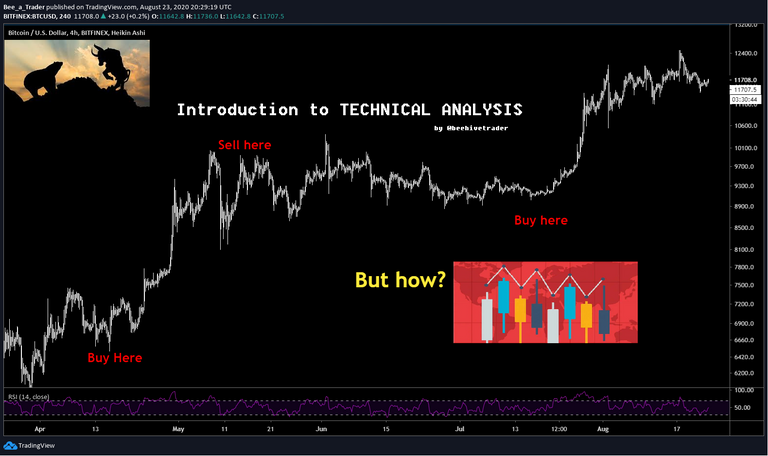

Technical analysis is the method of analyzing the markets, primarily by studying about charts, and identifying statistical trends to get insights about trading activity, price movements, and volume.

Think about the price action; you may want to 'predict' the next course of action of your favorite stock/crypto/precious metals, but you don't know how to analyse the charts!

Let's introduce "Technical analysis" (TA) !

You can examine the historical price actions and identify previous market patterns, to have greater probability in identifying where the market is headed to! Using those insights you can take a trade and get profits in the market

But wait, is it really that simple?

Probably no, but it's not rocket science either; and even knowing the very basics work out most of the time!

If you don't understand what those mean, don't worry, I'll cover them all one by one.

Of course I'm going to help you out if you have some queries/doubts, so feel free to let me know in the comments, or on Twitter :)

The content of this article is primarily for educational purpose only.Disclaimer: I'm not a certified financial advisor, and even though I've been trading for quite a few years, I urge people reading this, and my other posts to #DYOR (Do your own research) before taking any financial decisions! There is no guarantee whatsoever that you will become a profitable trader.

In the first article in the Series, I covered How to not get REKT.

I'm yet to cover the following topics as mentioned in my previous article:

Understanding Probability (and a little bit of mathematics)

Understanding Risk management

I'm going to cover them and relate them with how to use them in technical analysis.

Before that, let's have a look at what TA is, some common misconceptions about it, and what all you need to know, to become a Technical Analyst ...

What is Technical analysis?

As already mentioned previously, Technical Analysis is the study of the market, primarily by analyzing charts, price actions, and various other factors, and we use them to come up with strategies on how to get profits in the market.

A typical technical analyst will look at all the information from the charts, which will be reflected by price.

If you open up any charting software, (Tradingview.com is a great example, though there are various other good charting tools as well), you will notice that the price is mapped with respect to time, on a chart.

Our end goal is to make the most out of it, by understanding how to analyse it.

Some critical points to understand:

As a Technical Analyst:

- We don't need to know why the price of an asset moves.

- We don't need to get emotional with the fact that the price of an asset is too high or too low

- We don't need to "get married" to a certain asset class, or stock/crypto/currency/metal.

- Since fundamentals are carrying less weight in the market, being a technical analyst, we can use the analysis in almost every market. That is the beauty of Technical analysis.

- We analyse and play according to the price action.

Yes, you heard that right. You can use the same principles across all markets, and it will work everywhere.

The reason is, Human psychology works in a similar fashion across all markets, and that is reflected in the price. This is why, we often hear "History repeats itself".

Although I'll diverge from this opinion a little bit and say, "History has a tendency of repeating itself."

It is because of these psychologies, we identify various patterns and inefficiencies in the market, and we use analysis to profit from it.

So coming back to what a technical analyst actually does:

He/she determines the probabilities of certain things happening, after checking the price action and the historical price movements.

Technical analysis requires a little bit of understanding the market psychology, and of course, the most important factor: Common sense.

By common sense, I'll say, Let's assume the price of an asset went up by 200% in just 1 day.

If you are planning to enter this asset after the 200% pump, your common sense probably got a bit influenced by emotions.

What Technical analysis does not tell you:

- How to protect your capital

- How to grow your portfolio

- How to manage the emotions

- Which strategy to use

- You don't know when and how to use a particular trading strategy.

Misconceptions:

- There is no instant money making strategy, or formula that will guarantee you success by using any kind of analysis.

Now you may see a lot of people selling various courses like: "Get into this course and earn 2000% per year"; or stuff like "Learn how to earn like Warren Buffet"; or even "This is something every trader was keeping a secret from you" or some extremely deceiving courses like those.

Let me tell you, if someone is guaranteeing you something, there is a 90% chance that's a fad, they are looking to profit from their course by selling some garbage at a very high price (Oh and sometimes they even give very big discounts too, like they mark up some courses to something like $20000 or something, and give a 90% discount on that). So, don't actually go for those.

It's always better to go and find a good mentor, or someone who is willing to help you out, or else learn the hard way. (Un)fortunately, I learnt everything the hard way. I had no mentor, and there were a couple of people who were willing to help me out, and they probably charged me nearly double of what my bank account probably had at one point of time... But learning the hard way is what is going to make you one of the most successful traders!

No I'm not yet on that list! But I'm gaining confidence everyday :)

There are of course a lot of very nice books, I'd personally recommend you to have a look at some of them, (Martin J. Pring is a good author IMO, or even check out some life history of traders like Dennis Richie, and how they traded the markets; "The turtle traders" for example)

There is a common misconception that many people believe. A technical analyst can "Forecast" or "Predict" what the market's next movement will be.

That is not true, and if you are on the same boat as those people, I'd personally say, forget about that.

Markets as such cannot be predicted, and are very random in nature. A Technical analyst simply understands the market price action, and finds inefficiencies in the market, and profit from them.

If someone says he/she can predict the market with 100% accuracy, then that person probably exists in another dimension, and may be richer than warren buffet and bill gates combined, and may probably even have a secret house in Mars (Elon Musk? 🤔)

As a new trader, you may go out and search for things like "How to earn money from technical analysis"; or "How to earn money in the market"; or "Best strategy to become a profitable trader", or basically, just asking other people for trading entry/exit.

Again, this is where you may get trapped, as there's no one strategy that will guarantee you success. Here, you should apply a little bit of common sense. It it was that easy, everyone would have found that holy grail somewhere on the internet, and start trading, and probably make like billions.

A lot of geniuses will be born in a bull market, who will multiply their portfolio, and call themselves crypto experts, or gold bugs, or stock analysts, but believe me, once a bear market comes, a huge number of them will be wiped out like crazy.

Additional Points to note:

- There are no shortcuts in this game

- You will probably need to do some trial and error and see what strategy suits you

- You need to be emotionally composed.

- There is no correct style. No one can be absolutely correct and wrong about the market.

- You need to build a strategy

- Understand panic and greed in the market (emotions)

The best way to successfully create a strategy is to actually build a trading system:

- Psychology

- Sticking to the decisions and not deviating from it

- Risk management (Because all strategies make losses)

- Entry

- Exit

coming to the thing "All strategies make losses" there are no such system in the world which will guarantee you profits. Trading is essentially a Zero sum game, and by default if you are taking a position, you will have a 50% probability of losing that trade.

A major thing which I understood is that increasing this probability may not help, but improving the risk management helps much more. (I'm going to cover that later on, and is beyond the scope of this article. so stay tuned).

My personal experience: My winning rate varies, and there were many cases I had nearly a 70% win rate in a month, but I ended up in a net loss. This was me in my early days, where I had very poor risk management. I studied about Technical Analysis like batshit crazy, but I missed out about risk management and position sizing, and I also succumbed to greed and fear, and ended up getting burnt initially, while trading. Now I've also seen many successful traders still being profitable even after having a 30% win rate. That was because of their exceptional risk management capabilities.

Entries and exits are crucial, but not the most important. While exits are very important, especially to maximize the wins and minimize the losses; but again, risk management comes in.

Now there are some people who make additional mistakes, immediately after learning Technical analysis.

For example, in my early days, I used a lot of lines and curves, tried to use almost every indicator possible, even took up a tradingview pro subscription just to use more indicators, and finally ended up messing up almost all my trades because I got confused and fickle minded about what exactly to do! Later on, I learnt that keeping things simple is far better and more profitable. People often miss out basic things, like major supports and resistances, and end up missing out major trades.

I personally prefer using supports/resistances, RSI/Moving averages, (And sometimes some confirmatory indicators like Ichimoku cloud/ Supertrend). And for price action, candlestick analysis is very powerful.

For secondary tools, and additional confirmation, you can use Open Interest rates in the futures/options markets,Fibonacci tools, Volume, or volume profile analysis to identify stronger supports and resistances, or even heat maps (for a bit advanced level). But I'd say, the more tools you use, the more confused you'll get.

(Stay tuned for the next article, where I'll be covering about candlestick analysis, and what they are)

Another very important factor to note:

Consistency

If your trading style is random, and you swing back and forth from one strategy to another, you are probably not going to make money.

Always take what works for you and stick with it. Consistently!

Have some confidence in your strategy, and believe in it.

If you have read this far, congratulations.

So, now you will understand that Technical analysis is just the tip of the iceberg. There are a lot of factors, It's not simply "Draw a few lines, use a few indicators, see the chart, throw money, and pull out more money". It is definitely a little bit more complex, we need to understand what we want to use, and this is why we can see that there are a lot of big books on Technical analysis.

(Covering everything from everywhere will be extremely overwhelming for both me and the readers, so I'll try to make the next topics as brief and insightful, though being solid, as possible.)

I Hope you got a fair Idea about a basic introduction to Technical analysis.

For further reading, have a look at the below external links:

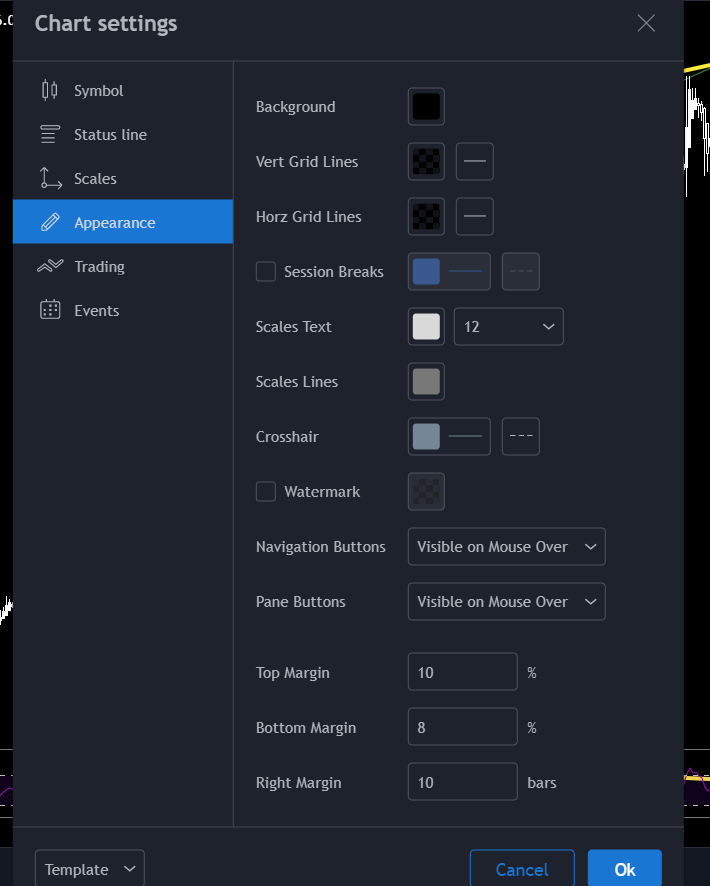

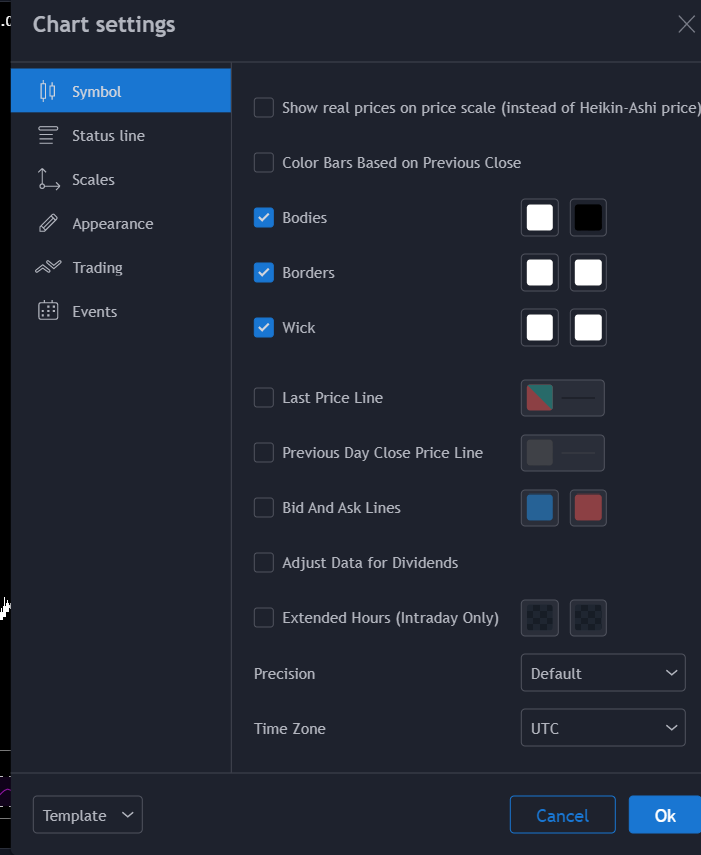

If you want to make your tradingview charts look like mine, do the following steps (optional):

1) Change the theme to dark (I prefer the dark/black theme almost everywhere)

2) Right click on the chart, select "Settings" and do the following:

3) For symbols, you can do the following:

Play around with the charts, see what all are available, in case you are new, and I'll come up with the next article soon!

In case you want to support my work, because trading series will require a lot of time and efforts, please consider using the referral links to sign up on any of the crypto exchanges below using my affiliate links: (You will also get benefit and save on fees) 🙂

FTX: https://ftx.com/#a=1846613

Binance: https://www.binance.com/en/register?ref=NL4008SG

Okex: https://www.okex.com/join/2172681 (Get $10 for free)

Kucoin: https://www.kucoin.com/ucenter/signup?rcode=E3t8Ao&lang=en_US

Bittrex: https://bittrex.com/Account/Register?referralCode=XWY-LBA-B5F

Pionex: https://www.pionex.com/en-US/sign?r=eOxX26Bq

Poloniex: https://poloniex.com/signup?c=M5NDJH48

Delta Exchange: https://www.delta.exchange/referral?code=CVIVPG

Bitbns: https://ref.bitbns.com/56721 (Get 50 Bns tokens)

Bitpolo: https://www.bitpolo.com/registerUser?ref=RAH25C

These are the exchanges I'm using right now. I'm not directly affiliated with any of the above exchanges, and signing up is voluntary. In case you do sign up, let me know on twitter, and I'll thank you, and probably share some more insights and analysis, and some of my personal stories as a trader! :)

If you liked the article, please this with your friends and circles, and also upvote this article, so that I get motivated to keep sharing market insights and analysis

Click this to get onboarded and start earning on Hive 🔥

Posted Using LeoFinance

Excellent post

@tipu curate

Upvoted 👌 (Mana: 6/12)

Thanks a lot for checking this article and curating it! :)

Posted Using LeoFinance

Congratulations @beehivetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

I see you have put in a lot of effort to make this post.

Your post has turned out to be very effective.

A bigger congrats to you for making to the list of top earning people on Leo Finance

Good going and congrats once again!

It just proves that hard work pays ;)

Posted Using LeoFinance

Thanks a lot for appreciating the work! :)

Hope you find some value from my future articles as well.

Posted one more today. Please feel free to check that out !

Posted Using LeoFinance

Wow. Very insightful. As I said before, I am subscribed and waiting for the next post in the series. Are you at least planning to explain key concepts of support and resistance, and other indicators?

Ra

Thanks for appreciating! :)

Yes, I'm planning to cover everything from extreme basics to little bit advanced levels over time.

Some teasers:

Key concepts of supports and resistances, candlestick patterns, some indicators, some dos and donts, trend following system, different types of orders, chart patterns, will be some of the topics I'll be covering in my future posts.

(original posts may not be in order, but I'm planning to cover as much as possible)

Posted Using LeoFinance

Quality as always.

Are you planning on turning this into some sort of paid course in the future? It's certainly got the potential.

Posted Using LeoFinance

Thanks a lot for appreciating!

I don't have plan to turn it into some paid course. This is why I've included some affiliate links, so that people who find the posts useful may join their favorite exchanges by using my affiliate links.

There are a few people who already joined and I appreciated that. :)

Posted Using LeoFinance

It's certainly an idea for you to consider down the track. Especially if all the content is already written, it just becomes about repurposing it.

Very cool anyway mate, good to have you writing here on LeoFinance.

Posted Using LeoFinance

Will take this into consideration for sure!

Posted Using LeoFinance