Misstkes I make’em, you make’em, we all make’em. Our mistakes fall within a spectrum of consequence. Small mistakes like misspelling mistake are of virtually no consequence, while others can have life, if not world changing consequences. Small mistakes taken on their own are virtually powerless; however the cumulative effect of a multitude of minor mistakes can be powerful. The aggregate effect should not be underestimated.

What happens when the cumulative errors of humanity threaten the king of cryptocurrencies, Bitcoin? At what point do collective mistakes accumulate to undermine the protocol? One of the greatest fears of any cryptonaut is losing one’s cryptographic keys, and consequentially their stack. This is indeed tragic, but once it becomes magnified on a global scale it transforms from a personal tragedy into a phenomenon. A famous quip attributed to Joseph Stalin illuminates this point,

“The death of one man is a tragedy, the death of millions a statistic.”

Is it possible that we lose all our Bitcoins? The answer is both yes and no. Like Schrödinger’s famous half alive cat this answer is both confusing and not very satisfying. There is a very real chance that so much Bitcoin is “lost” that the protocol is rekt, so…yes. But, like with quantum particles, our observation can change the situation, by recognizing the impending disaster and taking mitigating actions. Additionally, Bitcoin’s rising fortunes will foster a sense of caution when dealing with the asset hopefully, insuring its long term endurance.

Basic economic theory informs us of the truth that every “lost” Sat makes all other hodlers a little richer; however, these irrecoverable Sats have other effects. One of which is that BTC will actually become a deflationary commodity. Mass adoption of Bitcoin in conjunction with the hodler mentality, scarcity, and a deflationary characteristic may cause the price of Bitcoin to go bananas.

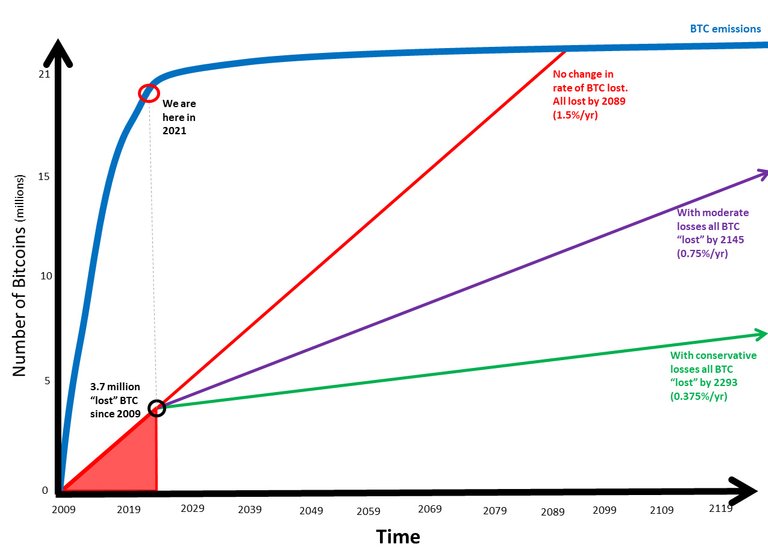

At a minimum these accumulating errors will make BTC a deflationary asset, and could be an existential threat long term. Let us examine several scenarios as depicted in the graph above. In the first scenario-the red line on the graph-there is no change from the current rate of Bitcoin being lost per year. This was calculated from 3.7 million being lost over the last dozen years. This equates to a loss of 1.5% each year, with no change in the loss rate we can see that all Bitcoin currently in existence will be lost by the year 2089 (Bitcoin would have the same life expectancy as your average human). Given that it is calculated the last Bitcoin will be mined around 2140, by the end of the twenty first century the cryptoverse would be dependent on the trickle of Sats coming from miners. One can only imagine the value of Bitcoin mining at that juncture.

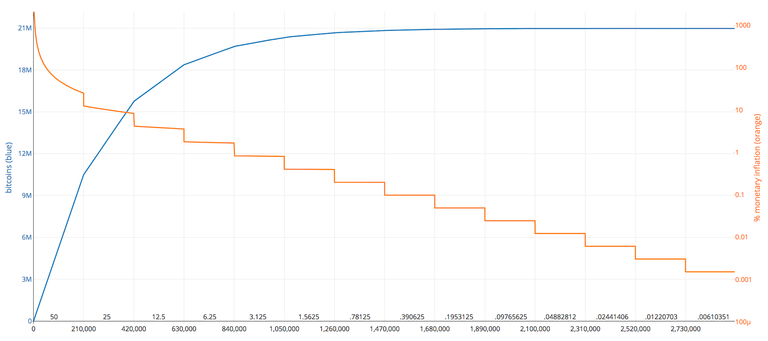

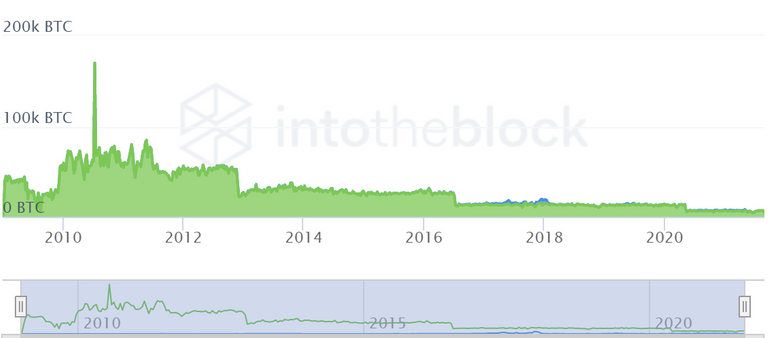

The top graph above shows the Bitcoin halving events in relation to its supply and BTC inflation. The bottom graph shows actualized miner rewards, the having events are clearly evident.

How likely is this scenario? Not very, for starters many Bitcoins were “lost” at genesis, the so called Satoshi wallets (≈1 million BTC), so that leaves us with a lower number of 2.7 million lost since 2009, and while that is a significant number it is not totally unexpected. Since in the early days Bitcoin was virtually worthless and so people were more careless with their cryptographic keys. In just over a decade the value has gone parabolic and hence people are much more cautious now than a decade ago. Most importantly this “loss” rate would hit a wall of diamond handed hodlers who’ve probably buried their keys in some artic repository.

Referring to the first graph the “moderate” loss line is derived from dividing the current loss percentage in half, this pushes the date of Bitcoins “death” to just beyond the end of its emissions schedule (block rewards). Halving the loss percentage again gives use the green conservative loss rate of Bitcoin pushing its demise deeper into the twenty third century. While it is unlikely that all Bitcoin will ever be “lost” all three of these scenarios do illuminate the fact that there is a steady erosion of the amount of Bitcoin in existence. When this erosion rate exceeds the number of new coins being minted in the creation of new blocks then Bitcoin will effectively become deflationary, piling on additional supply side pressure.

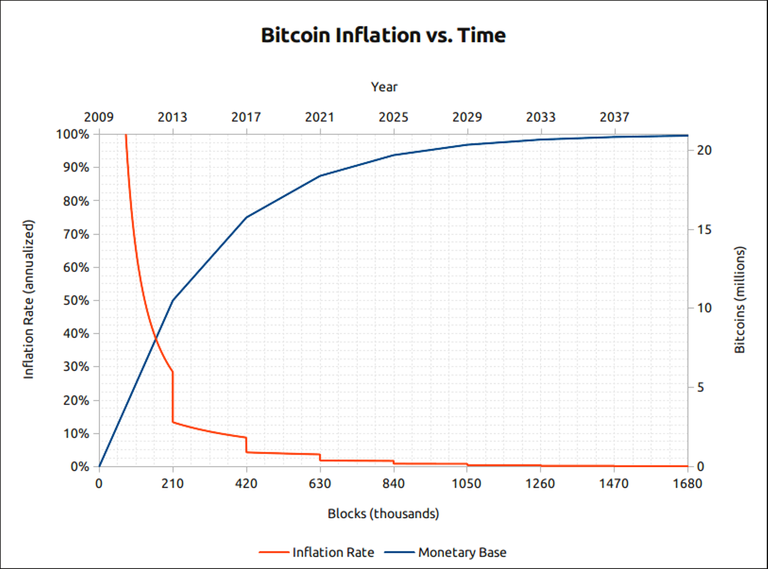

Projected Bitcoin Inflation

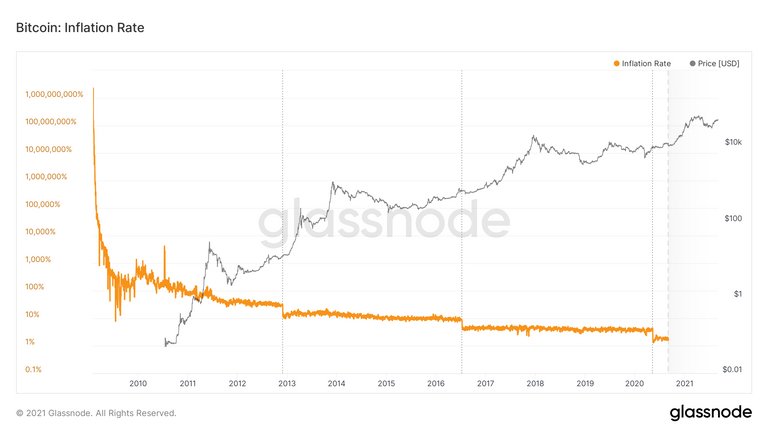

Observed Bitcoin Inflation

{18,769,000 Bitcoin in circulation. This means that 89.376% of all Bitcoin that will be introduced into circulation is already out there. The current mining reward is 6.25 BTC per block. The "halving rule" means that the mining reward will be cut by 50% every 210,000 blocks (or about every four years). Glassnode shows that the total amount of long-term bitcoin holders or potentially lost bitcoin has reached 33.96%. The total amount is 7,131,084 bitcoin held in these wallets.}

When exactly will Bitcoin become Deflationary? Well…not anytime soon. It may take a few more halvings for this to occur. The current rate of inflation is around 2%. That exceeds even the most extreme model of BTC being lost per year. However, after a few more halvings the amount of Bitcoin rewarded for each block mined will be below even the conservative rates of BTC being "lost." There is a real possibility that in the late 2020s or early 2030s that Bitcoin could become deflationary. Scarcity and a deflationary tokenomics would have major implications for the price action of Bitcoin.

As previously mentioned, the likelihood of losing all BTC is nil. Even in the worst-case scenarios there are enough cryptonauts who are careful, consequently there will always be a minimum supply. However, there are factors that could accelerate or slow down the loss of Bitcoin. One factor that may increase the percentage of "lost" Bitcoin per year would be the fabled mass adoption of crypto. If there is a new influx of crypto noobs this could cause more mistakes and more BTC locked on the blockchain. But inversely mass adoption would cause the price of BTC to rise steadily making people much more cautious. Mass adoption may also increase the use of custodial solutions for people too nervous or who can't be bothered being their own bank. If a custodial service was to lose access to large amounts of BTC through some mistake or error, then a single event could drive that loss percentage above that redline for any given year. One last factor to consider in Bitcoin becoming locked on the blockchain is human mortality, people dying and not properly passing along their cryptographic keys could be one of the largest sources of lost Bitcoin in the coming generations. It is never too early to look to the far future; the best players strategize for the long game.

Solutions? The first obvious solution with the correspondingly greatest impact is education. People need to learn the importance of being their own bank. As more institutions attempt to co-opt the cryptoverse there'll be increasing propaganda designed to increase custodial solutions, this must be resisted. Unfortunately, with mass adoption of crypto there will undoubtedly be a market for people who are too lazy to take care of their own financial destiny. In the long-term there could be changes to wallets or other technical fixes. There are businesses now that can assist you in recovering lost Bitcoin, this field may only grow. Some of this inactive Bitcoin may not actually be "lost" after all since some ancient wallets wake from their deep freeze every now and then. This dynamic adds a certain degree of uncertainty as to how much Bitcoin is truly beyond recovery. One thing is certain: Bitcoin will become deflationary due to decreasing block rewards and human error. A deflationary Bitcoin supply with increasing demand will have a dramatic effect on its price. Hodl to 2030 and beyond. Congratulations are in order, Bitcoin just passed its seven hundred thousandth block and is stronger than ever, here's to hoping for seven million and beyond.

TIME is the most valuable coin in the cryptoverse, and thank you for spending yours reading this article. I hope you have a wonderful day.

>>>Anarchiss<<<

Article also appears on my Publish0x blog.