We must have been tempted at some point while being in the journey of trading/holding cryptos, to take up trading as a full time career. While some of us may have made a big fortune, many of us must have lost a good sum of money.

Now many people, at the same time must have got tempted to take up a trading course that somewhat "Guarantees" you that you will make 1000% or 10000% per year, or you will be able to catch all altcoin pumps in this market. Now let me tell you something. If such a thing was possible, you would have seen many people beating Warren Buffet just by buying some course like that.

There are some really good trading courses as well, and you probably need to do a lot of research before getting hands on one.

Also, it will be better to always speak with your financial advisor before taking decisions.

This is the first article in the series, Bee_A_Trader, which I'll be publishing today, and I'll be sharing some of the key things which make people lose money, and how to avoid them. Later, I'll also cover why 90% of the traders lose money and, what you can probably do, so that you actually get somewhere close to the top 10%, or at least minimize your loss!

I'll also covered some major mistakes I have personally made in the last few years, over the course of this series. Please stick around if you are interested! :)

Disclaimer: I'm not a certified financial advisor, and even though I've been trading for quite a few years, I urge people reading this, and my other posts to #DYOR (Do your own research) before taking any decisions! There is no guarantee whatsoever that you will become a profitable trader.

Of course I'm going to help you out if you have some queries/doubts, so feel free to let me know in the comments, or on Twitter :)

So Let's get started!

The following things are the most important, when it comes to trading:

- Human Psychology

- Human emotions

- Understanding Probability (and a little bit of mathematics)

- Understanding Risk management

- Market cycles

- And of course how money works in this market.

The scope of this article for today will be about Human Psychology and Human emotions.

I'll be covering about the other articles slowly, over time, so please stay tuned! And also I'm open to suggestions/constructive criticism. Feel free to share your thoughts below

Understanding the Market and the psychlogy:

The basics:

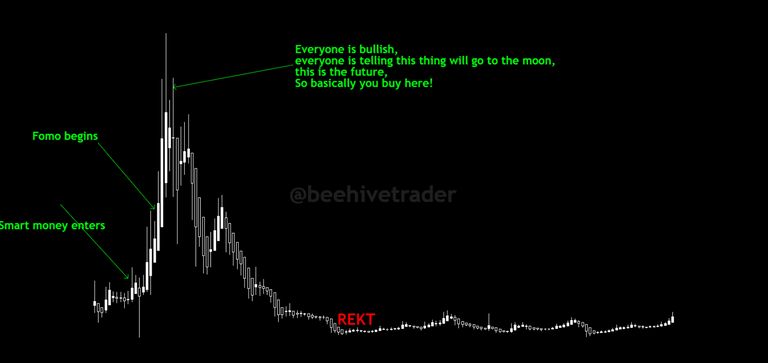

Let's see one of the most obvious mistakes the newbies make in this market:

This chart is just for an example.

Even though trading is not gambling, there are certain instances by some traders, who emotionally fail to keep their greed in check, and end up gambling instead.

Let's take a very simple example:

Your friend suddenly tells you that he/she made $400k on a gamble. You go online and see a lot of people gambling and making a ton of money.

You go ahead, decide that you should stake some of your hard earned $10k, take a gamble anyway, and make your capital 2x.

Being happy with $20k, you take a second bet, somehow get to $40k.

After sometime, euphoria kicks in, and you take the third bed and go REKT!

You lose everything.

What you must have missed out was maybe the fact that almost 90-95% of the people actually lose money in gambling.

But with proper risk management, even gambling can be profitable.

Let's see this in terms of trading and have a look at why I took the context of gambling.

The reason why 90% of the traders fail in this market is because, most of them trade without any strategies, and that's gambling!

Example:

Your friend tells you that he/she made $300k by taking 30x long on some altcoin which pumped nearly 100% in some hours.

You are a complete newbie, and you go and research about cryptos, and see that there are many people who are making fortunes in this market. Excited, you put in your hard earned $10k in Bitcoin. It becomes 12k, you are happy.

Next someone tells you abut some altcoin which can move faster than Bitcoin.

You sell your Bitcoin, and buy that shiny new altcoin, and again make yourmoney 2x.

Next you try to find out new altcoins, join groups, try to get information about every altcoin that can possibly move and give you gains, and somehow gamble your way to 5x.

Greed creeps in, and now you are playing with high leverage, hoping that you will soon become a millionaire.

-> You take your first long on Bitcoin, earn money, get a long on altcoin, earn money, and then market corrects, you think that you will double down and just wait.

-> You put in more money, doubled down, and market corrected even further.

-> Now you take another long hoping that the market will come back, you keep on paying the funding fees, and then suddenly you are in disbelief, as you suddenly get liquidated.

If this thing (or some similar thing) happened to you as well, you were probably gambling.

By strategies, I don't just mean Technical analysis; it is just a small part.

There are many things you can do in order to participate in this crypto market:

Two of the many alternative things I'd like to mention if you are an investor:

- Buy and HODL (Yes that is profitable)

- Trade

If you have other sources of income, you can do the following:

1) Buy and HODL (or hold :P):

A) You have a fixed amount which you want to allocate into cryptos.

You deposit that into your favorite exchange, and buy your favorite crypto.

--> And you may want to transfer that crypto to your hardware wallet, or your private wallet, for more safety.

B) You may want to systematically buy any cryptos, irrespective of the market price, at a fixed date of every month, or even week, and keep on doing that. You may want to allocate 5% of your earnings from your salary, or any other income stream, and put it into cryptos.

2) Trading:

This is the tricky part. You actually need a lot of discipline, conviction, and strategies to survive. This may be a combination of Holding and selling after a few months, or when you feel that something is overvalued.

First you should start with paper trading. Take a few trades, backtest that on historical data, and see if your strategy is working out.

It may be a simple strategy based on supports and resistances, or involving some indicators like Moving averages/RSI/Ichimoku/MACD, or anything, or some complex strategies, which may involve analysing the market sentiments, understanding the psychology of the market, and then taking a decision.

Tip: Sentiment and psychology may take some time to play out, and usually works best on longer timeframes.

After you are comfortable, put in a small capital you are willing to lose, cut the noise, focus on a few altcoins, use your strategies and see if they are working out.

In case they do not work out, go ahead, make sme changes in your strategy, do paper trade, backtest, and again try that out with your small capital.

If you are successful, wait, and execute a few trades, learn to manage your emotions and try to control that.

Now there is a reason why I'd tell you to avoid taking trading as a full time career especially if you are desperately looking for money.

you will end up taking wrong decisions and may blow up your capital, and get REKT,or chances are, that you'll try to chase every "Hot Altcoin" out there, and FOMO buy into them, and then sell them for breakeven prices, as you fluctuate between greedy and fearful, and probably make literally ZERO money. (Yes, it happened with me, and it took me nearly one year to overcome that)

In case you find some strategy to be profitable, stick to it.

Using thousands of indicators, for example will not make you rich, you will also end up taking all the wrong decisions.

Usually, I personally found that supports and resistances concept, candlestick patterns, and using some passive indicators like: Moving averages/Ichimoku/SuperTrend, and coupled with RSI to be profitable. (Now using these same tools, you may even lose a lot of money if you don't use them properly)

The end goal is to forget that you are actually here to make money.

The greatest challenge, which you will probably need to overcome would be to get your emotions in check.

Trading with a $200 positon can be very different than trading a $20k or a $200k position.

Also, as your capital increases, you should be managing risk more efficiently, and usually, the exact opposite thing happens. As people get more money, they forget about all risk management systems, get emotionally impacted and take wrong decisions.

Now another important thing I'd like to highlight:

To become a successful trader, you need to take breaks!

Yes, especially after you made a big win, or a big loss, it will affect you emotionally. Exit all trades, go out, spend some time with your near and dear ones, enjoy your time out, (just like you take a vacation from work), and again come back after a few days.

Also you need to be disciplined, and keep yourself healthy.

You don't want to suddenly wake up at 4 a.m. at night on seeing alerts and try to trade the volatility thinking that you will lose the opportunity to make money!

This will take a huge toll on your health, and you will probably take very bad decisions and get REKT. (Similar thing happened with me back in 2018, when I got REKT as I did not sleep for 2 straight days when altcoins were at their peak. I ended up taking a 20x long on some shitcoin which dumped by almost 20% the following day, and I lost nearly 80% of my REKTfolio.)

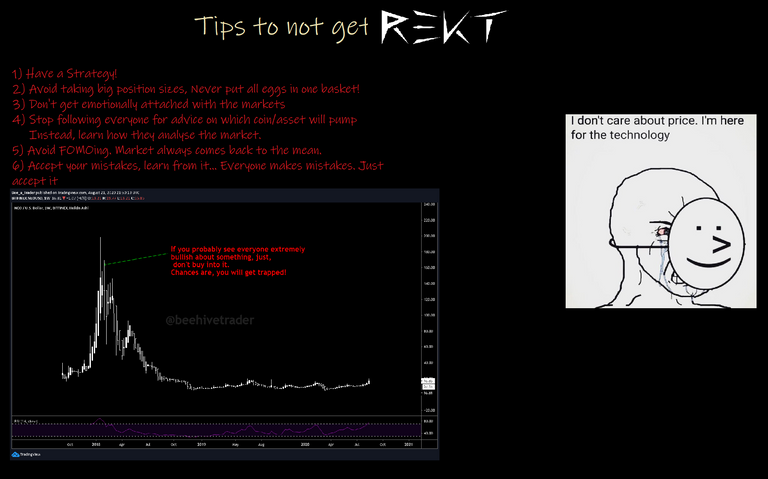

Please check this image below :)

P.S. Even though I didn't buy much Link, or Band, I did tell all of my friends to sell when Link was trading around $19, and Band was trading around $16. In spite of repeatedly telling, only 10% of them actually listened, unfortunately! And the funnier thing is, most of them fomoed around $15-16. That's how psychology and emotions work!

This was a practical example of an article on theory of contrary opinion which I posted long back :)

Key takeaway: If you have a small portfolio and you want to make it big in a short time, or keep on asking other people about what coin will probably go up by 20% in the next few days, or ask other people about investing strategies, you will end up losing money instead. Start taking small steps, learn about the markets, else if you are just interested, simply put in an amount you are willing to lose, and forget about it for a couple of years.

(And of course, as always, if you are in for the long term, it's always better to store your cryptos in your private wallet)

Hope this helped!

Stay tuned for the next update! :)

Topics I'm planning to cover in the next articles:

Introduction to

- Technical Analysis,

- Market sentiments/Psychology

If you liked the article, please this with your friends and circles, and also spare an upvote for me, so that I get motivated to keep sharing market insights and analysis:)

Did you know that you will get some rewards for curating this content?

Feel free to get onboard and follow me to know more :) !

Gif by @thepeakstudio

Posted Using LeoFinance

This is nice we are kind of doing the same thing but my series us mainly on forex tho. Although i tried crypto trading first before i fell ib love woth forex.

I look forward to your series

Posted Using LeoFinance

Cool! I'd love to look forward to your series as well :)

Posted Using LeoFinance

Nice article. I have also crossed all those paths you have crossed. Made lots of stupid decisions. Hurt my hand several times by catching a falling knife.

We all learnt from our mistakes :)

Hope we all stay strong until the next bull market peak. Then we all know what to do :P

Posted Using LeoFinance

Lol yeah. 😉

Really nice piece. I am waiting eagerly waiting for your next post on technical analysis.

Thanks a lot for appreciating and finding this useful :)

Posted Using LeoFinance

Well articulated.. Lot to learn from the pro traders like you.

Thanks for appreciating! :)

Posted Using LeoFinance

🎁 Hi @beehivetrader! You have received 0.109 HIVE tip from @amico!

@amico wrote lately about: Engage Community Manager - New Feed Management Feature Feel free to follow @amico if you like it :)

Sending tips with @tipU - how to guide.

Congratulations @beehivetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

View or trade

BEER.Hey @beehivetrader, here is a little bit of

BEERfrom @amico for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Who has never seen trading places?

Great article, @beehivetrader!

!tip & !BEER

Posted Using LeoFinance

Thanks a lot for appreciating!

This is the first post on this series.

I hope you find the future posts insightful as well :)

Posted Using LeoFinance

I'll read your future posts, mate.

A huge hug! 🤗