Internal documents reveal Binance created Binance.US to elude U.S. securities regulators and tried to hire Gary Gensler before he became SEC chairman. This doesn’t look good for either Binance or Gensler. Last year, the Securities and Exchange Commission (SEC) dove deep into the BNB ICO to determine whether it is a security. Given the fallout from FTX last year, we could see something similar happen to Binance, but I suspect Changpeng Zhao is more politically savvy than Sam Bankman-Fried (SBF)—and less of a privileged punk.

Speaking of SBF, the court is allowing him to get a non-internet phone while out of jail on bail.

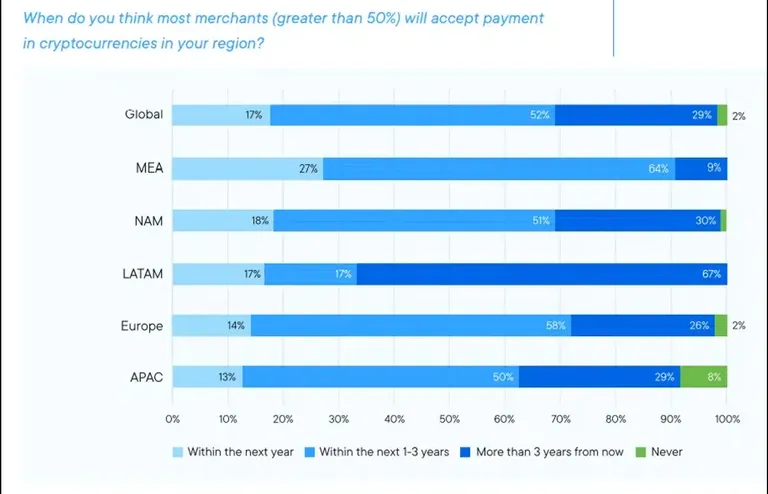

Ripple releases report with Faster Payment Council (FPC) that indicates 50 percent crypto adoption by 2025. (A MUST-READ) The Middle East and Africa are particularly bullish.

The Milk Man predicts Web3 commerce will be a big deal. I completely agree with this thesis. As soon as brands discover the value and benefits of NFT-gated content, Web3 commerce will be the greatest thing since sliced bread. The one major issue I see with the future of Web3 commerce is that it will be platform-based, the same as Web2 commerce. That itself goes against the principle of ownership. Shopify, for instance, is letting brands reward customers with NFTs. The good news for Shopify creators is they can export their customer emails to a CSV file and use them elsewhere, giving them ownership of their customer base. Not every platform will provide that benefit. I imagine some will be like Facebook and Twitter, providing rented land for creators instead of facilitating a homestead.

Coinbase Acquires One River Digital Asset Management. For its Layer-2 Ethereum solution Base, the crypto exchange is using price feed data from Chainlink.

Tether is lashing out at the Wall Street Journal for reporting on falsified documents.

Yuga Labs is taking some heat for its auction model.

Digital Currency Group lost $1 billion last year.

Venture capitalists are more bullish on decentralized finance (DeFi) than centralize finance. _Can anyone blame them? _Institutions look beyond bitcoin and Ethereum to altcoins. This isn’t surprising.

DeFi hackers walked away with $21 million payday in February.

People optimistic about crypto are more pessimistic about the general economy. Maybe that’s why they’re optimistic about crypto. Correlation does not equal causation. However, in this case, I think there’s a clear connection.

Babel Finance tries to cut its noose with Recovery Coins. At least they have HOPE (read the article if you want to understand the punch line).

Are cryptocurrencies a capitalist’s dream or nightmare?

Just because you drop an NFT doesn’t mean your project is Web3. Hollywood should be used to “no shit” moments by now.

Snoop Dogg has been outed as a co-founder of Web3 live-streaming app Shiller.

NFT sales dip 32 percent in one week. How to choose the right NFT marketplace. Most NFT buyers do it for the status. That may be why I have no interest in collecting NFTs. I’m not much on status.

Is India destined to be a Web3 leader?

Singapore and Nigeria top Google searches for leveraged crypto trading.

Israel investigates NFT creators over alleged tax invasion.

A Russian blogger in Bali was robbed of $284,000 in bitcoin.

South Korea is targeting voice phishing with digital currencies.

Egypt arrests 29 people related to alleged crypto scam.

If you haven’t got your copy of Web3 Social: How Creators Are Changing the World Wide Web (And You Can Too!), it’s at 99 cents on the Kindle for a very short time. And I might also add it is trending upward in sales. Currently, it’s a No. 1 New Release in the Web Marketing category and is in the top 10 in two other categories with average 5-star review rating.

At the very least have a cigar.

Snark and commentary are in italics. Inclusion of an item doesn’t mean I agree or endorse the ideas presented. Of course, it also doesn’t mean I don’t.

Cryptocracy is a decentralized newsletter published several times a week. I curate the latest news and crypto analysis from some of the brightest minds in crypto, and sometimes offer a little insightful and snarky commentary. Always fresh, always interesting, and always crypto. Original articles on Fridays.

First published at Cryptocracy. Not to be construed as financial advice. Do your own research.

Image credit: Ripple and FPC

Congratulations @allentaylor!

You raised your level and are now a Minnow!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!