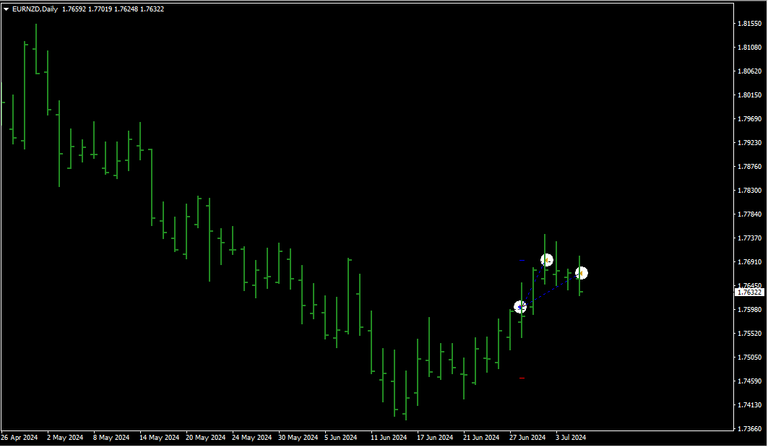

I opened this trade around late June and closed it around early July and I made 159 pips.

I opened two positions as usual, closed first position when tp1 was hit.

Then for the second, I was supposed to move stop loss to breakeven and then set a trailing stop as the trade continues in my direction. I made a little mistake there.

When my tp1 was hit.. The candle was still full, so I automatically calculated my SL for the second position with the current price and my trailing stop was set above breakeven. After three days candle, the SL was hit and position closed and unfortunately, the pair trended sweetly at my previously predicted direction and seeing that brought me some pains.

The right thing I should have done was to wait for the daily candle to close before I calculate and set my SL for the second position.