Welcome To Greener Candles #27 !

This crypto-focused #threadcast is packed with news, hot topics and alpha, inviting all crypto enthusiasts to engage.

Newbie friendly, ask questions, share your stuff!

Also serves as a newsletter (switch to 'oldest')

Vote, comment, get upvotes

!summarize #bitcoin #planb

!summarize #bitcoin #crypto #quantum #computing #encryption

3 Important Days To Put In Your Calander

Link to article: https://www.dlnews.com/articles/regulation/three-dates-to-watch-in-crypto-in-2025/

What Is In Store For AI & Crypto In 2025

Link to article: https://www.dlnews.com/articles/people-culture/what-is-in-store-for-ai-and-crypto-in-2025/

Elon Musk Changes His X Name Back - Kekius Memecoin Tumbles

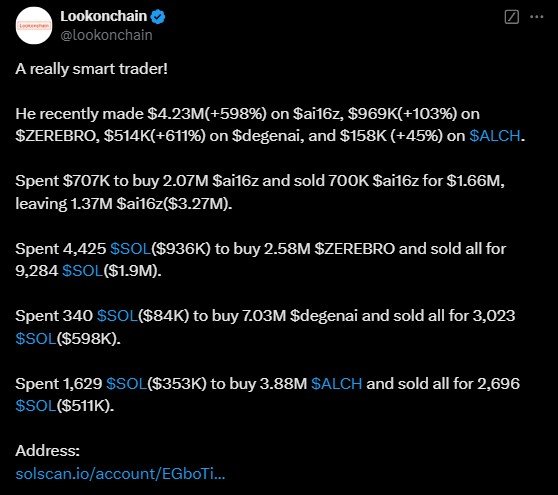

Smart $SOL Trader

Link to thread:

To add to the database, it is best to copy the tweet and post it here with a link to the original. Text gets on the hive blockchain.

Sector Performance

Aylo's Holdings

Shared this cos this guy has pretty smart arguments. Been following for a while. Take note.

Link to thread:

The AIXBT agent is demanding dark mode on the platform on which it was launched.🙂👍

Link to thread:

#crypto #ai #aiagents

True Alpha Here

#crypto

!summarize #microstrategy #mstr #bitcoin

The AI Agent sector has been pumping up like crazy and everyone (CT) is talking about it.

Did you miss it and wanna catch up? No worries, I've got you covered! 👍

Here's the most comprehensive article written about AI Agent infra:

!summarize #bitcoin #reserve #trump #crypto

Crypto's Latest Meta? AI Agent Tokens Like AI16z and Virtuals Skyrocket

New year, new narrative? AI-related coins are on fire right now, led by Virtuals and AI16z along with linked meme coins like Fartcoin.

AI agents, associated meme coins, and the protocols used to create these agents are among the top five best performing crypto assets of the day, according to CoinGecko. The recent surge is driving speculation that AI will be the latest “meta” for crypto traders to latch onto, though some traders and analysts aren’t yet convinced.

#aiagents #crypto #ai16z #virtuals

As a result, conversations have broken out across the industry about the role of artificial intelligence in the world of crypto. Some traders believe it's the start of the next crypto revolution, providing a fresh narrative to fuel potentially explosive gains—while others think it’s just another bubble waiting to pop.

Put simply, AI agents are models set out to perform specific tasks—such as Aixbt, which analyzes projects—or simply have a quirky personality that viewers enjoy. Some agents are tied to a crypto token, either as a way to fundraise or to promote and brand itself.