capital shares the "Stock-To-Flow Model" chart, and he poses the question of

"How much does # BTC's price tends to deviate to the upside, beyond the Stock to Flowline?"

As the analyst points out, on average, bitcoin deviates three digits from the stock-to-flow line, which means that once bitcoin starts turning from the current S2F model trend line, it could grow north of 100%, meaning it could reach anywhere between $200,000 and $300,000, perhaps go even higher.

The most bullish reason behind the current uptrend, as Rekt Capital points out, is that, during the recent rally, "#Bitcoin hasn't deviated...yet".

Should we be expecting a bitcoin price jump towards $100,000 soon? Let's ask PlanB, the creator of the S2F model.

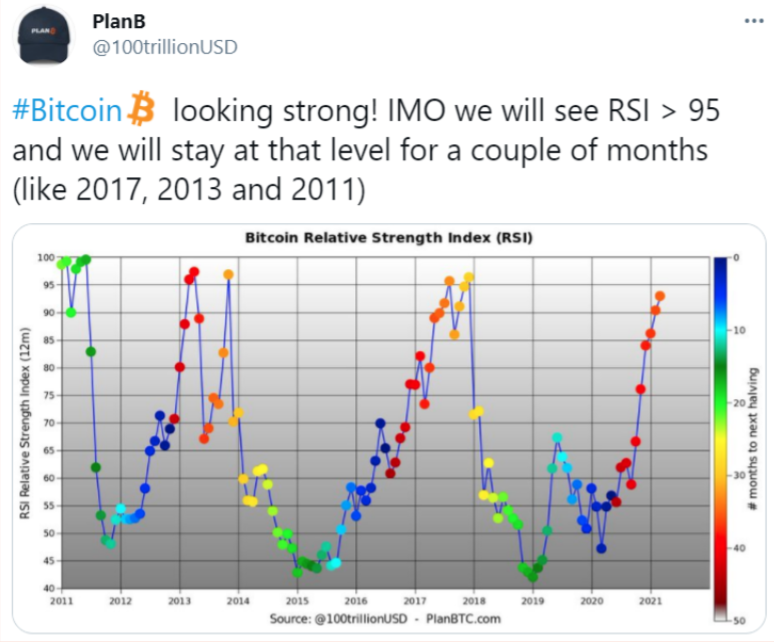

The following post comes from PlanB (@100trillionUSD), a Dutch institutional investor with a legal and quantitative finance background and the creator of the “Stock-to-Flow Model”.

PlanB shared the “Bitcoin Relative Strength Index”. The RSI is a helpful indicator used by most technical analysts that, according to Investopedia,

“is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

The analyst also wrote that “#Bitcoin looking strong! IMO we will see RSI > 95, and we will stay at that level for a couple of months (like 2017, 2013 and 2011)”

Essentially, PlanB considers there is plenty of room for bitcoin’s price to grow and that it could go above 95 in the RSI indicator and remain above this level - clearly overbought - during a few months.

That would most likely mean bitcoin’s price would break all known price records.

The following tweet comes from CJ, a bitcoin trader who runs a trading academy.

CJ shared two daily price charts of bitcoin in his post, one relating to 2017 and the other to today, and the trader highlights a potential fractal taking place.

He wrote that

“In 2017, we rallied around 230% from the low prior to the ATH break before putting in a 40% correction.”

Even though bitcoin’s price just suffered a significant 30% retrace a few weeks ago, adding to this week’s 10% drop, we find it challenging to think BTC/USD would drop another 40% after reaching $58,000. Not only that, but bitcoin has just broken $60,000 while we wrote the Daily Roundup, which points to a continuation of the rally. To conclude, the current players are different to the ones playing the bitcoin market in 2017.

Therefore, we think bitcoin’s price will continue to grow. Despite that, if bitcoin’s price suffers another sharp drop, CJ’s analysis might come in handy.

The last post of the week comes from Blackbeard, a bitcoin trader.

In his post, Blackbeard shared a weekly chart of the total cryptocurrency market cap, excluding bitcoin. The data shows a sharp increase in altcoins' entire buying volume, which means cryptocurrency traders and investors have started to move from bitcoin into altcoins.

Not only that but as bitcoin's price continues to rise, we anticipate the subsequent rally has just begun.

Therefore, we conclude that alongside bitcoin, some altcoins will enjoy a sharp upswing in the next few days.

Tomorrow’s Price

At the time of this writing, bitcoin's price is trading close to $59,000, according to CoinGecko. It's now closer to its record price, at $62,000 since it started to drop early this week.

Despite the 10% drop, most traders believe bitcoin's price will soon recover and most likely go above $70,000 soon. We think that bitcoin has found critical support above $55,000 and that the likelihood price continues to grow is now much higher today, than earlier this week.

Additionally, most on-chain indicators point towards bitcoin's price, having some room to grow, before starting the following correction.

How do we think the price will trade today and throughout the weekend? As shown in the above chart, we believe that bitcoin could go above its prior high and top a little over $65,000 in the next few days, as long as buyers return to the bitcoin space.

On the other hand, we don't expect the cryptocurrency to drop much below $55,000. If it fails to hold that level, the next support zone is around $50,000.

To finalize, the VPVR shows a high number of buy orders between $47,000 and $50,000 and that there are almost no sellers left above $60,000, which means once BTC/USD rallies back up, it should break a new high and continue into price discovery mode.

Posted Using LeoFinance Beta

Thanks for the thorough analysis!

Posted Using LeoFinance Beta

You are welcome

Posted Using LeoFinance Beta