CZ is riding off into the sunset with your crypto. Or is he?. Image copyright: @beggars

Let me preface this article with a disclaimer: this is not intended to be FUD. I use Binance as my primary exchange and have a high degree of trust in Binance as a platform. They have done a lot for cryptocurrencies. This article is an opinion and should not be construed as financial advice or fact.

Cryptocurrency as a whole is experiencing bear market conditions. We have seen our fair share of market turbulence in 2022. Some blame inflation and interest rate hikes on the turbulence, but the issue comes down to gross mismanagement and incompetence.

Binance has allegedly exposed some red flags in its finances to improve transparency and alleviate concerns surrounding its reserves. The report undertaken by audit firm Mazars and released has not seemed to give some confidence Binance is in good shape.

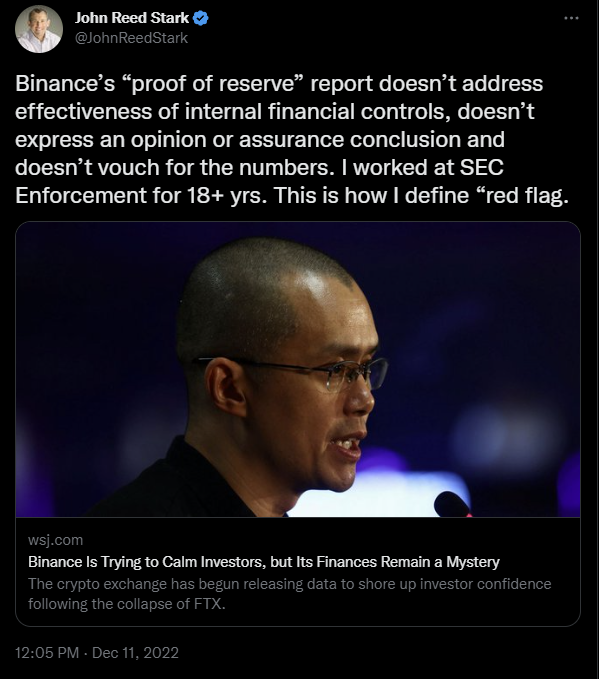

John Reed Stark is a senior lecturing fellow at Duke University School of Law and former chief of the Securities Exchange Commission's Office of Internet Enforcement. He isn't just some random armchair expert creating FUD.

"Binance's "proof of reserve" report doesn't address effectiveness of internal financial controls, doesn't express an opinion or assurance conclusion and doesn't vouch for the numbers. I worked at SEC Enforcement for 18+ yrs. This is how I define red flag."

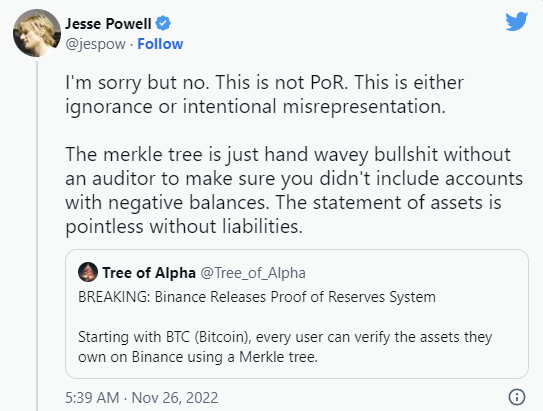

The issue here seems to be Binance is proving collateral but not proving its reserves. Even the CEO of rival exchange Kraken, Jesse Powell, seems to be sounding the alarm. Although, he runs a rival exchange and stands to gain more than others from Binance FUD.

And despite its best attempts to be "transparent", Binance has increased the size of the target painted on its back. If Binance were to fail, it would be catastrophic to the point where Bitcoin would tumble well below $10k. And I am not saying Binance is going to fail. I am saying if it did, it would not be good.

The issue with this audit appears to be Binance controlled the scope and didn't allow Mazars to audit other cryptocurrencies it holds or its liabilities. We know nothing about Binance's liabilities. The veil of secrecy that shrouds Binance continues to loom.

Sham audit aside, we saw some other interesting developments with Binance this week. Pausing USDC withdrawals after seeing over $900 million in withdrawals and, according to an internal memo to staff, saying turbulent times were ahead.

Once again, I am not trying to FUD, but there seems to be some smoke coming from Binance. If they're not hiding dangerous liabilities or other nasties, they are hiding something they don't want people to know about. Whether or not that secret they're hiding is financially related or something else. Something doesn't feel right here; either way, we might find out as the crypto winter drags on.

Here is a reassuring Tweeting from CZ to alleviate your concerns:

Ignore FUD. Keep building!

How inspiring and reassuring. In all seriousness, though. You shouldn't be keeping large amounts of crypto holdings on an exchange. Even if you are trading, keep a portion of your holdings on an exchange and the rest in wallets you have the keys to. How many times do we need to say this? Not your keys, not your wallet.

It is quite interesting to see how deluded some people are. Some people think the concern about Binance is FUD created out of thin air and not a legitimate concern driven by poor crypto conditions and the collapse of FTX and a few other DeFi platforms before it. People like this Twitter user always end up being left holding empty bags.

Having said all of this, if by chance it is FUD and Binance are being unfairly targeted, despite people withdrawing funds, if Binance is a properly run exchange with adequate controls and proper business practices in place, it has nothing to worry about. If Binance isn't up to its neck in liabilities it hasn't disclosed, in the long run, Binance will be stronger than it is now.

We must remember that right up to the demise of FTX, SBF was on Twitter and in news stories calling the concerns around its collapse FUD and trying to reassure people their funds were not in jeopardy. Then FTX melted into nothingness. So, never assume you're being told the truth, even if it is the biggest exchange in crypto. We saw the statement "too big to fail" proven wrong in 2008, and crypto is much smaller than the traditional financial system that failed in the 2008 GFC.

Posted Using LeoFinance Beta

I think it's outright comical that Binance performing an unsolicited audit is deemed a "red flag" by some random person claiming to have authority. It's not a red flag because he never had to do the audit in the first place.

CZ has been on the front lines of this entire ordeal basically begging for a bank run across every single centralized exchange, including his own. Binance does not make money from users depositing crypto within their cold storage. They make money on trading fees. They even make a little money on withdrawals as well, so this bank run gives them a slight profit.

CZ poured gasoline on a fire knowing that his house is made out of bricks and the other houses (which are competition) just might burn to the ground. It's basic capitalism and no cause for alarm.

Posted Using LeoFinance Beta

I suspect that might be the case as well. Binance holding itself to the fire. Whether it's to win loyalty points, prove it is more fiscally responsible than competitors or something else, if they can hold their ground, then there is no doubt it will solidify Binance as THE exchange (it kind of already is).

I trust Binance more than other exchanges and platforms (including Coinbase). The showmanship from CZ puffing his chest makes me suspicious, and it might not be financially related if something is amiss (or anything at all).

There are things we can't ignore, like the ongoing investigation from the DOJ, with there allegedly being enough evidence to charge CZ and other executives for possible money laundering and criminal sanctions violations.

Posted Using LeoFinance Beta

I think it's quite obvious that Binance allows hackers to freely slosh crypto through the exchange.

We've seen it happen first hand as far back as the wLEO hack.

There's a case to be made that illegal activity is going down, but it doesn't matter.

That's the price that gets paid on a libertarian system operating out of a dozen countries.

The DOJ has no power over the situation.

Its just a PoV... that he wanted this. I think he didnt .... its a huge risk and a gamble to play a game like that.

You cant ignore a lot of the voices ... even if they are 100% backed, there is something else there. Maybe money laundering? Remember CZ is friend with our man Justin Sun.

Plus there is a chance for big regulatory pressure for Binance now having in mind their no office thing ... and maybe even court cases.