Will Bitcoin ever decouple from the rest of the Cryptoverse? Or will the price of altcoins always be at the mercy of the “King” of crypto? A topic hotly discussed amongst cryptonauts, and due to the uncertain trajectory of the market one with no easy answer. An argument can be made that for the de-synchronization of the crypto market to occur Bitcoin must move into the background and lose its top position as the “King of Crypto.” Looking at some of the potential scenarios for a decoupling in the Cryptoverse we can see that the answer may not be as straight forward as many assume.

To Flippening or to not Flippening?

It has become an inevitable assumption within the Cryptoverse that a “flippening” is destined to occur at some point in the future. If there is one maxim by which to live your life it is to question the biases and assumptions of the herd. Why do we just assume that Bitcoin will be dethroned? There are several valid arguments that feed into this assumption. The most persuasive of these is that other blockchains-Ethereuem specifically-have more usage and utility. Secondly, as crypto experiences the fabled mass adoption this utilitarian argument moves to center stage.

Will Ethereuem scale up to rival Bitcoin? There is no doubt that Ethereum is an important asset and adds value to the Cryptoverse, but it would need to more than double in value while Bitcoin remains static just to catch up. At its current market capitalization Ethereum would need to add over $700 billion USD to catch up to Bitcoin. That is just not feasible this market cycle. In its current POW configuration Ethereum is bouncing at the limit of its capabilities.

The cost benefit analysis of the utilitarian argument breaks down for Ethereum as it exists now. Gas fees are just ridiculous and getting stupider by the day. Ethereum will never service the mass adoption of crypto, especially if a $50 fee for a $20 transaction is the average Joe’s first experience with the Cryptoverse that would serious jeopardize mass adoption. Much of the value and adoption of the Ethereum blockchain can be attributed to its first mover status. The fact that many of these unique new protocols and properties, NFTs, DeFi, and the Metaverse to name a few, were first developed on Ethereum gives it a serious edge. But first mover status isn’t everything ask the likes of Atari, Nokia, and IBM. So Ethereum will have to accelerate its development to stay ahead of the curve.

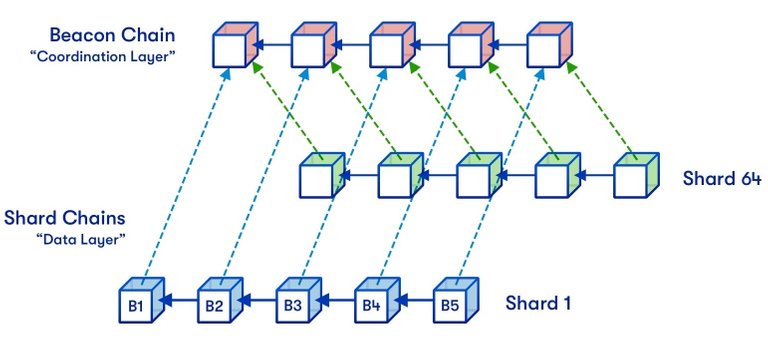

A successful transition to the proof of stake (POS) model with chain sharding will theoretically assist in Ethereum’s rise to a true Bitcoin competitor but this is more than a year away, and not a certainty. In that time Bitcoin will continue to rise in value. But What about ETH’s deflationary nature now after the London hard fork and fee burning? Many proponents of Ethereum take a dig at Bitcoin by labelling ETH as “ultra-sound” money (as compared to Bitcoin’s claim to the “sound money” title). A deflationary currency in combination with robust tokenomics is a very strong argument in favor of Ethereum. However, as block rewards decrease on the Bitcoin blockchain and lost coins increase BTC could also achieve a deflationary status. If Ethereum can hop its hurdles to a POS chain that can handle serious traffic, then a stronger case can be made for the “flippening.” Time however is not on Ethereum’s side, competitors are taking aim.

Competition

It is precisely the intensity of competition in the smart-contract sector of the Cryptoverse with the likes of Solana, Polkadot, Cardano, Algorand, Avalanche, and many others all fighting to get their slice of the action that may keep Ethereum from achieving the prophesized flippening. As of November 2021, all the top smart contract competitors combined still fall short of Ethereum’s market capitalization. While no single project may rival Ethereum in the short term their combined market capitalization is depressing the kinetic potential for Ethereum since billions of dollars are flowing into projects that are in their essence clones of what was first done on Ethereum.

All these projects could easily survive in the coming years since there may be more than enough capital flowing into the Cryptoverse to make all their chains viable, however, while the smart-contract sector as a whole may surpass Bitcoin’s market capitalization, it is entirely possible that no single blockchain surpasses Bitcoin including Ethereum. Essentially, do not take anything for granted.

A second less persuasive argument is the appeal of newness, trend, and fads. Will bitcoin be perceived as your “grandfathers” crypto? While this may sound ridiculous there is some evidence that this bull run is seeing just such a faddish phenomenon in the Cryptoverse with the rise of the meme coins. However, with the two top dogs at over sixty billion dollars of market capitalization (absolutely ridiculous btw) this only accounts for a smidge over five percent of Bitcoins $1.2 trillion USD capitalization. So while the meme coins have captured a lot of attention and made a lot of noise in reality they are a mere blip when placed next to the true top dog. Style, fad, and trend alone will not be enough to depose Bitcoin. Again, these funds are not flowing into smart-contract cryptos; nor Bitcoin, so the shit-coin phenomenon in terms of capital is crimping the rest of the Cryptoverse, but conversely memes are on-boarding some new users.

Doge v. Shiba

The Gold… -cough- Bitcoin Standard

One final consideration in relation to this discussion of the flippening and Bitcoin’s dominance of the cryptoverse is the concept of belief and faith. Traditional national currencies work (and fail) because of people’s faith in their government. Citizens must believe that the little paper rectangles are actual worth something, an act of faith. Of all the crypto coins out there BTC is by far and away the one in which people put their faith upon. Bitcoin has the most name recognition and is by far the most visible of all crypto’s, even the traditional financial media covers Bitcoin regularly.

In addition to Bitcoin’s “brand” is its technical prowess. It is still the most secure decentralized crypto out there with a fairly equitable distribution. The proof of work consensus mechanism, despite all the ESG negativity, is the most robust from both a decentralization and security standpoint. There are of course challenges like miner centralization, but this has yet to materialize. Proof of stake while less energy intensive has drawbacks some POS blockchains are more centralized (Binance Smart Chain, Solana, & Tron to name a few) plus the largest bag holders have serious sway within these protocols.

It has become quite clear over the last several years that BTC is now the premier store of value in the Cryptoverse. The phenomenon of capital rotation between BTC and the altcoins is evidence of this dynamic. (alt-season) As the mass adoption train of crypto picks up momentum many serious investors will make Bitcoin their first stop in the Cryptoverse all the money getting tossed into the BTC boiler will keep that gravy train chugging along. While Bitcoin dominance will inevitably decline that doesn't necessarily mean another blockchain will flip Bitcoin…maybe eventually, but it’s not too likely in the near to medium term.

There is a trend of sectorization in crypto where different blockchains are taking on more specificity. As the Cryptoverse matures there is no reason for different sectors to all move lock step with the price of Bitcoin and there may be some degree of desynchronization of the various market sectors. But as BTC remains the premier store of value and the bellwether of the Cryptoverse then its price action will continue to have an oversized impact on the altverse.

TIME is the most valuable coin and thank you for spending yours reading my post. I hope you have a wonderfully profitable day.

>>> Anarchiss <<<

Posted on my Publish0x Blog

Congratulations @anarchiss! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: