Cash Secured Puts to built a stock postion

Today was my Friday off, well I have most Fridays off, and after a long time I was looking into my various brokerage and trading accounts. Typically I don't look at them much. Most are long term holdings, and lately my wife most of the futures trading on indices, so there is nothing much for me do. However, recently a bunch of my accounts moved to a different brokerage house due to a M&A, and I saw some of the accounts are not properly connected. That triggered a rare phone call!

If you are in the US, you can imagine why we hate customer service phone calls! They are typically a nightmare. However, lately in some cases I am pleasantly surprised. Yesterday, it was a discount tire dealership; and today it was one of the top brokerage houses in country! Wow! I checked the website, and I learned that I don't have to call the 1-800 number, and I have a dedicated person for free. I quickly ask my wife on the side, is it real? She said, yes, nice kid, you should talk to him! Wow!!

I called! The kid picked up on second dial tone! Wow!!! After a quickly greeting, I mentioned my issue and he connected the accounts the way I wanted in 2 minutes. Now I am really impressed. However, I was waiting for the sales pitch. I knew it will come, I knew he will say that he would love to manage my account for a small commission! Yet, that never came. Instead, he said something cool. He correctly observed due to futures trading we hold certain amount of cash in the account, and also we have large stock positions, and we don't use that position to leverage income. I admited, yes, I don't. I used to do a lot of leveraged trading, and I don't that much anymore. Getting old, I said! He appreciated, and understood that I probably traded a lot back in the days. Then he mentioned about cash secured put.

Strategy

For those who don't know what option trading is, you probably need a primer. This post will not reach you about trading option, as I already assumed basic knowledge. I recommend Lawrence McMillan's Options as a Strategic Investment.

Anyways, the kids recommended me to collect some income by selling some puts against the cash and the margin position that I already have in the account.

A cash-secured put is an options trading strategy that involves selling a put option on an asset, while also setting aside cash to buy the asset if assigned

| What it involves | Selling a put option and setting aside cash to buy the asset if assigned |

|---|---|

| Potential benefits | Can generate income and potentially help buy stocks at a lower price |

| When it's a good strategy | If you're bullish on a stock long term but think it might drop in the short term |

| Potential risks | If the stock price drops significantly, you might be forced to buy the stock above market price |

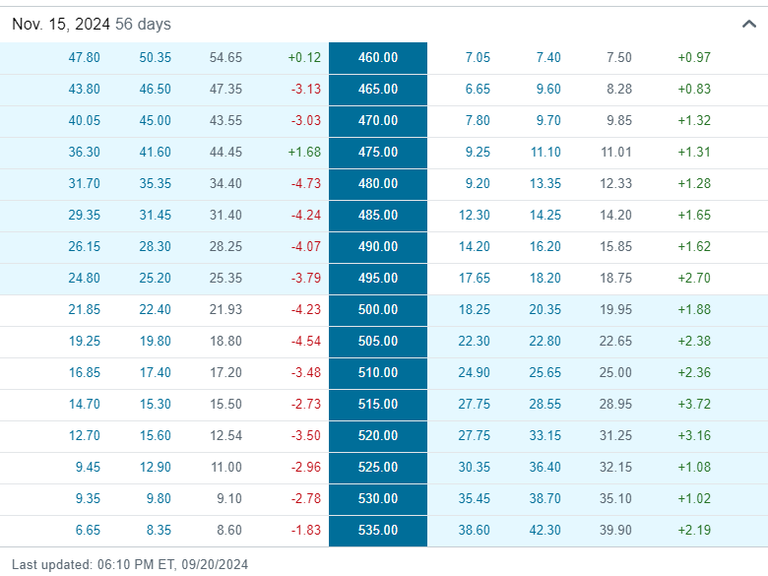

It is easier with a recent example. My wife wanted me to build a position on GS; Goldman Sachs. The interest rate in the US is begining to fall, and in the falling rate environment banks and investment houses do well long term. That is her thesis, and a good one. Trouble is with the high market GS is trading near ATH. Today, Friday, Sep 20, it closed at 498.53 (say $500). She wants to purchase 100 shares, so it will cost us about $50K on Monday, if I just outright buy it.

This is the chart for GS. I have no idea where the price will go, and I don't really care, as this is a long term buy. I considered the Nov 15 expiration for the GS options. The table is below:

I can potentially sell the GS Nov 15 460 puts for $7 on Monday, that will let me collect $700. One of the two things can happen by Nov 15:

GS will trade below 460; the option will be exercised, and I will be obligated to buy 100 shares of GS at 460. However, I already got $700 for the sell of the put. So my cost basis for 100 shares of GS will be 453/share; for 100 shares $45,300

GS will trade above 460. The put option will expire worthless. I will get to keep $700. I will have to try buying GS again at a different price with a different trade

Risks and Rewards to consider for selling puts

Benefits of Selling a Put Option:

Income Generation: When you sell a put option, you receive a premium upfront. This premium is yours to keep, regardless of whether the option is exercised.

Potential Stock Acquisition: If the stock price falls below the strike price and the option is exercised, you're obligated to buy the stock at the strike price. This can be advantageous if you believe the stock is undervalued and has potential for future growth.

Limited Risk: The maximum loss you can incur on a sold put option is the difference between the strike price and the premium received, plus the cost of the stock. This is because you can always sell the stock at the market price if it's trading below the strike price.

Risks of Selling a Put Option:

Obligation to Buy: If the stock price falls below the strike price and the option is exercised, you're obligated to buy the stock, even if you don't want to. This can be risky if the stock's price continues to decline.

Unlimited Upside Potential: While your downside is limited, the potential upside for the buyer of the option is unlimited. If the stock price rises significantly, the buyer can exercise the option and sell the stock to you at a profit.

Hope this helps you guys to understand how I typically build a position for cheap. I am grateful to the kid from my new brokerage. He was polite, knowledgable and soft spoken; and he got me thinking about this trade and triggered me to write this post.

Covered calls are another good way to generate income!

The issue with covered call against my existing position is there is good chance they will get called away, as we are in a bull market and I only keep market leaders in my portfolio. If the stock gets called away they will create capital gain (and taxes) which I absolutely do not want.

Makes sense are you trading an in IRA in a 401K or ROTH. I love my Roth those tax free gains are sweet.

Roth doesn’t allow what I do most of the time. Yes I do like Roth and I have it but this is not something I can do on Roth.

Wow, I can't imagine what it must be like to have a partner that is so knowledgeable about trading and stuff like that. My wife has no desire to get involved with any of it. She would just prefer me to take care of it all. I try to give her updates every now and then, but largely she doesn't care. I think she could if she wanted to, so it isn't lack of ability, it's just lack of desire!

Takes a lot of stress away for sure. Also we are school class mate so together for a really long time and grew up learning the exact same things in exact same job and all helps too.

That's cool. My wife and I are both in public education, but very different aspects of it.

Such a luck your wife is trading for you, sir!

At first I thought this was a "protective put" operation, where you buy stock at spot and buy puts at same time, which is also a nice way to insure and mitigate risk...

But then I noticed its really a "cash-secured puts" deal. I didn't know the term, even though it sounds basic... Sounds like you didn't want to buy at that price near ath, decided to set it to buy at a discount if so (exercised), taking the upfront money by selling puts, also accepting that if price went up you wouldn't want to own the stock anyway.

I almost don't trade options, rarely. I know greeks and did somewhat an immersive study, like I still have difficulty reading these payout curves and calculate premiums, but know whats an IV rank, whats intrinsic or extrinsic value, or smile and skew curves... But still want to read the hull book and learn better how to do delta neutral (or zero) operations, like streaddles.

Overall I like the idea that you can take more leverage in a safer way through options than other leverage instruments... Like only by buying cheap otm calls or puts, which is easier to do (by calculating risk) but more unlikely to happen, depends on volatility... I have some aversion to the idea of selling calls.

I really like macroeconomics! The interests rates its like a extended talk, I'd need to study more the impact on banks net results. But overall its good for stocks, yes. Good luck there!!

A cash secured put is selling a put.

You sell the put while holding the cash that is needed if the option is exercised. It is a very low risk strategy but only applicable if you have a large account.

My respect to you. I lost a lot of money on options in the 2000s, a very risky instrument when you can take on a lot of leverage. Although I was able to make money on futures with 10 leverage for a long time.

Lots of people lost money on options. Leverage usually is hard to manage especially if you put your emotions into it.