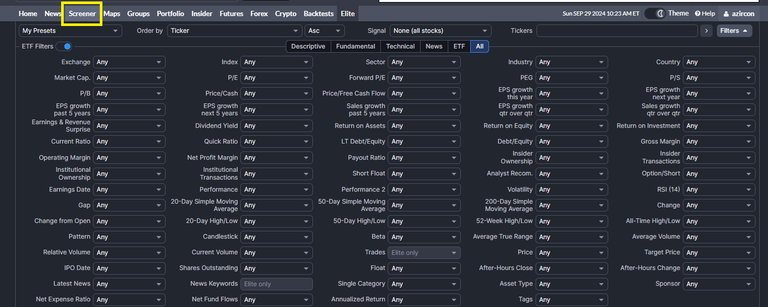

I like to continue a bit more into the depth of finviz website. I am following up on my previous post. Along the top one of the most useful free tools that I find is "screener".

I will explain what a stock screen is, and will show you a few of my basic personal screen to set things up for you, if you are interested. Hopefully once you get a hang of the tool, you can alter criterias and set your own screens.

A stock screener is a powerful tool for investors and traders that allows them to quickly filter through thousands of stocks to identify potential investment opportunities. By setting specific criteria, such as market capitalization, price-to-earnings ratio, dividend yield, or industry sector, users can narrow down the list of stocks that meet their investment goals.

In stead off looking at 100s of stocks and randomly select something, this helps you organize your thought process. For example, Nasdaq new-high is a stock screen; it simply lists all the Nasdaq stocks that is making a new high on a particular day.

How to Use a Stock Screener

Set Criteria: Determine the factors that are most important to you. For example, if you're looking for growth stocks, you might focus on companies with high earnings growth rates and low price-to-earnings ratios.

Apply Filters: Use the screener's filters to apply your criteria. Most screeners allow you to combine multiple filters to create more targeted searches.

Analyze Results: Review the stocks that match your criteria. Look for additional information, such as financial statements, company news, and analyst ratings, to make informed investment decisions.

Simple Screen Example

If you remember William O'Neil's book that I described in this post; that book has a famous screen called CANSLIM. It is a combination of fundamental and technical analysis driven screen. It is old but still relevant. It helps one identify growth stocks.

CANSLIM is a growth-oriented stock-picking methodology developed by William J. O'Neil, founder of Investor's Business Daily. It's a combination of fundamental and technical analysis techniques designed to identify high-potential stocks poised for significant growth.

The acronym "CANSLIM" stands for:

C: Current quarterly earnings

A: Annual earnings growth

N: New products/services

S: Supply and demand

L: Leading industry group

I: Institutional sponsorship

M: Market direction

By focusing on these seven factors, CANSLIM aims to help investors identify stocks that have the potential to outperform the market.

It's a popular strategy among growth investors, but it's important to note that no investment strategy is foolproof, and past performance is not indicative of future results.

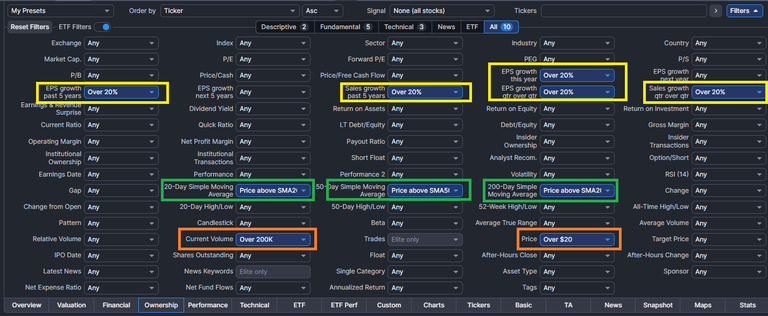

With the disclaimer out of the way, I can show you how to screen CANSLIM in finviz. This is what I do, this is not exactly the prescribed method, and you will see what I mean.

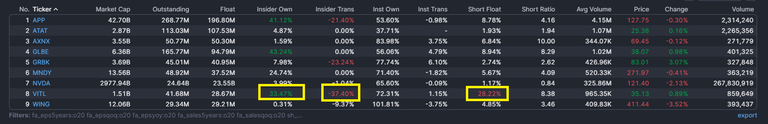

Fundamentally CANSLIM is based on high Earning per share (EPS) growth. This is both quarter over quarter, and year over year for past 5 years. I chose for 20%. You can also chose 25%, if you want to be very aggreesive, but the list will be small. I have added quarter over quarter sales growth as well at 20%. Those are basically the fundamental screens and typically they have a "new product"; but there is no easy to screen for it. These were all the yellow boxes. Next are the "supply-demand" and "Leadership" screens. This is mostly technical analysis. A stock showing high demand and industry leadership will be above all its long-medium-near term moving averages, so I screen for that. Price need to be higher than its 200-day, 50-day, and 20-day simple moving averages. Next the orange boxes. Institutional leadership translates to volume and price above a minimum threshold, and I chose volume > 200K and price >$20.

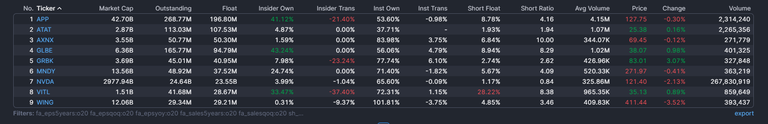

There you have it: a rather small list of 9 stocks only out of 6000!

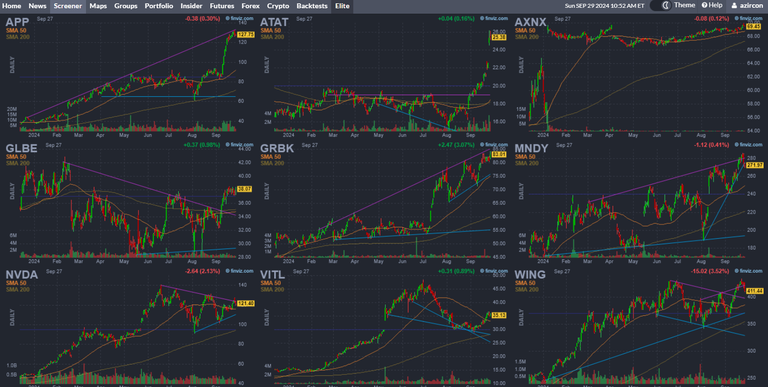

Mind you, this is just a screen, not a stock buy recommendation! Next I like to look at their charts quickly. A couple gets discarded if the chart looks weird!

None look terrible, perhaps AXNX at the upper right looks a bit dodgey! A few are in great spot! Wow, I am happy to NVDA on this list! My fav stock for the last 10 years! Full disclosure, I own a lot of NVDA. VITL looks great as well, coming out of a dip. I like to buy pullback plays.

However, if I look closely, seems like lot of insider ownership, which is good, but insiders are selling (which may not be good). That can happen after stock has a big run. Another important thing is the short interest, very high! Looks like 28% of the float is short. That could trigger a short squeeze! You see, suddenly we can have a lot of conversation around the stock and that is the intent.

There you have it. I have just described a simple and easy way to screen for potential opportunity. Oh, I almost forgot, you can save your screens at finviz too. I have severals saved there which I use quite frequently.

I find the stock market, finance and dynamics quite fascinating but I know so little about it. Growing up in Germany you just didn't need to. Now, here in the US it's a totally different story. I learnt a little already but have a ways to go. In the meantime, I can rely on my hubby who knows his way around since he grew up with it and also studied it.

Yes, people over there unlikely to talk about money and it is considered a taboo topic even for grown up. This is why so few can be financially free.

It is critical to be financially educated at an early age, but it is never too late.

wow! i did not know you were a daytrader, that is awesome, yeah finviz the OG👍 of all screeners but i usually use WEBULL and Stock Rock Live screener

Yes. I have been for a long time. I don’t trade much these days, I am too old! :) But still like the rush sometimes.

That's a nice screener I have not used that and stick to my screener in think or swim. I'll have to check it out thanks for sharing.

If you have thinkorswim, you do not need anything else.

Facts that's my main trading platform

I am using thinkorswim for 20 years at least. Went through many mergers :) Now at Schwab!

finviz provides a lot of information. 👍

!INDEED

@blkchn, sorry! You need more $IDD to use this command.

The minimum requirement is 50.0 IDD balance.

More $IDD is available from Hive-Engine or Tribaldex