Financial Acumen, Market Correlation and Hive

The year 2022 have not been kind to the markets. I am talking about both stock markets and crypto. After the all time high in Nov 10, 2021, at nearly $69K, we all know BTC sold off, and at $34K after nearly 6 months, it is down just more than 50%. Comparatively, S&P 500, the bencemark of US stock market, put on a high on Jan 04, 2022, just north of 4800, and currently after 5 months, it is down just more than 15% at about 4100. These are facts. So the question is how do we analyze this?

| BTC | S&P500 |

|---|---|

|  |

I put both charts side-by-side for a simple visual correlation. Often human eye is the best analyzer compared to any automated technique. We can see, althrough the ATH was slightly offset but the downturn is surprizingly similar, albeit, at a different percentage as I mentioned above. Actually if I do a like-for-like comparision, and check the BTC price on Jan 04, 2022, at the high of the stock market, BTC decline is about 30% (28% to be more precise). So BTC decline is about 2X the decline of the stock market during similar time period.

Correlations are at All-Time-High!

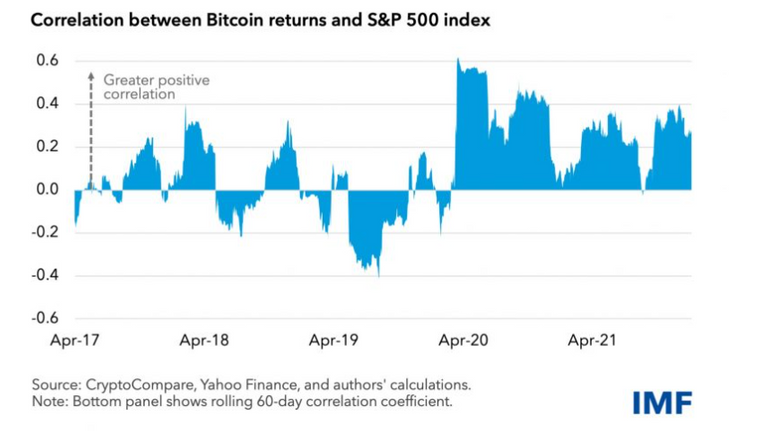

Here is the problem. A good investor always look for alternative assets. Meaning assets with low and perhaps negative correlation with the stock market. BTC used to provide that solution perfectly, as shown this recent IMF blog, that the correlation between BTC and the Stock market used to be low, especially during 2017-18 during the early adaptation of BTC. Most of the 2017-18, the correlation between BTC and S&P 500 was in the order of 0.0 - 0.3, sometimes even -0.2! Negative correlation was typically consider juicy hedge for a portfolio highly correlated to the stock market. But alas, those days are long gone!

Below is the current correlation between BTC and S&P 500 over a rolling 60D window. Currently it is at 0.7! Just for reference 1.0 will be a perfect correlation, it will be like an index fund or ETF (SPY). This is an unreal correlation for something that is typically called 'alternative investment'.

Therefore, the obvious conclusion is that BTC is NOT an alternative investment anymore. Just like most things in the present world, it will go up and down with the stock market and the general economy. If that is the case, to understand and predict the downturn and end of it, we must use the same forward looking tools that we use for the general stock market and the economy.

Inversion of the Yield Curve

For the stock market there are very limited number of forward looking indicators available. Yeah, please don't tell me technical analysis of a chart can predict the future move of the market. I have used technical analysis for 30 years and I can tell you that it is an useful tool but predicting market move is not the main use of them :)

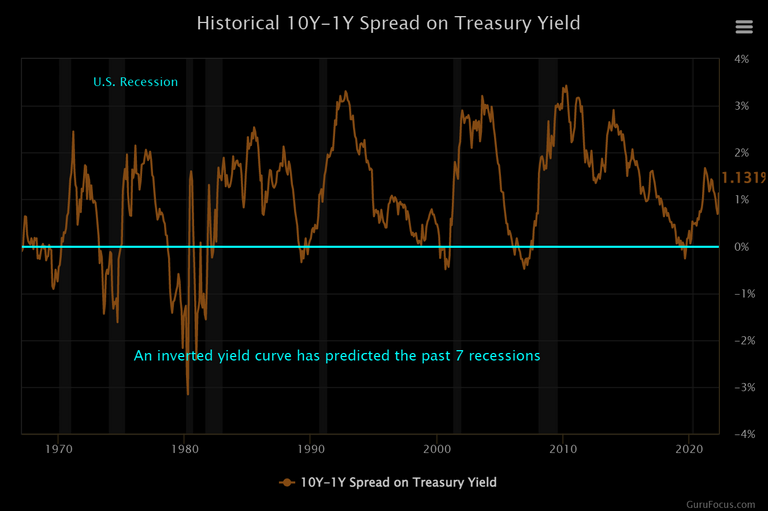

One of the tools that can predict the market moves, more precisely a particular move, the one we are currently interested in: RECESSION; is the US Tresury Yield Curve, or more precisely the inversion of the yield curve. It is one of the best forward looking indicator of the recession of the stock market.

First, What is a yield curve?

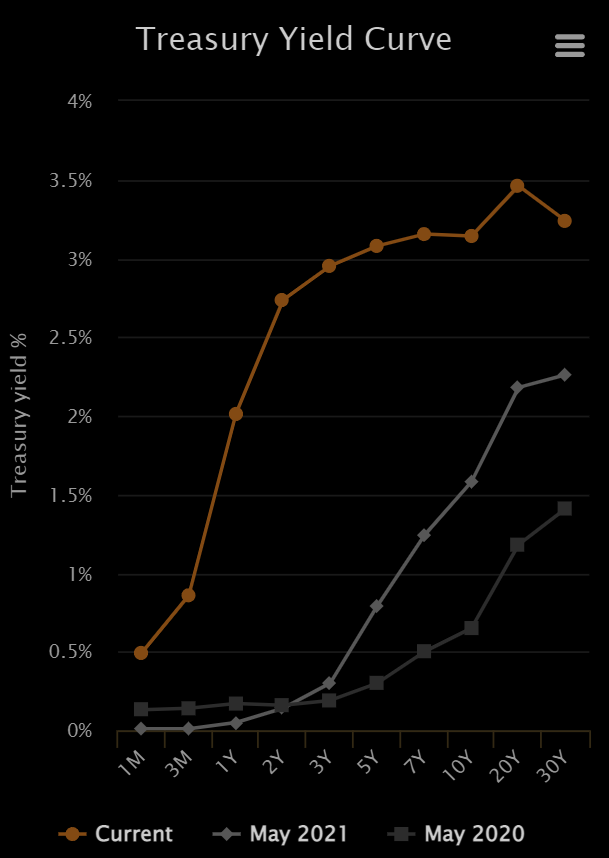

A yield curve is a graphical representation of yields on bonds with different maturities.

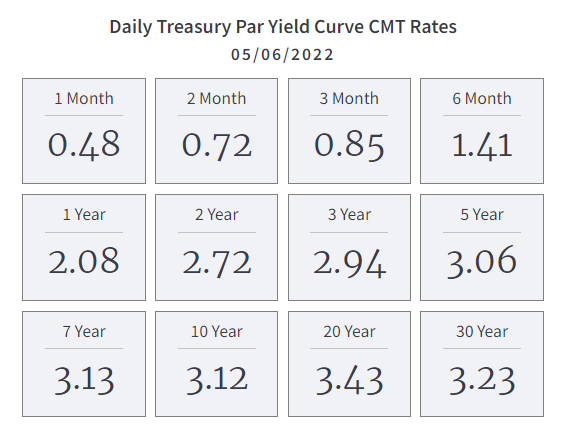

The government bond yield curve is often referred to as the benchmark yield curve. Each day, the US Department of the Treasury (www.treasury.gov) reports the yields for various maturities of US government bonds, ranging from 1 month up to 30 years.

Second, What is a Normal yield curve, and what is an inverted yield curve?

Generally speaking a yield curve reflect peoples collective perception of risk. In a normal scenario, people typically expect higher compensation (yield, interest) to invest money in bonds for longer duration. Meaning a shorter maturity (say 6- month) US Govt. Bond will have lower interest (yield) compared to a longer maturity bond (say 30 - Year).

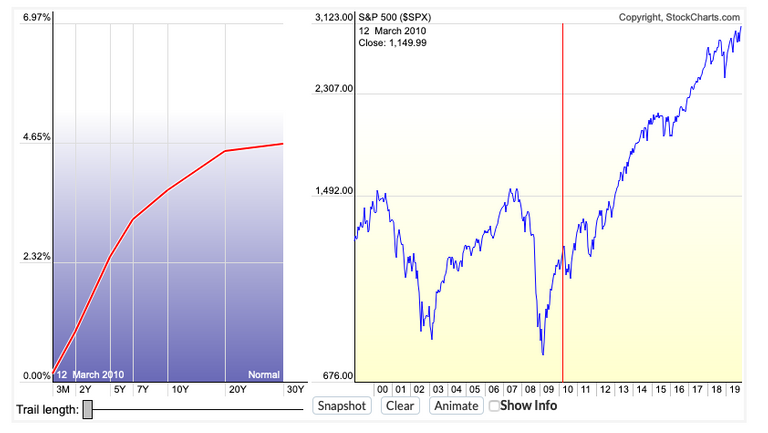

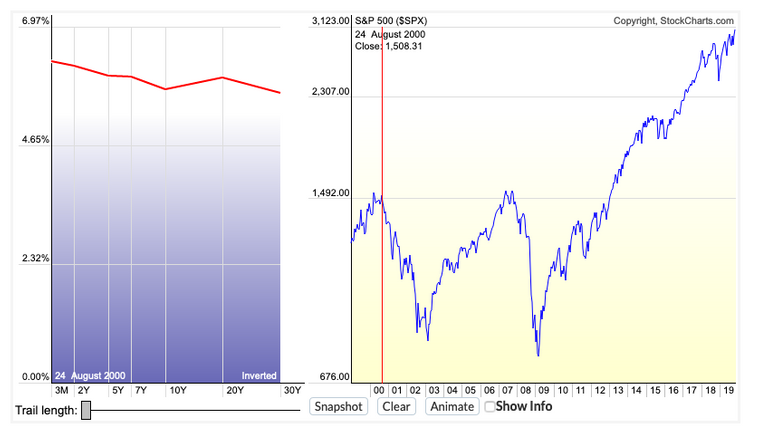

An inverted yield curve happens where shorter dated Govt. Bond yield higher interest rate compared to longer dated bonds. This means investor are afraid to invest money longer term and like to keep it all in cash or equivalents. An inverted yield curve is a rare event and typically widely talked about in the financial media. An inverted yield curve usually begins with flattening of the longer duration yield and typically is never completely inverted. However, even a slightly inverted yield curve is enough to trigger a recession. Important to note: Yield curve inversion is forward looking, and happens before the recession, and it has correctly predicted the last 7 recessions.

There is a nice animation of historical yield cuves can be found here:

https://stockcharts.com/freecharts/yieldcurve.php

So: Now What?

Yes, the million dollar question. My working hypothesis this to predict the recession based on the shape of the yield curve. This is not a rocket science (I will also argue that rocket science is not particularly hard!). Below is the current yield curve for US Treasuries. We can see the flattening past 3-Years as Fed continue to rise interest rate and signal further rise (which is a fine thing to do, to manage inflation). There is a slight inversion at the longest duration between 20-to-30-Years.

So this this typically the early sign. Market is smarter and smarter these days. Everyone have access to this data. Market is forward looking to the n-th degree, so it has already beginning to price-in the downturn (recession?)!

Is there a silver lining? Yes, there is a myth in financial system, called 'soft landing'. Meaning, raising the interest rate gently enough so that not to trigger the inversion and therefore a recession. It is very hard to accomplish. All these respected people tried, none succeeded!

I am a big fan of Ben Bernanke, the depression scholar, and even he couldn't pull it. So I don't think, I have very high hope that we can pull it this time. If recession happens we are looking at 40%-60% further decline, if it is deep. If it is shallow, then 15% - 40% further decline of the stock market. Which is really no big deal in either scenario. Just keep cash and you will be fine!

Based on the current correlation of the market to BTC, if market drops 40% from here, BTC probably not going to drop 80%, simply because, lower it dips, lesser the correlation. But just saying, $10K BTC on a spike low is always a possibility. I have the cash ready to buy if that happens.

Oh! I am keeping my hive powered up as an inflation hedge and some income and looking to buy more hive if the price declines further.

Disclaimer: This is NOT professional advice, this is all just my own opinion and experience. I am NOT a Certified Financial Adviser. Consult professionals for any financial, accounting or legal related questions you have.

Charts are created in Tradingview.com, which is a free service.

Everyone who got caught up in the FOMO at the last market peaks hasn't sold for the purpose of reinvesting and that's a lot of people. Pandemic, War, Lunarsupercycle, all that stuff, and in the end we get a pretty normal economical cycle - with the addition of an intense inflation phase due to the increased money supply. It's insane to me how independent the market seems to be in action. By all means, if the market would start coming back strong and at the same time all human life would just end, maybe the market would go for another full cycle without us.

Oh this is poetic! Market without us! :)

My thesis is mostly about the general market. Crypto these days is just following it, which is a double-edge sword, right? Many of us came to crypto to get aways from the general market. Now the general market is coming to us :)

I wonder how much of that is due to BTC traded by brokers and how much of that is the stable coin dependency via all those automated LPs with high yields.

If I draw a bubble around all crypto markets and look at it only via I/O, wouldn't it be possible to drain the overall energetic level of the system with my 100Billion USD$. I'd be going hard into Stable Coin Assets with good APR only, and then leave the market again at the end of a given period with the profits. I'd have taken the high APR, and took only the platform risk but the overall system that I just left again, has to compensate for the monetary energy balances.

Without BTC strength the health of high APR on the stable will dry up real quick. Have you thought where is the high APR on stable-staking coming from?

My assumption is that the stable coins are constantly illiquid and therefore it doesn't really matter how much is created because they're not used outside of DEFI itself. This means, they just bubble up the market and prove financial utility without getting really tested considering their legitimacy.

That's a fair assumption.

The thing is, we must create lending...true lending in crypto...wide spread. I am talking home loans 30 year mortgages, business loans. Only then stables will be stable.

Wouldn't that mean we have vast loans leaving the crypto space via the FIAT exchanges to buy building materials and pay for construction work?

We might need to get domestic exchanges of goods up first. I'd run a Hive/HBD-based webshop sooner than later. The dream would be a WooCommerce plugin and run with that.

Maybe start with selling PIZZA for Hive, that seems about right for the space :D

I have butterflies in my stomach. :)

As you know Amor, I wrote this post on Sunday night. I was prepared, 100% ready with my battle gear this morning. Typically one or two days like this all year is all that I can handle or need anymore. Just to check if I still have 'it' in me.

Its very satisfying.

Having butterflies in stomach is a good thing. Means that you are in the know. You anticipate something, while others are ignortant. Makes you a warrior!

That must have felt good man! I wish I read this blog sooner lol! Should have shorted with a larger position. :D

Well, today is just a single day. If I am generally right, there will be many more days like today. Just wait for the next rally and fade the move. That is the general game plan until the status-quo changes.

The good old merry go round of peaks and troughs has turned once more. I will be buying some lows definitely

Sure thing, Boomy! Count me in as well.

Trouble is the general economy, that sucker is not looking good.

Everything does look to be going to hell in a handcart at the mo!

Just ask your representative at the village/town level, that this 'hydrogen for UK' will not going to fly. Start getting oil and gas from the damn North Sea, which is basically your backyard! People got to eat...

That's politics for ya. They are obsessed with ignoring it even though there is a lot of stuff still there!

"lots of stuff" is actually an understatement boomy. The 'island' is completely self-sufficient in terms of energy need for the length of our lifetime, perhaps even part of our kids lifetime. I am not making it up, as I did the study myself! One of the most unfortunate knowledge that I have....and I can do nothing about it.

Then that is really rubbish as we could exist on that and not be under the cosh of the East!

That will upset many of the bitcoin holders here, not because the price is down but because there will be a swarm of bitcoin owners if the price hits your assumption (or even close to it). But the 'usual' dip will revolutionalize the crypto world I assume— as more and more people will enter the realm to harvest the bounty when the price/value is expected to find its pace, around Nov-Dec-Jan, a profitable trade for the short-term traders and a giant leap toward becoming 'invincible' with a stake worth infinity for the futures traders :P

Financial matters always catch me off-guard, and this long post did the same—however, what I could sense from your valuable info is that I must be prepared with whatever I have to catch some fish in this troubled water.

Thank you for highlighting the scenario and giving a hint of what's coming next. :)

The simple thing I always tell people that market doesn't give a flying fuck on what you think, where you bought, if you hold or trade. Market doesn't care if you live or die. Market doesn't know if you even exist.

If you fight the market there is one outcome. You will loose. It will be swift and efficient. Its ruthless and relentless. There is no escaping the market. It will do what it want to do, you can sink or you can swim, its upto you.

That's right— either you hop on the train before it leaves the station or wait for the next; it's up to you. But the thing is, your choice makes a huge difference, if you buy a ticket for the first-class, you get top-notch service in return and the same goes for economy or business classes.

Also, purchasing a ticket for the first class may not serve as per your expectation as the road is considerably longer and can get bumpy anytime. So, don't get used to the single route, plan out some alternatives while you travel.

So, the moral of the story is be rich and most of the problems goes away.

You do have a talent for explaining this sort of thing to those of us who DO find rocket science to be hard! 😁

Thank you for the visit and comment Melinda. Living in Houston and being an academic has some advantages. I happen to have many friends who are rocket scientists :) And let me tell you this, they are just normal people like you and me.

I appreciate the kind words!

As long as I keep my day job, it will be an accumulation phase of a lifetime coming up.

Yeah, and the industry you work in, it is probably one of the safest place to be.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment !STOP below

View or trade

BEER.BEERHey @enforcer48, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Already bought Hive, powered up small earnings too and looking to buy more. I've trained my mind to forget I have invested money too avoid feeling upset during times like this. I'm still learning so information like this is very helpful.

Investing is mostly a process. It like a degree. Takes time.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

That will be insane, unfortunately I invested all that I have in PolyCub and its a total disappointment so far.

Posted Using LeoFinance Beta

Poly what? 😂

Discord Server.This post has been manually curated by @sayee from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

muje ab holding me rakna chaihe, bohud loss me hai mera cripto protfolio, bhul karke sikraha hu? failure is the best teacher.

If BTC will go down to $10 000 USD, then probably it will go even lower too. $10 000 USD is like a milestone.

Who knows?! I have no prediction power. My trading is just a bunch of if-else statements