As the use of digital wallets and cryptocurrencies becomes more abundant,new users cases for micropayments will b further explored and developed.

source

source

I recently cam across Marc Andreessen's article from 2014 on Bitcoin Btc. In many ways, it is visionary ( no suprise). I hav been in the industry for four years now with most of my focus being on the social impact of blockchain. It is astonishing to me that in 2014 before there was any institutional presence in Bitcoin_or, indeed a popular understanding of this new technology Andreessen was able to outline its potential economic and social impact for the future.

Near eight years after he inked his words,i would like to address one of the topics from his article: micropayments. I will explore how blockchain could help transform micropayments and thus enable not only the monetization of certain aspect of business that are in need of solution but also could assist society's most vulnerable.

Micropayments

Micropayments are not a new concept. Since the mid-1990s, micropayments have experienced various degrees of popularity.By definition,micropayments are transactions with a value smaller than a certain threshold. Importantly, below that threshold,the transaction fee incured becomes a significant portion of the total transaction value and,consequently,not economical.Another important aspect is that due to the minuscule monetary amounts, micropayments refer only to digital transcation of non tangible goods. Any additional cost of handling and shipping might mean a hundredfold increase of the original tranaction value,making it utterly irrelevant.

Credit card companies offer merchants various types of price plans for the fees they charge. These plans usually comprise a lump sum charged per transaction and a percentage charged out of it. Not suprisenly,this information is not openly available from the card companies themselve,rather its published by others who compare these rates as a service for merchants. Within that context. Let us examine what fee a merchant would be charged for a mircopayment.

We assume the following:

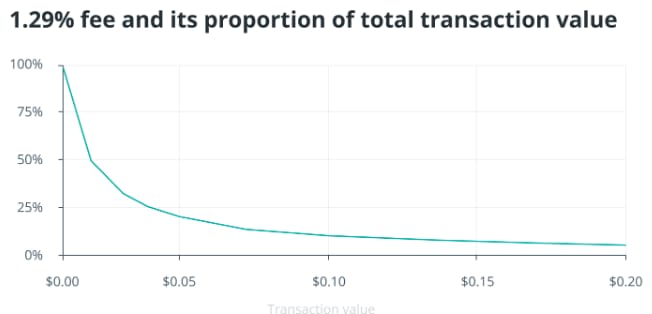

• The lowest fee we uncoverd was 1.29% of the transaction value,and no lump sum fee was charged.

• Since the smallest building block of (most) flat currencies is 1/100 of the whole_i.e., $0.01_ this would be the minimum fee the credit card company charges,regardless of if it is higher than 1.29%.

Charting the proportion of the transaction fee as a function of the transaction value we get the chart below. For exampl, a $0.01 transaction incures a fee of 100%. While the fee on a $0.10 transaction is only 10%

Naturally, this goes to show the irrationality of carrying out mrcropayment transactions under these payment platforms.

source

source

Blockchain has a solution

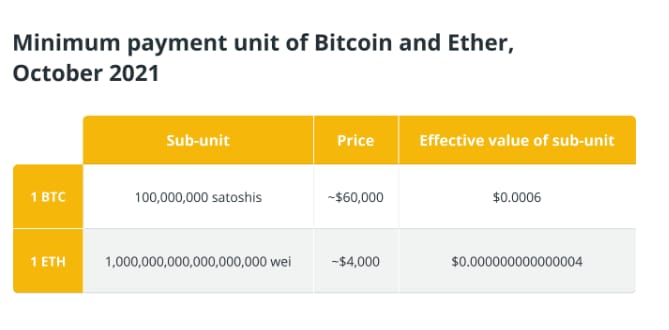

However,there is now an alternative.Blockchain technology provides the perfect solution for micropayments, for many resons. It provides the infrastructure for digital payments that are getting faster by the day and importantly, the minimum payment unit to both Bitcoin and Ether is incredibly small, as displayed in the table below:

source

source

In addition,crypto wallet are easily embedded in any digital device, whether a mobile phone,laptop or any other internet of things device. And while fees may greatly on various networks and on different occasions,fees are not an issue with many protocol and may reach as low as fraction of a cent.

Last,but certainly not least,is user privacy.Due to blockchain's asymmetric encryption the payer exposes only their public address when paying, which provides practically no information for someone who is looking to hack their wallets. Unfortunately, the same does not go for a credit card transaction, which requires the payer to share their full credit card number and hope the payment platform is secured.source