One of the best ways to accumulate satoshis is to stake your holdings to generate a passive income. In this way, you look like buying more at the bottom and start to gain a profit during the bull market.

I already shared some of my journey about staking, I got a decent amount of satoshis from them by holding and staking them. Unfortunately, despite my accumulation, I still have a loss because the price of those tokens were all down.

Binance Smart Chain tokens

These are the tokens that I staked in Binance Smart Chain. I bought these tokens last year before the April dump. Unfortunately, I have losses to all of them.

Bakeryswap

I was a lucky guy before when I bought it when the price was $0.30. I got a huge profit from it. In fact, they are calling me a Master Baker after getting more or less 10x of my initial investment.

It was a great experience, it was my first time to get a huge profit like that. But the greediness inside me is growing. I wanted to get more profit so I bought back $BAKE. Then, the price of it gradually decreases. It hurts me because I think I used half of my profit. The rest were all used to buy other tokens—that I think I am at a loss for.

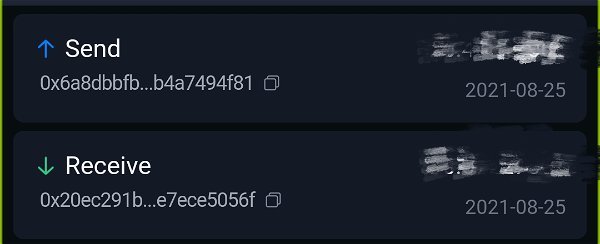

Thus, I decided to stake it in Bakery swap to earn a very small amount of interest. As you can see in the photo, I staked it last August 25, 2021. It is nearly one year but I only got a cent from the interest. It cannot even cover the fee.

Cub Finance

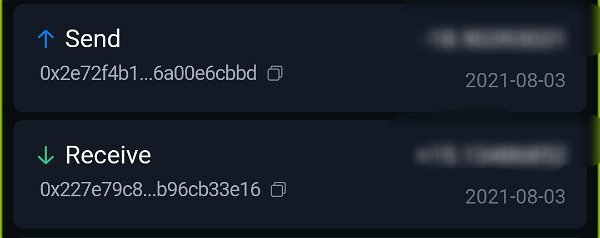

I also bought this one last August, 2021. I bought it when the price was nearly $3 per $CUB. After a few weeks, the price started to decrease and became less than $1.

The mistake that I had was I bought this because of the hype, without any research, I started buying this token. It will be better if I buy in the bottom.

I have no choice but to stake it in CubDefi to earn passive income. I stake it in Kingdom because of the auto-compounding. Unfortunately, after staking for more than 3 months, I found out that I am not gaining anything from Kingdom. I don't know what was the reason. So, I staked it in Dens instead.

Venus Protocol (XVS)

Buying this one was one of my biggest mistakes. I bought this because of my greediness. Months ago, Binance announced that all $XVS holders will receive an airdrop called $VRT. Hence, I bought this token.

This was more than $100 when I bought it, and now, it is less than $20. Man, I just lost more than 80% of my investment. So, I decided to stake it in Harvest Finance because it offers a higher APR compared to Venus.

Pancakeswap (CAKE)

I bought a $CAKE just because of its high interest which was more than 50% annually. The APY tempted me to buy the token. I bought it when the price was $20 each and until now it is still not in recovery.

But somehow, I do not lose my hope with this because there are a lot of people who believe in it and we are manifesting for $50 per CAKE.

As of now, I decided to stake it in Pancakeswap so I will generate passive income while holding it.

Conclusion

It seems that the DeFi trend has been replaced by NFTs and Gaming after the massive dump in April. It is one of the reasons that I am looking to make its price drop. Hopefully, we can recover from our losses. If not, take charge of the experience.

Also, if you don't need the money that you invested, you can consider to stake or lend it for you to earn passive income. But this is not financial advice.

The power of compounding will give you a profit maybe not now, but possible in the future.

Cool....

Thank you:)

Congratulations @anonymous02! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 3000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!