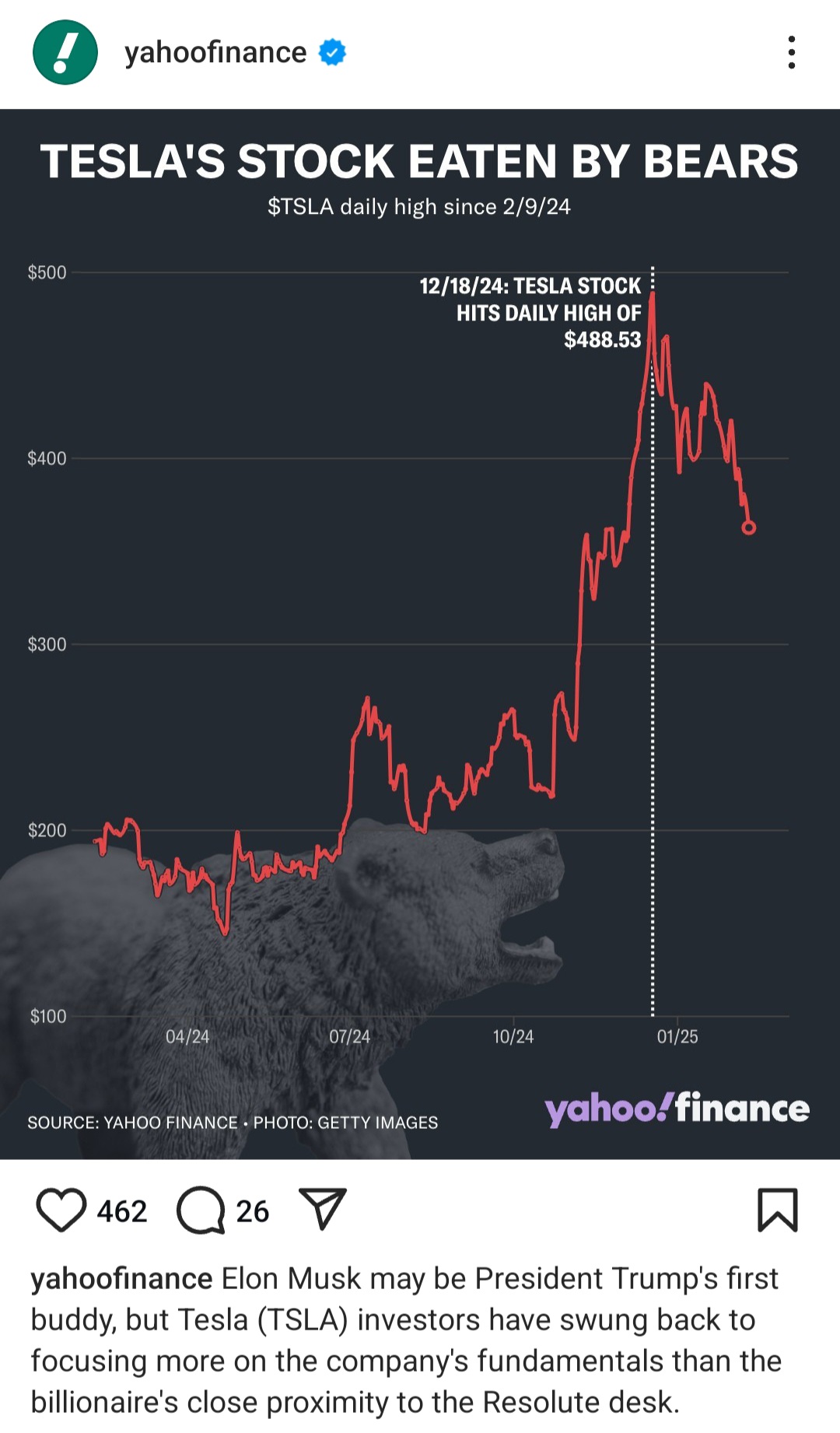

Tesla's stock has taken a sharp fall after reaching a high of $488.53 on December 18, 2024. The chart shows a clear uptrend throughout the year, followed by a sudden drop, signaling that investors have pulled back.

While Elon Musk’s connection to politics has been a topic of discussion, it seems Tesla investors are now paying closer attention to the company’s actual business performance rather than Musk’s relationship with President Trump. This shift suggests that fundamentals like production numbers, sales, and profitability are driving investor sentiment more than external factors.

Despite Tesla’s strong rally in 2024, the recent decline indicates growing concerns. Some analysts believe high interest rates and increased competition in the EV market could be contributing to the sell-off. Others point to the broader market conditions, which have been volatile in recent weeks.

The coming months will be crucial for Tesla. If the company delivers strong financial results, investor confidence could return. But if challenges continue, the stock may face further pressure.