What if you could capitalize on venture funds investments even if you hated their long-term effects on the cryptocurrency ecosystem?

Thanks to funds investment tracking platforms, you can actually front run every of their investment and profit before they get a chance to sell. But of course, we have to first determine if it would actually be profitable to do so in the short-term.

Investing in crypto projects openly funded by VCs is a risky bet, considering the nature of most crypto projects funded by these VCs. Retail traders incur losses because they are fond of taking huge bets at top prices when the logical entries should be at much lower price levels, preferably at early hours of VC investment announcements or listing times.

Generally, any bet made on such tokens should be short-term, anywhere from 1 to 3 months is the most reasonable timeframe, depending on each individual discipline and tolerance level.

As such, this profitability analysis will lean largely on the short-term performance of tokens associated with crypto projects that have received funding from Coinbase Ventures.

Keep in mind that long-term bets increase your risk exposure and several factors come into play and can greatly impact the profitability of one's investments.

At the time of writing, Coinbase Ventures is at a +401.58% profitability across 417 investments in its portfolio, according to data from Cryptorank.

Coinbase Ventures has a uniquely diversified portfolio with data services and payment solutions each making up 19% of its portfolio.

Without wasting any more time, let's explore the profitability of a few of these tokens over 3 months periods if individuals were to invest $1,000 following funding news and early listing times for projects funded before official listing.

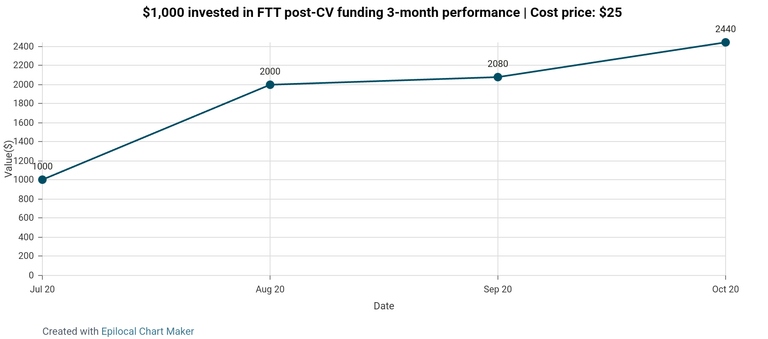

FTT Performance after CV Funding

FTT, the native token of FTX, the now bankrupt US-based cryptocurrency exchange is one of Coinbase Ventures’ biggest investments, according to funding reports on Cryptorank.

Whilst FTT crashed when it was revealed that its associated exchange, FTX, had its management mishandling users funds and assets, overleveraging and losing it to the markets through its trading partner firm, Alamanda Research, the FTT token performed great pre-bankruptcy.

Coinbase Ventures invested in FTX token on 20th June, 2021 in a $900 million series B funding round. At the time, FTT was already listed on major global exchanges including Binance. On this day, FTT traded through a high of $30 and a close of $25 per token.

As evident in the chart above, a $1,000 investment into FTT after Coinbase Ventures funding yields a +100% ROI in the first month and this grows to +144% in the third month.

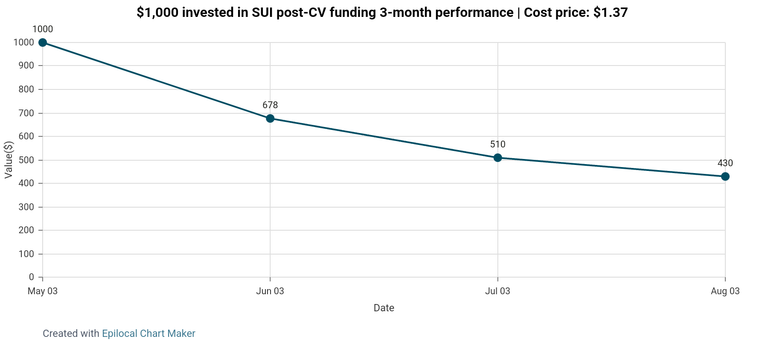

SUI Performance after CV Funding

The SUI token is the native cryptocurrency of the Sui blockchain, a high-performance layer-1 blockchain designed for scalability and low-latency transactions. Sui is developed by Mysten Labs, a team that includes former Meta (Facebook) engineers who worked on the Diem blockchain project.

According to funding report on RootData, Coinbase Ventures invested in SUI twice, first in a $36 million Series A funding in December 05, 2021 and also in it's Series B funding of $300 million in September 07, 2022.

SUI is also one of Coinbase Ventures' biggest investments. That said, at the time of funding news, SUI was not available for trade. SUI was officially listed on May 03, 2023 and the average price throughout the day was $1.37 according to markets data from multiple sources including Binance, coinmarketcap and cryptorank.

SUI performed poorly in the following months as seen in the chart above. A $1,000 investment incurs a -$570 loss, representing a -57% price crash from entry.

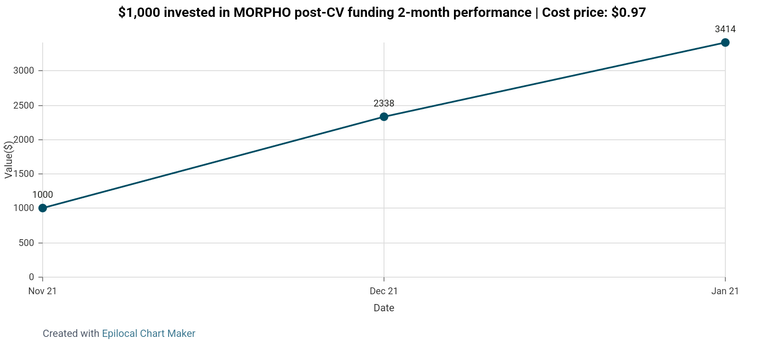

MORPHO Performance after CV Funding

Morpho is a decentralized lending and borrowing protocol built on Ethereum. It is designed to enhance the efficiency of DeFi lending markets by optimizing interest rates for both lenders and borrowers through a peer-to-peer matching mechanism.

Similar to SUI, MORPHO also received Coinbase Ventures funding twice, first in July 12, 2022 in a $18 million seed funding reportedly led by a16z and secondly, in $50 million funding round led by Rabbit Capital in August 01, 2024.

MORPHO is the best performing asset on our list, growing by +241% in the first two months. As seen in the chart, $1,000 invested at listing grows to $2,338 in the first month and $3,414 in the second month.

Due to MORPHO being a recently listed asset, a third month is not available as we're still two days away from having February's performance data. However, judging by the market value at the time of writing, being $2, the portfolio value is likely to fall to $2,061. That said, investors would still be in a +106% profit.

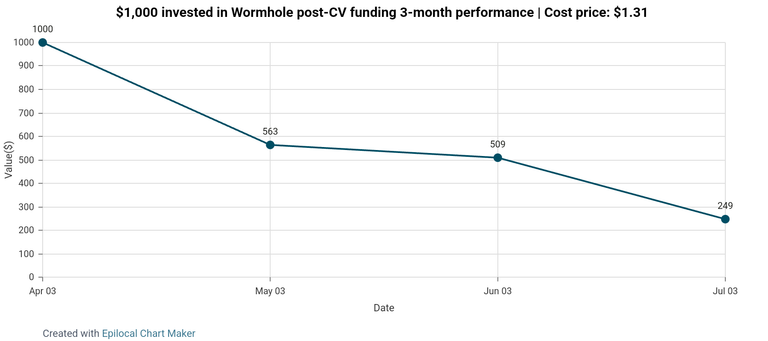

Wormhole Performance after CV Funding

Wormhole is a cross-chain messaging protocol that enables interoperability between different blockchain networks. It allows assets, data, and messages to be transferred securely across multiple chains without requiring centralized intermediaries.

Coinbase Ventures invested in Wormhole in November 28, 2023 in a $225 million funding round.

The Wormhole native asset with the ticker $W is the worst performing asset funded by Coinbase Ventures in our list. A $1,000 investment at listing would incur a staggering - 75% loss through a three month period.

Other assets like EIGEN and USUAL presented short-lived opportunities for profitability but overall not enough flexibility for most investors. That said, some other assets like VANA, ZKLINK, Supra, and ARKM, which all received Coinbase Ventures funding all performed poorly within the first three months of listing/post-funding.

Evidently, like most things trading and investment, it's largely a gamble as there's no assurance of past trends playing out exactly as before especially when several external factors can contribute to price movements in either positive or negative directions.

It helps a great deal to hit a high profitability rate if you have access to initial coin offerings as those are more often than not, low-priced.

The bottom line is that all investments carry risks and investing for the long term based on convictions backed by research is always going to be the best bet.

All data presented in the charts are manually curated from multiple market data sources.

Posted Using INLEO