Today I hope to show how it works and what is this history of tokenization (transformation into token) of assets. In order to use our Bitcoin (BTC) in financial Dapp’s (Decentralized Applications) (DeFi), we first need to bring this asset into the Ethereum blockchain where most of these applications and liquidity are.

It seems to be a very complex process, but today we are going to address here a way to expose yourself to BTC but to continue within the revolutionary environment of ETH that brings us all its ability to connect between “Money Legos” (concept that talks about aggregability and easy connection of these applications) and thereby open up new opportunities for using our Bitcoin.

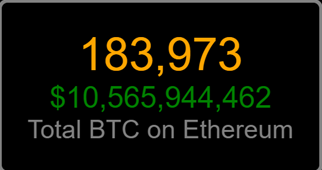

In the environment of Ethereum, the asset that until today was most tokenized without a doubt was Bitcoin itself, today together all its forms together we have a total of 10.5 billion dollars as shown in the following figure or on the website btconethereum.com.

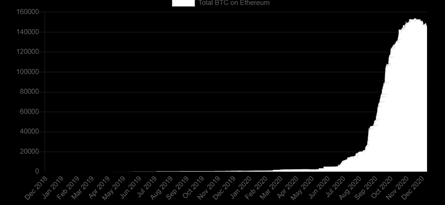

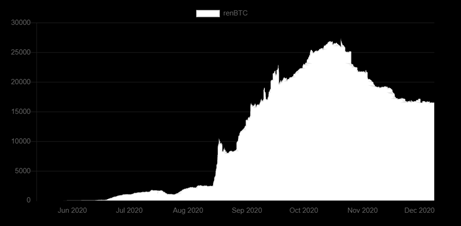

And also check in the graph below how the volume of tokenization has been until today.

We can see that the tokenization movement is parabolic and in just a few months we have reached a total of 142k BTC tokenized on the Ethereum blockchain.

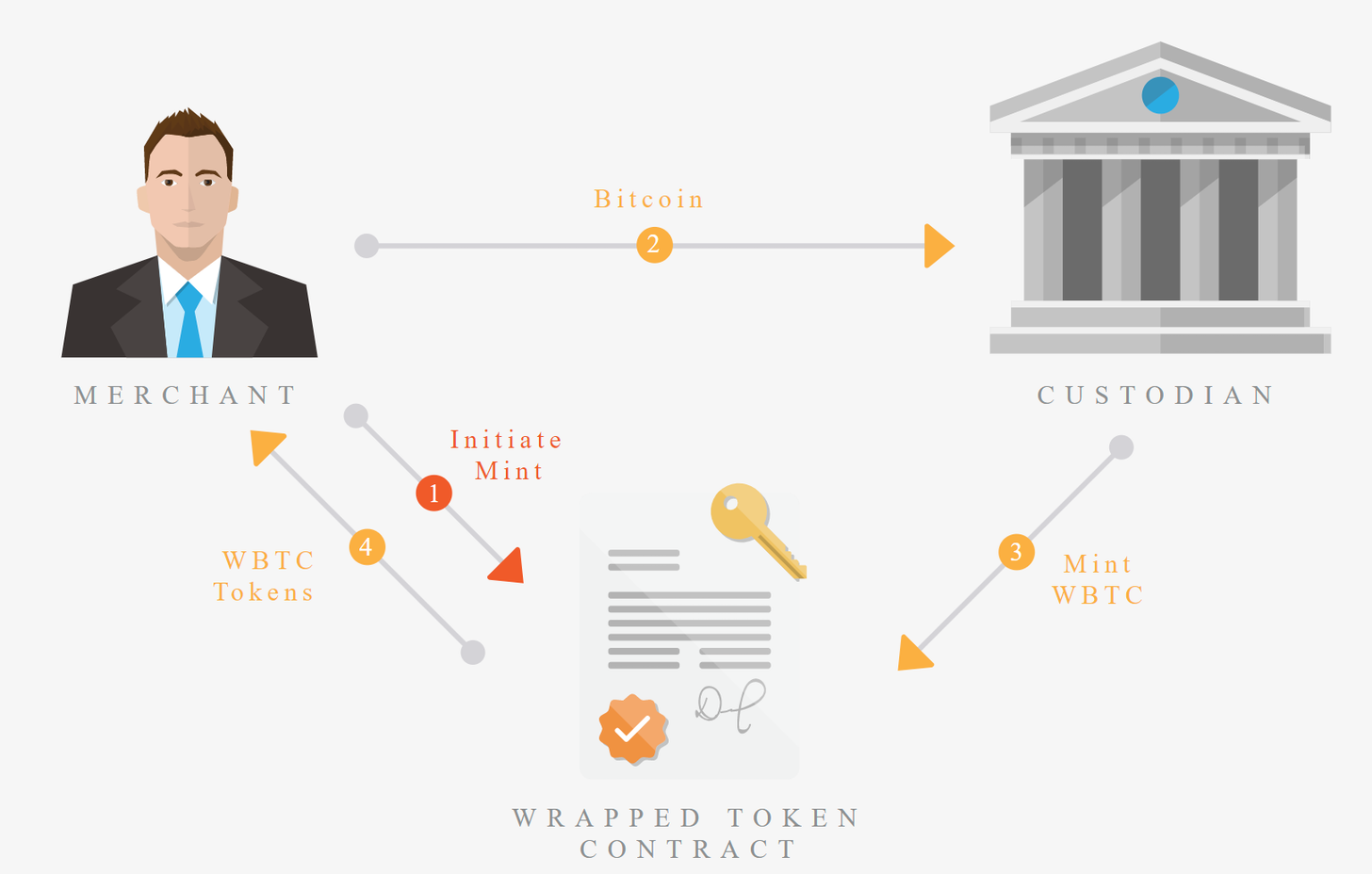

Of this total, the most liquid, that is, the one that has the most value available to be used as a second layer is the WBTC. This is controlled by a company that makes the custody and issue of the assets and guarantees the solvency of the system, Bitgo, one of the largest custodians of digital assets in the world.

The tokenization process through the WBTC is centralized, that is, you will have to do a KYC (Document Verification) process to be able to perform the task, as well as the reverse process too, if you want to withdraw your BTC for your position in WBTC.

This image shows how the process is done:

The user interacts to request the creation of an amount X of WBTC;

The user deposits the amount X of BTC to the custodian;

Custodian creates the WBTC and sends it to the smart contract;

Smart contract sends the X amount of WBTC to the user.

With that the process ends and the user can use their BTC in ETH / DeFi through an ERC-20 token (standard token model on the Ethereum blockchain) the WBTC.

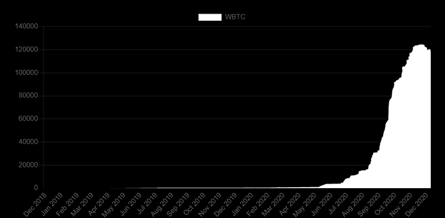

Today, the WBTC has $ 7.9 billion in liquidity as shown in the image below.

But there is a way to make this process decentralized and with the exclusion of intermediaries, in this case the custodian company and that is the most fantastic thing that exists, the automation of financial services or not that we can achieve with this revolutionary environment that we have in Ethereum.

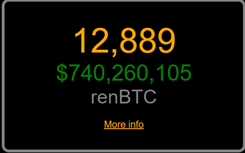

The other way I'm going to show you here is renBTC. Decentralized and any of us can be a validator of the RenVM network, just configure a Darknode (Transaction Validator for asset tokenization) and thereby earn money from fees for this process, but this is not the subject of this content, so it will not be covered in depth. The idea here is to explain how you can tokenize your BTC to use it on Ethereum.

This is the decentralized tokenized BTC format with the highest liquidity available to date on the market, with a trifle of US $ 740 million.

There are 12,9k BTC already brought to Ethereum with this technology from RenVM and just by this number you already imagine that we are at a very early stage in the development of this type of tech, after all in the world of the trillions being printed, what are a measly million ein? Anyway, boring jokes aside, here is the graph of renBTC's growth in the market.

To perform this process, it is necessary to enter RenVM's chain bridge platform (portal to tokenize digital assets) at https://bridge.renproject.io/welcome

It is the platform that you can use to do this process of tokenization of BTC and other cryptocurrencies.

Below I will explain the steps of the process:

1- First step, connect the Metamask wallet to the website.

2- When you connect you will be taken to the page below. In the "Mint" area you will create renBTC by depositing BTC in the process, while in the "Release" you will return renBTC to get BTC back. Set the amount and click "Next".

3- Check the data and click on "CONFIRM".

Deposit the specified amount of BTC that you wished to create in renBTC and note the 0.25% “Darknode” fee that is paid in BTC in the tokenization process. When carrying out the transaction, the counting of 6 validation blocks on the Bitcoin blockchain will begin, and when this happens, it can take approximately 60 minutes as each transaction block takes 10 minutes on average to be validated. Attention, never send the BTC from an exchange (broker), always use your own wallet when interacting with Dapp’s.

At the end of this process of waiting for confirmations, you will be able to return to the site and request the withdrawal of your X amount of renBTC that you minted (created), and then you can use your tokenized bitcoin on the Ethereum / DeFi blockchain.

There are risks of contract bugs and the other risks of becoming financially involved with DeFi, study your investment case before making contributions, test the processes with small amounts.

I hope to have contributed to the development of everyone in this decentralized world, until the next people.

Posted Using LeoFinance Beta

Congratulations @biginvestor! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP