This post was initially supposed to be published about 15hrs back but I decided I needed to do a lot of research into the topic of “Bitcoin Hashrate'' as I've never really done that.

For context, I came across a report insinuating that the Bitcoin network is witnessing decreasing hashrate primarily due to declining rewards for mining and an upswing in cost.

This story comes as a result of an announcement made by an American Bitcoin Mining Company “CleanSpark” of its acquisition of a rival miner’s infrastructure, GRIID.

Leading Bitcoin miner CleanSpark has announced the acquisition of rival company GRIID Infrastructure for $155 million in a 100% stock deal. The transaction highlights the consolidation among Bitcoin miners amid the lower revenue trend.

According to CleanSpark CEO Zach Bradford, the GRIID acquisition will enable the company to meet its goal of having 400 megawatt (MW) capacity in Tennessee by 2026. GRIID Infrastructure facilities are located in New York and Tennessee, with the mining facilities within Tennessee in three locations.

The story goes on to highlight that many miners are powering down - evident in declining hashrate as network rewards drop low post-halving.

For those who don't know, Hashrate in the case of Bitcoin is the computational power used by the network to reach a consensus and find the next block.

An increasing Hashrate typically indicates more miners joining the network but that is not always true!

Fundamentally, the more participants assigning computational power to secure the bitcoin network, the higher the Hashrate. However, the very same effect "increase in Hashrate" is witnessed when existing miners upgrade or increase their rigs.

The latter cannot be determined unless companies involved publicly announce it.

A few things to note: I could start mining bitcoin and you wouldn't know, the government too wouldn’t know simply because it's an open network, I don't need to register a name and sign with anyone to gain access, I just need to run the node, basically.

As a result, the number of miners present on the bitcoin network cannot be quantified, although many top miners/pools are publicly tagged.

Now, there have been many speculations of specific mining pools controlling the network to a great extent but that’s all there is: speculations.

That said, significant network control when it comes to Bitcoin at this point holds no importance except the monetary benefits of mining more blocks than others. All other perks that come with network centralization would not be attempted by any miner as the benefits are largely lower than risks of execution.

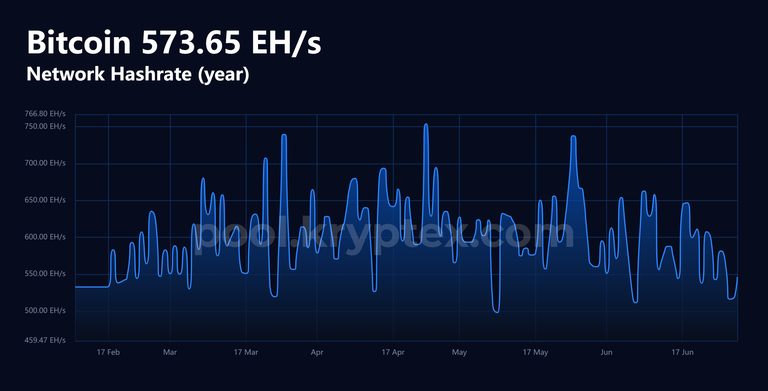

A great deal of reporters love to talk about Bitcoin’s falling hashrate but looking at historical data, it's quite on a steady uptrend. Recently noticed falls are rather a common trend judging by the chart above.

Of a surety, many bitcoin miners are losing money and many cannot keep up. Lots of the small miners will power down but we may not see a significant drop in hashrate because medium size miners in financial ruin may be bought out by the stable ones as evident in the recently reported acquisition. In addition to this, top mining companies are likely going to upgrade their systems for sustainability and increase their mining capacity at the same time.

At the end of the day, it’s a life-long game, you only lose when you stop playing.

That said, many may expect that miners shutting down will open an opportunity for new ones to join the network, primarily based on the idea that mining equipments would experience a decline in cost.

I do not see this happening. As bitcoin earns more exposure and becomes widely sought after, the industry leaders will attempt to keep the business of mining and network control off the reach of the general markets, hence the rigs markets would either maintain a stable cost range or experience further increase.

At the end of the day, the network will consistently grow in value and cost, with metrics such as Hashrate not being a valid determinant of its decentralization.

Posted Using InLeo Alpha