"BTC is going to 200k"

"BTC is going to zero"

"Btc is going to be dead"

"BTC is going to be the future of the world"

"(Insert random coin here) is going to be the next BTC"

"Btc is the .... "

The list is endless. It goes on and on.

I’ve seen many people believe others on the internet blindly. They get emotional when looking at moon theories, and most importantly, "only consuming content that they want to see" or what fits their narrative.

Example: If you are a Bitcoin HODLer, obviously you will be a bit more biased to be reading and supporting bullish articles. (I hope this one as well, but wait, dont just get into any conclusion yet)

If you are, let's say, coin xxx believer, you'll be biased when reading and more supportive of bullish articles about that coin.

Update: Even though I posted a short term bearish chart, that does not mean I am a permabear. Maybe I should show one possibility of where BTC and altcoins can reach in future :)

Before going into details, here are a few disclaimers:

- Never get married to one chart/idea/thesis.

- The world is moving very fast and while you spend time trying to figure out what's happening on one side; you may miss a couple of other trains :P. Such is the world.

- This is just a theory, and may or may not be true in the future, and is not financial advice.

- I am not implying that BTC "will" reach this point, or the alt marketcap "will" reach this point, but this is just a theory based on my simple observation of the 1 week charts.

A small note about predictions: There can be thousands of predictions, by thousands of people (and since markets move only two ways; up and down; some of them may even come true,and this is the reason why every person gets emotional.

A note about my prediction: I don't know why I am posting this, even if it's true, even if it's false later on, maybe somewhere 4-5 years down the line, I'll be remaining the same here, with my small account. But I'll be really happy as of now if you like this idea and upvote/share with your friends/other investors, or let me know what you think

Things I'll be pointing out here:

- BTC price chart (BLX, (Brave new coin Index)

- Alt marketcap (Total mcap - BTC mcap)

A point to remember: I saw many similarities between the price action of Ethereum, and a few of the top 20 Altcoins, so I'm considering the whole alt marketcap here.

I'll be posting about individual altcoin charts (with both bullish and bearish cases later on.

- Lets now have a look at the charts and the fractals:

Here's a brief observation about Bitcoin and Altcoin charts, on a 1W timeframe, log chart.

Altcoin Total Marketcap:

Notice the Bull and Bear cycles below:

Is it safe to say that the Altcoin Marketcap has completed one full bull and bear cycle?

(Because Before 2015, altcoins were not significant, so I am not considering what happened before that)

Also Note the circle, where it broke below the log support, somewhere around 2015. I'm going to write this a little later on this post.

Total gain in the first alt bull cycle: 12801366% (crazy right?)

Total value lost in the first bear cycle: 92% (this is also crazy right?)

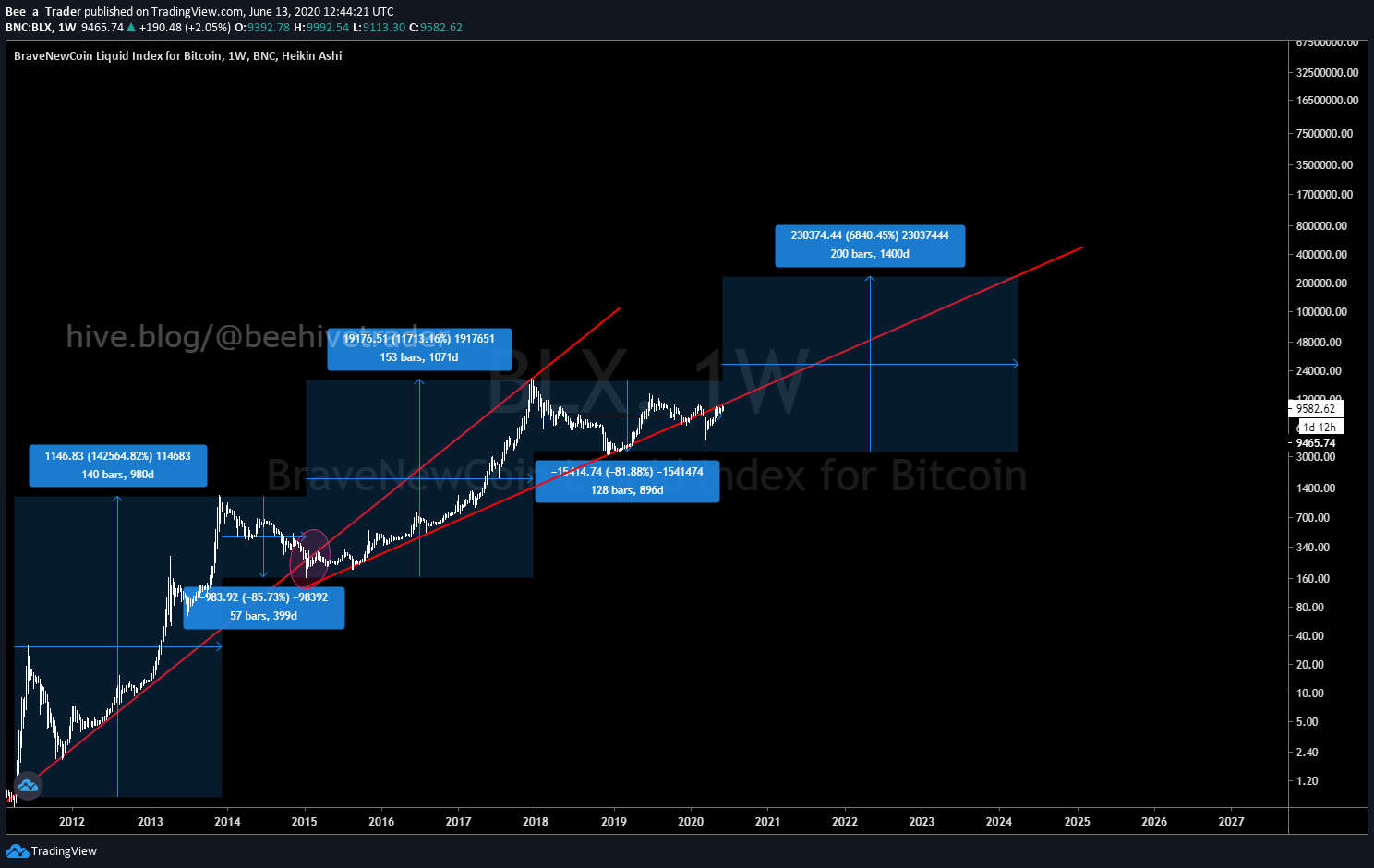

Bitcoin Chart:

Notice the following: I have covered one Bull and Bear cycle since 2011.

Gain in the first bull cycle: 142564% (still significant)

total value lost in the first bear cycle: 86%

Point to note:

Look at the first breakdown of the support.

Can you see the same pattern on Altcoin Market Cap? :)

So Bitcoin broke down the support. But was it really bearish?

Also, we see Altcoins broke below the support on March 2020, will it be bearish?

Lets see what Btc did after that:

Did it do a bearish retest after a huge 11713% gain on its road to $20k which caught the attention of the whole world?

Or is Bitcoin designed that way only?

There's another interesting insight coming up soon.

Now, If you consider the following fact:

Bull cycles are getting longer, gains are getting smaller (I am not going too deep into the mathematics right now and only sharing it from a lay man's perspective,)

Also, considering that it is doing a bearish retest of the diagonal resistance on every bull cycle, what will happen if we apply the same theory to the altcoin market cap?

Lets see below:

considering it will do a "bearish retest" on its way to the moon, somewhere around the next 1400-1500 days (as I am not calculating the exact time right now)

If you consider from current market prices, it will be around a 45000-50000% gains till peak

This may seem unrealistic as of now but read on. There are a lot of factors to consider before coming to a decision.

Another interesting take:

Let's see what Bitcoin did on March 2020:

Just one more observation. Did you notice a similar type of breakdown?

More points: spot volume reached a record high soon after.

So do you think we are going to repeat history again?

Let's see what happens if there is another similar retest in the future, considering all points above.

Well, time will tell if this is correct or not.

There are a few models (like stock to flow, regression models and stuff) out there made by many popular users, on which I can't comment because I haven't done any deep dive to see how they work, especially because they look like a black box to many newbies out there. I am not claiming they are wrong either. Also, there are a few hardcore bankers who don’t want Bitcoin to succeed and they come up with predictions like $0 or something like that. I must say, they are not wrong in their perspective as well. (They don't want Bitcoin to succeed and this is the reason they come up with such stuff)

The thing is, everyone has their own perspectives about the market. If you are forming your own perspective, that's the best thing.

If you are a believer, it's best to stay invested for the long term and avoid the noise (like FUDs and stuff) out of the way, and cash out or spend when you need it instead of becoming too greedy :)

And also another word of advice: Going all in will alter your decision-making skills, so that is also not recommended.

So let me pull up some data to see whether these have any chance to come true.

Taking some data from the above observations:

Bitcoin

Bull Cycle 1: 980 Days, 142564%

Bear Cycle 1: 399 days, (Just before breaking down from the log chart), -85.73%

Bull Cycle 2: 1071 days, 11713%

Current Bear cycle 2: 896d, -82%

Estimated Next Bull cycle: 6840%, 1400 days

Altcoin

Bull cycle 1: 1372 days, 12801366%

Bear Cycle 1: 791 days, -92% (and it broke down from the log chart)

Estimated bull cycle 2: 127190%, 1400days

Total Market Cap Now:

Bitcoin: 117.81 Billion Dollars

Altcoins: 89.12 Billion Dollars

Estimated peak: (If it goes as projected)

Bitcoin: 4.5 Trillion (Roughly considering price of BTC to be around $230k)

Altcoins: 46 Trillion (If it goes as projected)

It means Bitcoin Dominance will decrease slowly over time.

Is it possible? Because these are just ridiculous numbers.

Also, note that the first alt bull cycle was having a gain of a ridiculous 12801366%

Let's find out more!

Total Value of money in this world: $95 Trillion

Global Debt: $253 Trillion

Stock Markets: $89.5 Trillion

Gold: $ 10.9 Trillion (If banking systems fail, then this will perhaps explode and go to the moon)

Silver: $43.9 Billion (I feel its undervalued, so I bought some silver :))

Cryptocurrency: $244 Billion (this seems to be undervalued as well)

Global Wealth: $360 trillion

Gross Market Value: $11.6 Trillion

Notional Value in Derivatives: $558.5 Trillion

Notional Value: 1.0 Quadrillion (High-end Estimate)

All Data were taken from this brilliantly explained visual article: (I am not affiliated with them)

https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2020/

Where is this money coming from?

Brrrrr? 😂

Point to note about Derivatives(taken from venturecapitalist website):

"it’s worth mentioning that because of their non-tangible nature, the value of financial derivatives are measured in two very different ways. Notional value represents the position or obligation of the contract (i.e. a call to buy 100 shares at the price of $50 per share), while gross market value measures the price of the derivative security itself (i.e. $1.00 per call option, multiplied by 100 shares).

It’s a subtle difference that manifests itself in a big way numerically."

For this next crypto moon to be possible, here are a few points we may consider:

- We are inside a ticking debt bomb, larger than we can imagine. I have been following the US debt clock for some time, here's one website showing a visual: https://usdebtclock.org/ (you can search other countries on your favorite search engine, and see if you can find something )

- The declining interest rates, (I will cover one more article on this later on, and its impact on prices of crypto/gold/silver/commodities/stocks, and what it means.)

As of now, we can assume: If interest rates drop, prices of assets will go up.

How about a negative interest rate? That will be a significant catalyst IMO. - Looking at the already existing hyperinflation in many countries, like Lebanon, Zimbabwe, Venezuela, (and many more), I believe many more countries will soon follow them, and this can create somewhat like a ripple effect in the whole world economy.

- The declining value of the currency. We are already starting to see a lot of currencies getting devalued quickly, many countries are buying tons of gold,

- And of course, there is a gold shortage, which we may consider, as the economy is weakening, and people are looking at alternative investment schemes.

I am a very firm believer in privacy coins. (Grin is one more coin which caught my eyes recently, I'll take a deep dive onto this soon.)If you believe in altcoins, my suggestion is to buy alts that have solid development going on, along with a solid community (One example here right in front of your eyes, $Hive, but again, it's better to #DYOR and then invest wherever you want instead of believing some random person from the internet you don't know )

A word of advice though: Don't go for those centralized altcoins, held mostly by whales, and having no utility as such.

Another major point: Current world economy is looking pathetic, with no correlation between the S&P, joblessness claims, losses in businesses and all. It just seems the stock market is behaving irrational, they are going up even when the whole world seems to be in recession, amidst all these job losses and all. So is this something you can disregard?

If the stock market can behave irrationally, crypto market can behave 10x more irrationally :)

(perhaps in a positive way?)

We may mint millions of Dollars if this thing comes true, and if you can actually ride this wave.

But in the end, will the money really be worth it?

What is the use of becoming a millionaire if the dollar loses value? (think Venezuela, Zimbabwe, Lebanon, for example. I'm sure many countries will follow them soon) :)

We should perhaps think of a completely decentralized world economy soon if the current monetary system fails.

Upvote this article if you liked it, share this within your circles if you like this,

I'll pin this to my profile to verify whether this comes true or not :)

P.S. My take: I'm going to ditch most of the "popular" models which are difficult to understand by newbies, and go on with this theory instead :)

This is not copied from anywhere, this is my personal observation, and in case you see something similar on the internet, it may be a coincidence.*

But, like the OG says, #DYOR 😎

And again, a gentle reminder: This post is not any financial advice. And also, you dont know me 😜

Dont become a REKT bull pleb by selling your house to take a 100x long on BTC only to get liquidated 5 minutes later.

I'm going to watch what unfolds,, over the next couple of years.

Sit back, enjoy the show, watch the fractals play out, and "History may not repeat itself exactly the same way, but it often rhymes" :)

I'll appreciate all the constructive criticism here in the comments. :)

Share this with your friends/other investors if you like this post.

See you on the Moon! 🌕🌜

Gif source: Internet

Update: I forgot to add the links to the chart, so I'm updating them below:

BTC Chart: https://www.tradingview.com/x/mxldEAII/

Alt Marketcap Chart: https://www.tradingview.com/x/REm5bwTr/

Posted Using LeoFinance

some good charts and fundamentals here, I won't pretend to understand all of it (although I understand some), .. I totally agree on the information filtering we do based on whether we are long or short the market, it's just the way we operate I guess, but to be mindful of it at least keeps you on track when you stray too far in your prefered direction. totally agree with the going all-in and decision making skills, I have found exactly that in my earlier days, it's very hard to detach yourself emotionally of you have overstretched on a trade.. good post.

Thanks a lot for appreciating :)

Since the time I started trading, I felt that most of the traders fail to make money because they cant control emotions. (It happened with me as well, I did lose a lot of times and I'll be honest here); but very few people learn from their mistakes.

Also, I agree, too much information about the market confuses people, and many people end up taking wrong decisions. Right now, I personally feel that "Buy Zone" has not yet come, but it will come soon, over the next few months.

Cutting out the noise, ignoring the FUD and FOMO mentalities will definitely help in the long run; if the risk is managed well :)

I am a bit amused to see the alt marketcap theory. I am in disbelief that those kinds of gains are still possible in cryptos. but this is nice, I like it, never thought from this perspective.

let us hope we get somewhere

Thanks for stopping by to check this article :)

Hope you liked it!

Congratulations @beehivetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

posted on Twitter.

So we'll all be rich

Well, maybe, or may not be.

Also,

Not exactly, 'rich' if we think from a different perspective :P

Remember: There are millionaires having no value in some countries, because of hyperinflation, and extreme loss of value of their fiat currency.

No one knows exactly what can happen though in future :D

I may be wrong here as well.