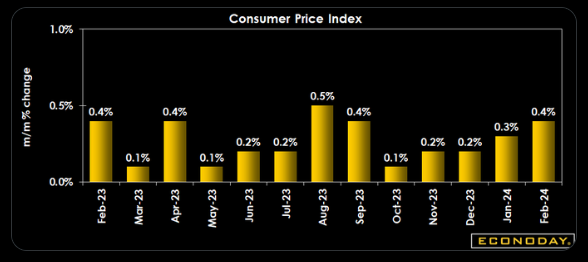

CPI comes in hotter than expected for third month in a row, putting more pressure on the Fed", the Consumer Price Index (CPI) for March 2024 was discussed, which came in higher than anticipated with a headline increase of 0.3% and a core increase of 3.8%. Greg Daco, EY Chief Economist, described the report as concerning, but noted that some of the increases were due to specific factors outside the Fed's control, such as car insurance and medical services. Victoria Fernandez, Crossmark Global Investments Chief Market Strategist, agreed that the third consecutive above-expectation

CPI print puts pressure on the Federal Reserve to maintain a higher interest rate stance. She also mentioned that the three-month average for CPI and PCE (Personal Consumption Expenditures) is moving higher, and the 10-year yield has jumped in response to the report. Both experts believe that the Fed may not cut rates three times this year, and the markets are reflecting this with all three major averages opening the day off over 1%. The discussion also touched on Atlanta Fed President Raphael Bostic's expectations for rate cuts this year and the potential impact on equities if the Fed does not cut rates as expected.

Sort: Trending