Hi,

interesting post that can be read in here. Check it out and spread some crypto love to it. I'm a fan of linking subject between them and developing a discussion from a point where it has been left in that post.yesterday, @revisesociology made an

Yesterday was a big announcement by Elon Musk, where the acknowledgment of BTC and crypto in general spiked up, especially on the electric car fans.

This can lead to a faster mass adoption of crypto. We all are aware that BTC is to slow and expensive for every day transactions and is more like a storage of value or as a payment method for a car or a piece of real-estate.

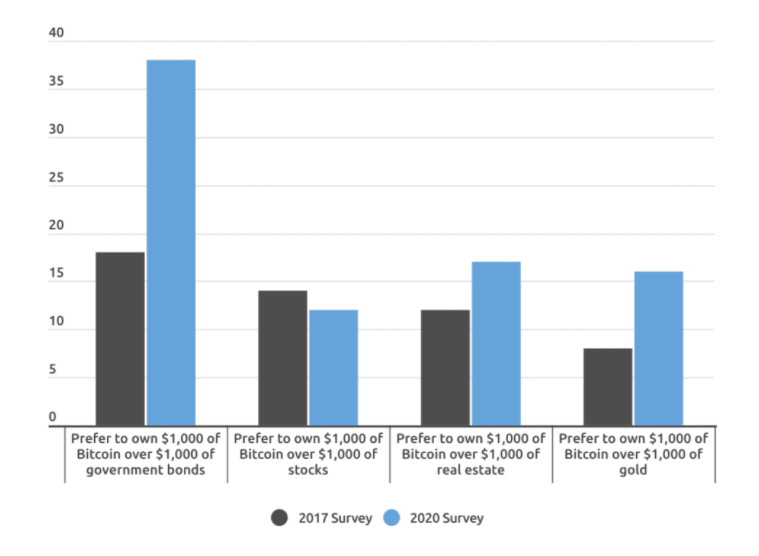

Now, from the graphic posted by @revisesociology we can see that people have changed their mind, I would say fast towards crypto and BTC. The states lose trust as they've lost the population and who would give money to a state that is not running properly and is only generating debt on the back of the citizens.

I want to ask you, what do you prefer to invest in as assets? Are you a maximalist in any of them or rather balanced with a focus point?

As I'm asking the question, I shall give the answer. I'm more a balanced investor and would rather balance my portfolio in a way that ensures growth and stability also in harsh times.

I'm not a maximalist in any of the assets fields and this might be a virtue or a defect in thinking. I have friends doing pretty well in their world by choosing only one asset, but also some others who lost fortune.

From the start, I'm not a fan of state bonds and gold holding as both assets don't produce anything and are used generally as a storage.

I love crypto, real-estate and stocks and sometimes I fund directly small enterprises when there is money and find a good enterprise.

My portfolio is at the moment imbalanced as the majority is in real-estate and land. This is caused by the leveraging effect via a mortgage. When I was younger I did buy real-estate with money down, now I buy with no money on the table, which helps this part grow faster than the others. Yes, debt is getting bigger with every new addition, but it is paid off slowly. After the first sleepless months with massive debt, I've realized that it is just building up. It is a high risk investment, as there are a lot of factors that can ruin this side, from a financial crisis where the tenants can't pay rent till the state changing laws. Also it is not for everyone as the business is harsh. Also I'm invested in different countries and look now at two further ones and yes only by credit.

Crypto comes next and it is growing everyday. When I started it was purely into buying it or gear to mine, than came this blockchain in 2016 and since then I've been building up slowly a stake that grows daily bit by bit. Here I'm happy that it is becoming more and more passive. My target is to automate most of my crypto holdings till 2025 to get a decent pay on a monthly basis.

Stocks I have a few and I buy on a fix savings plan for my son. Every dividend is reinvested so here I have no cashflow.

My target is 2025 to be able to quit the job I will have at that time and do only a small business on the side.

I have some old coins and stamps, but I see them only as space takers as they are purely for wealth storage used or emergency money in case of need. If the world goes down, skills will matter for survival. Don't get me wrong, this are nice assets to have, but they don't appeal me as I like constant flux of income, also in my sleep.

So how is your portfolio looking? Only crypto or do you have some other assets?

Posted Using LeoFinance Beta

Nice post!

I've been in the financial markets since 2006. In 2017 I started a slow transition 'all-in' crypto. So, in 2017 I slowed the pace of trading FX. I closed my last FX position in January of 2020. No, more FX!

I did the same with the stocks. No more stocks!

I am also not a maximalist. I prefer a well-diversified portfolio of cryptocurrency. Gold is a good investment. I like Gold. This is a nice hedge. Not a money-maker, but a nice hedge. The land is also a very good asset. Just think about it: The Earth is more valuable than Bitcoin (you can create many cryptocurrencies (just write code) but humans still don't know how to create planets). That's why land is the most important asset. Also, the population is growing, the land is limited. In the long run, the land will become a very valuable asset. Of course, this is some kind of generalization. If you buy some asset overpriced (e.g. a piece of land) it may turn out that your investment will pay out in one of your next generations.

Posted Using LeoFinance Beta

You must have nerves of steel to have been into FX with all that fast paced fluctuation.

Yes, land is also one of my favorites, but here needs to have the perk: location. Owning land at Chernobyl will not bring me very far :)

Thanks for the detailed comment and for droping by.

Posted Using LeoFinance Beta

I have crypto, individual stocks, funds, precious metals.

Posted Using LeoFinance Beta