Are you an Average Trader?

Several years back I took a defensive driving class. It was a fairly serious affair. With a real ex-rally driver trainer in a souped up Toyota Corola, where the entire back seat was removed and retrofitted with complex hydraulics. The trainer sat shotgun with a laptop and he can virtually do crazy things with his laptop. I mean as a student driver, I would drive the car and he can say, "alright, I am going to spin your right wheel 50% faster in a powerslide and lets see if you can control the car!!" Yeah! pretty scary stuff!! But, I learned a lot that day. The reason I brought this up on a trading post is because he asked a simple question during the training:

Are you an Average Driver?

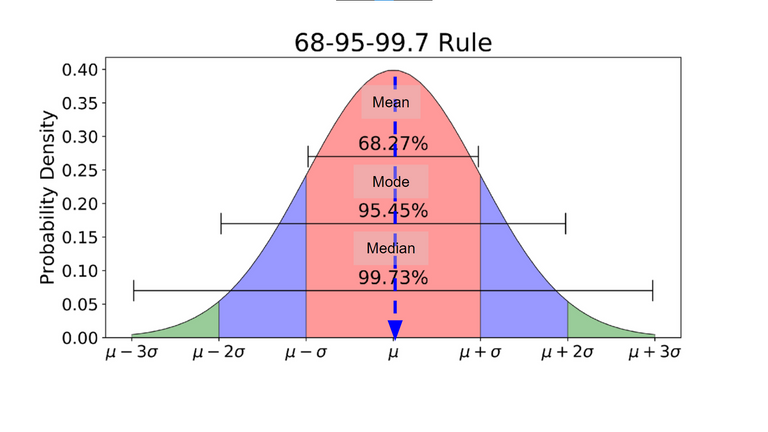

He says, that the answer he most commonly get is that everyone says that they are better than an Average Driver! Obviously that is incorrect :) If most people are above average driver then that defeats the purpose of average! If the distribution of drivers are a normal distribution, that is! Above is a normal distribution. Where probablity of a particular outcome is perfectly random. In such distribution, the mean, the median and the mode (I hope you know what these are, because I won't help you if you don't! Go ask your highschool kid or google!) are exactly the same, and located right in the middle of the distribution! The average! So, let me ask you my question:

Are you an Average Trader?

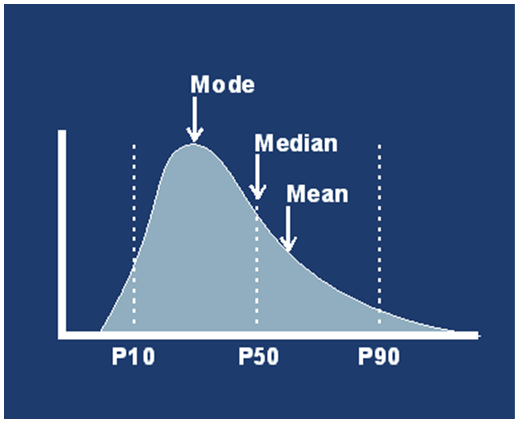

Life is complicated in trading world. It can be easily proven, like most natural processes, outcome/success/or profit or loss, by trades made by individuals, or even institutions are NOT normally distributed. It is mostly lognormal. Above is a log-normal distribution, where mode, median and mean are all at different places. Mode, the most requently occuring people (say traders here) are much less than mean (The Average). The mean of that imaginary distribution is probably P60 (or 60% of the people are below average). In reality, and data is hard to collect, but the mean of that distribution could be even further to the right tail to P70 or P75!

So let me ask you the question again:

Are you an Average Trader?

FACT: 95% of the traders wipe out 90% of their trading capital within first 6 months to a year. About 75% of them never trade again, and say market is completely manipulated (which it is! But that's an okay thing.)

So let me ask you the question yet again:

Are you an Average Trader?

Market Update: Post Luna Crash (forget about Luna)

These are the pair of charts that I used in my previous post, which a lot of people liked and commented. Some even said that it was 'actionable' (I don't know about that!). But anyways I put the chart below for an immediately side-by-side comparison.

| BTC | S&P500 |

|---|---|

|  |

Same Chart. Fast forward a few days, and at a slightly zoomed scale after the "Luna Crash". We can see that there is a green daily candle at the moment. I do not know if it will hold, but people already asking me, if this is an reversal. I always answer that question as follows: Reversal is a process!

| BTC | S&P500 |

|---|---|

|  |

Reversal is a process

Reversal means a switch of a trend. Say a trend that was going down. Something magical happens and it starts to go up (or vice-versa). The question you should always ask yourself, is:

Reversal at which scale or time-frame?

This is a very important question about reversal, trend, virtually anything related to charting in general. Trader typically trade at a particular time-frame chart. For me, for day-trade it is 15-min chart. If you trade in five different time-frame god help you!! So, it 15-min chart, which is on the left, I see the downtrend from previous day, 13:45 reversal bar (doji) marked the bottom. Then I am looking for 3 signs:

- A higher low

- Price above a medium term EMA (I use 50 EMA)

- A new intermediate high above the 50 EMA

If all these satisfies, I have a reversal on a 15-min chart, and I will look to go long. I may or maynot wait on a pullback. Typically I don't.

| S&P500: 15-min chart | S&P500: 1-hr chart |

|---|---|

|  |

However, compare that to the next higher level chart! The one I use is 1-hr. Did the trend reversed yet? Maybe, maybe not! It did sort of full-filled all three criteria, but the market still below major support (which is now resistance), the yellow line of 4062 from the daily, and the red - arrow, also from the daily, the major downtrend line which is way above at 4270! Price is below all that. So no, we are not out of the woods yet. But since I trade in 15-min, there is no harm in doing some long trade. If the rally fails, I will short it pronto!

Disclaimer: This is NOT professional advice, this is all just my own opinion and experience. I am NOT a Certified Financial Adviser. Consult professionals for any financial, accounting or legal related questions you have.

Charts are created in Tradingview.com, which is a free service.

Does it mean that if the above does not apply to me, I am above average? To be honest, I don't consider myself as a trader at all, so that the question in fact does not apply to me. That's simple somewhat.

Cheers!

PS: I watched a movie with the kids earlier this month... and now I know what your avatar refers to!

PS2: sorry for the quite unrelated comment... but yeah... life is too short to avoid unrelated comment ;)

Unfortunately No :)

And the reason is something you already have given. A trader, here a day trader, actually have a definition as per US security law. That is if you have done 25 round-trip trade (buy and sell) in a calendar month (which is 20 trading days), then you are a day trader as per SEC, securities and exchange commission! Please let me know if you qualify :)

There is no unrelated question or comment at my blog. Spirited Away is an iconic film. I recommend going through other Ghibli films too. Totoro should be next!

With this definition (I didn't even know there was one), I don't qualify. My free time goes elsewhere (science popularisation and fun on this chain, in particular but not only ;) ).

We have started to watch the entire set of films made by Miyazaki with the boys (they found about them and they are big fans). One film per week. They have watched Totoro without me a few weeks ago (I was visiting MIT on that week), and last week we tried Princess Mononoke. I must admit that I enjoyed those movies too.

We still have a bunch to go. A lot of upcoming nice Saturday evenings ^^

Another fact I think you will enjoy and appreciate.

Did you know that Sir Issac Newton lost most of his life savings in South Sea Bubble? Another example that investment prowess is not exactly proportional to scientific skills.

https://en.m.wikipedia.org/wiki/South_Sea_Company

https://physicstoday.scitation.org/doi/10.1063/PT.3.4521

I didn't know that story about Newton at all. The physics today article is very interesting and it is indeed a reading that I appreciated.

I fully agree with its conclusions: there is no such a thing as a universal genius. A single person can be excellent in one area but the worst in another. An also, it is important to diversify (to some extent) our investments, and also account for the fact that it could go to zero.

Cheers!

I am below average in most things, except words used... :D

Keyword: words used :)

I am hearing so many people around here got into Luna, and I didn't even know about it. I thought it's just another stable coin.

PS if most things in the world are log normally distributed, by definition most people are below average in everything. Right?

It's just logic.

I think most people must be below average at most things, as there are many things and only so much bandwidth to learn with. but some specialise highly, and everything has specialists that skew the distribution.

I didn't get into luna either. Well, other than for that post last night.

Yeah, for post it is all fun and good.

Is there a proper automated indicator you ever used for a long time with success?

None :)

Some says it impossible. Because of two reasons:

all indicators are slower than price/volume, because they are derivative of price/volume;

they all try to capitalize on a inefficiency of the market, but market is efficient (at least over 'long' term), so over time that 'edge'tapers out.

I can point to a lot of evidence affirming that, but the FOMO into auto and copy trading seems unavoidable.

There was FOMO into Luna-UST even after the crash started. You can call in greed if you want, I call it insanity.

Haha, yes, so what's the difference when it comes to investing? Bloodlust on the streets of a crashed market makes the greed of a man with a grey suit and a bicolor Rolex very comparable to the mindless FOMO that takes the last 500$ of a small retail investor.

I have to admit, lots of youtube no-goods have been baiting with luna recovery theories. I have to assume you're not very interested in the alt-coin markets when it comes to trading?

nah! I don't 'trade' crypto at all.

I only trade index futures these days, only major indices, basically just S&P 500 and Nasdaq index futures.

I am not much of a trader, mostly just holding.

me too!

I kinda hodl and cross fingers awkwardly...

Nothing wrong with that..

I would say that I am average. I lost quite a bit when I first started and didn't understand things. Going on on some penny stocks didn't really help but you learn I guess.

Posted Using LeoFinance Beta

Ive done awful on trading, lessons learned lol

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

(3/5) @captainquack22 tipped @azircon (x1)

Learn more at https://hive.pizza.

Buy high and sell low 🙄😆😏

It's a joke ! great post!👍