DeFi really changed everything when it came to crypto and finances. In fact it's still developing to this day with more and more liquidity pools popping up all the time including on platforms that normally wouldn't support this. I've seen them right here on the hive blockchain and on other platforms like Wax.

A lot of recent attention has been to pair up tokens with a stable coin such as USDT Tether. This new pairing helps to minimize the risk of what is known as Impermanent Loss but we have also recently seen cases where Tether is now working with governments and locking off accounts based on DOJ requests. Thus removing any decentralized aspect of the token and it's clear that USDT is set on this path.

In a way this is great for Tether as it puts them in line with regulations and standards making it a solid token that investors would be confident investing into and using. However on the other hand it completely breaks the laws of crypto and removes any deactualization aspect of the token.

This also brings us into todays topic about Tether and RWA (Real World Assets). I recently wrote a post on them here The Surging Interest of RWA - Blockchain Edition

The Release of stUSDT

stUSDT is a new token that is no the poop Tron network but also Ethereum. It's what's called staked USDT a receipt token that users receive when they deposit USDT into a stUSDT-RWA contract.

At this point the staked token the user gets represents random real world assets such as bonds and gains yield exposure to them. Each day the token is rebased from the rewards they get of more stUSDT which can be swapped at a 1:1 ration via the contract for USDT.

However because of this rebasing nature of things it's near impossible at the moment to use stUSDT into defi itself and currently acts as it's own RWA tokenonomics and interest earned.

To make that even more complicated to understand (because crypto for the most part is not user friendly at all still lol) is that this stUSDT token can be wrapped at wstUSDT which that can then be used on defi Platforms.

What Is stUSDT Invested In?

There is a certain amount of funds which can be placed into this contract. It's reported that stUSDT is invested in short-term government bonds. Currently these bonds are paying out record high amounts of 5% or higher making them an interesting buy in and way to generate passive income with digital crypto.

This is also the start of where everything will eventually become tokenized and in a way should be clearly visible and transparent at all times. For example when you put money in a bank and earn interest there's nothing that tells you how or where your money is invested and everyone simply keeps the APR the bank assigns.

With a digitalized blockchain version like this (while yes complicated for many normal users to deal with at the moment) you can clearly see where and what assets your tokens are in and your daily interest which can change day to day.

Right now this is a very high level approach but it does allow every day investors to be able to tap into what is known as accredited investors. Normally higher yields and less risk because more capital is being placed in.

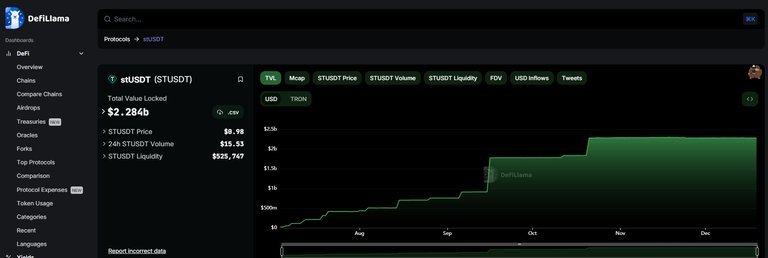

As we can see this area of investing is only getting started. The first small bits of funds dropped in end of July to early August and since that has seen a lot of massive investments now brining it to over 2 billion dollars in market cap.

Now the positive thing with this move is that it can start to really open up possibilities into fractional or total ownership of things. Stocks, bonds, mutual funds, royalty payments, real estate otherwise known as REITs, art and so much more.

Do you currently own any RWA on the blockchain?

Posted Using InLeo Alpha

The rewards earned on this comment will go directly to the people ( bitcoinflood ) sharing the post on LeoThreads,LikeTu,dBuzz.https://inleo.io/threads/bitcoinflood/re-bitcoinflood-i5nh7gyp

I haven't heard of stUSDT before. I only know of USDT as of recently (few months ago) when I found the interest in cryptocurrencies. So stUSDT is like a reward token? For USDT stakers?

I think the Crypto terms used here is not yet been familiarized by me so I find it very difficult to understand everything just piece by piece.

One of the more interesting, yet not greatly utilized, stable"ish" RWA's is Quintric.com Gold and silver in a vault which can be transferred on chain as Quint or QuintS. Beautiful that you can also invest (stake) Quint into a liquidity pool as well.

The market is ripe for a usdt alternative, yet it needs to be EASY to use with many different gateway pathways. I believe consolidation and collaboration between graphene based chains would help this situation tremendously.