It's learning time, bring your popcorn and don't forget your brain at home.

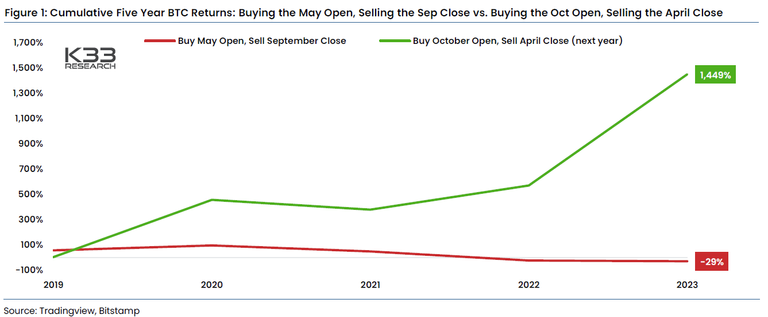

Over the past 5 years:

Buying BTC in October & selling in April had 1,449% cumulative returns.

Buying BTC in May & selling in September had -29%

However, this is just a cumulative number, there have been years where BTC didn't dump on May, which is why I decided not to touch my portfolio or try to time the market. All I did was prepare mentally and be ready for a possible turbo mega dump, and if there isn't I'll just be happy.

But what will happen this year?

"Sell in May, Go Away" is an old adage from TradFi which generally refers to the effect of seasonality, apparently it is knows a-la game of thrones, that during the summer most whales and market movers go on holidays and only the plebeians like us stay active in the markets. This sounds stupid to me, but it is a popular theory that apparently has been proven to an extend, either way...

It's statistically significant and studies have been done that have shown as much.

Apparently this is not just an adage that affects the stock market and according to a report by K33 research, the effect of this May bullshit bananas is just as strong in the crypto markets.

The below chart shows the cumulative return if you follow either strategy - cumulative five year BTC returns, quite stark if you ask me:

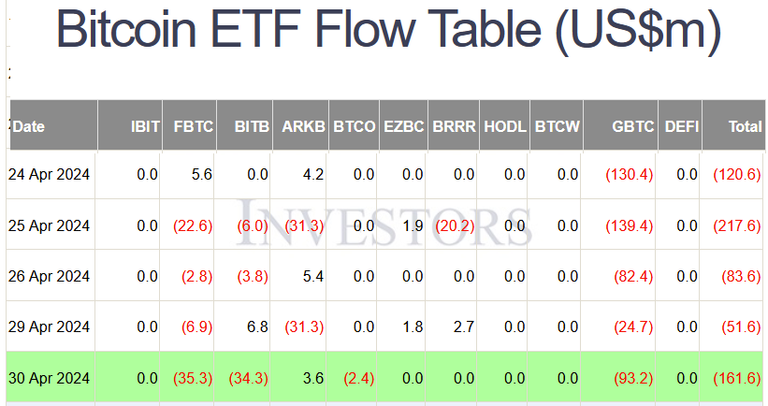

We have started this May with sentiment cooling considerably - my portfolio is in shambles, and some friend's portfolios have been effectively halved, or even more than halved - and we can clearly see this as there have been steady ETF outflows in the US. The past 5 days have seen net outflows of $632m and the HK ETF flows have also been much lower than predicted (way lower by the way, not just lower)

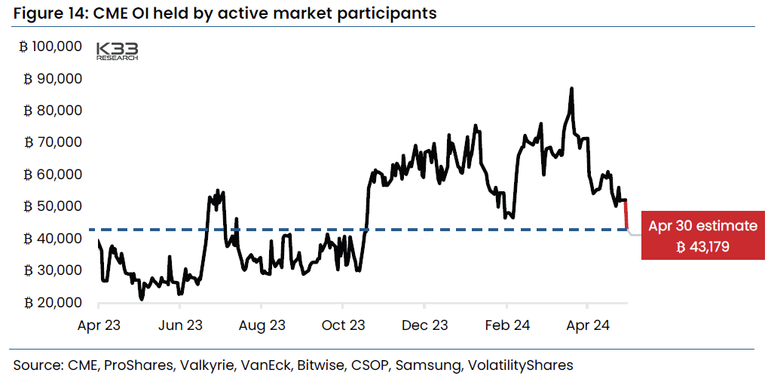

Daily trading volume & volatility has fallen to 2 month lows and futures premiums have fallen to 3 month lows.

Perps funding rates have cooled substantially, & CME futures OI held by non ETF funds is at the lowest since Oct 2023.

Institutions are less bullish.

Retail sentiment is also waning.

The Bitcoin Fear & Greed index is in neutral territory, "Bitcoin" search trends are heading lower & I am sure your Twitter TL is full of doom posting.

So, it's safe to say May has not got off to a good start.

Will the bleed continue?

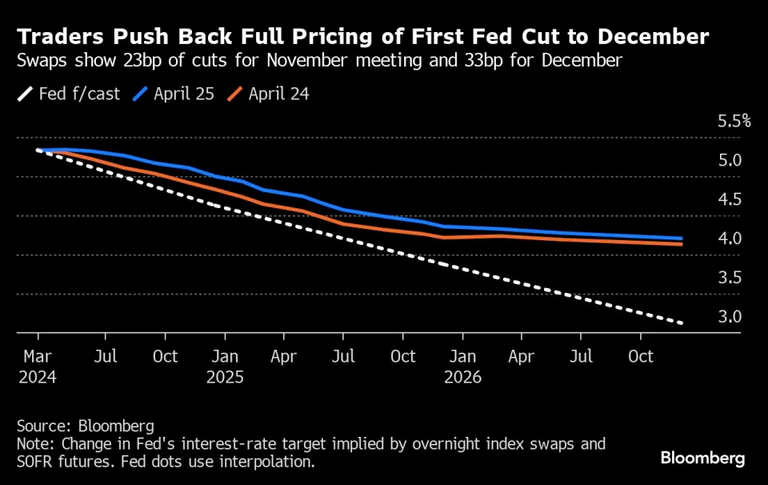

Well, a lot of what has been driving this is the worsening Macro for risk assets.

Core PCE inflation (the Fed's preferred measure) came in way hotter than expected.

Initial jobless claims also unexpectedly fell showing a tight labour market.

Translation: Pivot plays petering out

We need more liquidity!

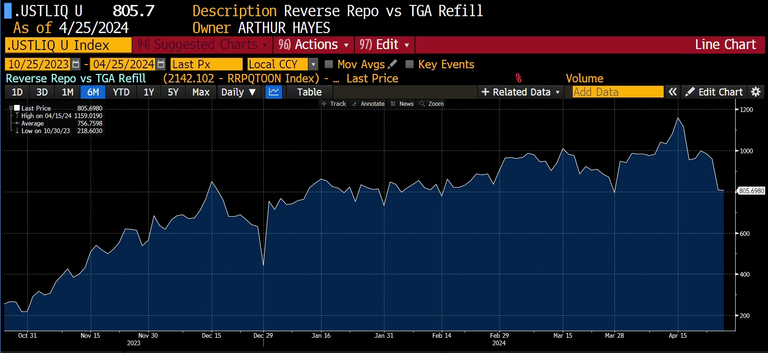

A saving grace could be the draining of the Treasury's General Account. This could provide risk assets the liquidity injection of up to $1.4trn.

This was most recently theorized by Arthur Hayes last week.

As expected tax receipts added roughly $200bn to TGA. Forget about the May Fed meeting the 2Q24 refunding annc comes out next week. What games will Yellen play, here are some options:

1. Stop issuing treasuries by running down the TGA to zero, that is a $1tn injection of liquidity.

2. Shift more borrowing to T-bills, which removes money from RRP, that is a $400bn injection of liquidity.

3. Combo of 1 and 2, issue no long term bonds, only bills and run down TGA and RRP at the same time, that is a $1.4tn injection of liquidity.

The Fed is irrelevant, Yellen is a bad bitch, you best respect her. If any of these three options happen, expect a rally in stonks and most importantly a re-acceleration of the #crypto bull market.

Whether Yellen & Co decide to provide this much needed stimulus depends on many factors.

Will the labour market worsen? Will GDP growth continue to slow?

How badly does the administration want to win the election?

I'm inclined to think that the Treasury will be forced to act.

Of course, a lot will also depend on what Powell says in the FOMC today.

So, even though many have sold in May, they may not stay away all the way to November.

Posted Using InLeo Alpha

self-fulfilling prophecy, profit taking, inflation, ... all sums up.

Nasdaq100 has gone up from 11 - 18.000 in 16 month.

Bitcoin has gone up from 16 - 70.000

Bbig moves.

We will rise no matter what happens in the US and what the Fed doing though I agree with you that this is an important catalyst.

My base scenario is one rate cut in the second half of 2024 btw.