If you're like me then crypto can quickly blind you from the rest of asset classes that are going on. These asset classes are things like Stocks, Bonds, Real Estate, Commodities like gold, silver, oil etc, Private equity, hedge funds and collectibles.

Most of us at least dabble in a few of these which the most common would be stocks and gold and silver while the others often get left behind. But being referenced as the digital gold a lot of people have been stocking up on digital assets like crazy and often forgetting about the physical side of things. You know the stuff that's actully used in ever day life especially in high end electronics like computers which would be your silver and maybe some gold.

Now there is a group here on hive dedicated to gold and silver stacking and I honestly love it the @ssg-community would be just that one which stack assets like this which I feel many people forget about.

In fact I've just recently made it a mission to stack some silver and maybe some gold every month in a DCA but doing so in bulk enough amounts that I can get good pricing on it over spot as well. Now for gold and silver there are two unique areas you can invest in or both and that's just buying up the metal in bar form or getting coins minted which have a collector value to them as well.

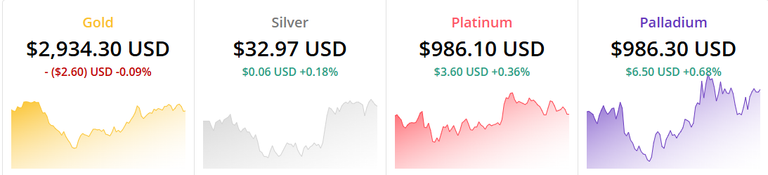

Rare Metal Price Action

Right now things are looking crazy in the world again. With tariffs bouncing back and forth and wreaking havoc on companies, wars still raging on and battles within the US government itself it's not the greatest time to be invested in some assets with this type of uncertainty. Investors don't like that and will often start to flock to other areas which are a hedge against inflation which is often looked at for Bitcoin as the digital method but sold examples of Gold and silver etc.

What's clear is the government over spending is still happening and inflation is still running rampid. So being in cash reserves right now, not the best option when you look at inflation numbers like 3% and a increasing inflation rate for the month. This makes it look like inflation is starting to move it's way back up again slowly and I wouldn't be surprised if the next report comes in at something like 3.2% or higher.

This is still far higher than the targeted 2% that the government and the world is suppose to hold and you really can't blame one little war in Ukraine for it. Things are just a mess right now and it's going to take a long time to try and fix them if they ever get fixed at all.

You see with all these promises from trump about tariffs etc we really haven't seen ANYTHING happen yet. Both times it was backed off of and government over spending the amount that it's actully cut out is a drop in the bucket compared to the overall picture. When they report 5 billion saved you have to realize that the government spends trillions every year.

Investors also have hoards of gold stock piles themselves and many right now are moving their gold from the UK out of it and into the US which makes for some interesting things going on.

EU, UK and that part of the world is actully a freakin mess right now. This part of the world has no real value in terms of natural resources and primarily got their wealth from exploring other countries when they colonized them. However that's been drying up over time and it's hit a point where these countries are actully rather weak on their own and needs to start to figure things out.

With the increasing demand right now we are seeing pressure on the liquidity of gold which is quickly starting to drive prices up. However there's actully plenty of gold in the world and most people just hold it and don't use it for anything.

This leads me to believe that when gold starts to dump people are going to start looking to other places such as crypto again as a way to build wealth and store of value again.

Posted Using INLEO

I don't know, I think a diversified income flow beats chasing stability in specific assets ahead of economic turmoils, ultimately.

If you have a diversified and healthy income stream, you should be able to adjust your portfolio comfortably at any given time.

I don't buy the idea of a "safe haven" — there's already more digitally traded Gold than what physical exists and that could be a huge problem for not just institutional debt but also the price of gold itself as that would mean that they precious metal is overvalued - wrote on this recently.

Same would be true for Silver, but it's industrial demand might be a good hedge.

That said, the energy sector is looking really promising with AI and Crypto developments expanding.

In a hyper-digital world, energy companies should experience explosive growth and some of that could result in great energy stock price actions.

Well for me is a matter of access. From Cuba the only asset avaible is crypto.