So... the best advice I can give to you is, as a trader your job is to always have an edge. An edge is just the probability of one thing happening over another and is typically founded in some kind of market inefficiency. So think of like a casino. Each next trade is a gamble, but that casino has like.. say...a 51% house "edge" over the customer. In this sense it's almost like the casino is trading against the customer.

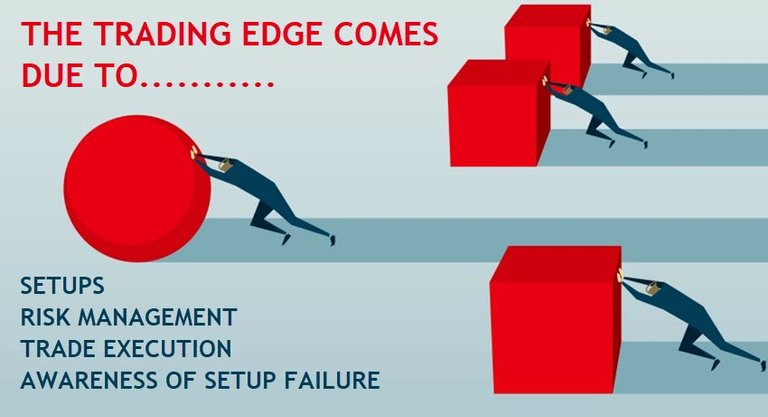

A trader might have 2-4 edges, or setups, that they're really, really good at playing. Things they've played many, many times before. This collection of setups or strategies is known as one's "playbook".

Consistent, successful trading is predicated on following this edge like a robot... so each next trade is not different or unique than the last trade. It is over a series of trades that an edge is present. For this reason, I suggest not falling into the trap of drawing TA thingies on a chart and sharing/validating that with your peers. Everyone has different opinions and that will only obscure your search for a real edge. Instead, find something that seems like it could work, test it rigorously without distraction, and record the results. I think most beginners do not think this way and are instead looking for "the next trade." This mindset is not how career traders think.

Posted Using LeoFinance Beta

The Hivebuzz proposal already got important support from the community. However, it lost its funding a few days ago and only needs a few more HP to get funded again.

May we ask you to support it so our team can continue its work this year?

You can do it on Peakd, ecency, or using HiveSigner.

Your support would be really appreciated.

Thank you!Dear @arcanelegends, we need your help!