Happy middle of the week, traders and diamond hands!

While reviewing my portfolio and planning new trades, I noticed that my stable coin positions represent less than 10% of my total portfolio. That's a bit less than I like it to be as something like 20% would be optimal during a week that is anticipated to be quite volatile.

Still, I can't sleep on the fire, so I'm constantly making small trades and as I mentioned in my previous posts, I'm a big fan of swing trading. Some positions I leave hanging for a longer time while others I tend to complete at a more rapid pace.

In this post, I'll share some of my trading ideas and analysis about $GRASS, a recently launched AI/DePIN token which claiming process I covered in this article. So, without further ado, let's dig a little deeper into $GRASS price development and the factors affecting it.

Trading The Airdrop

On Monday I received 80 $GRASS tokens with the airdrop that didn't go down without some drama. This time it was about issues with Phantom Wallet and bad communication about geo-blocking.

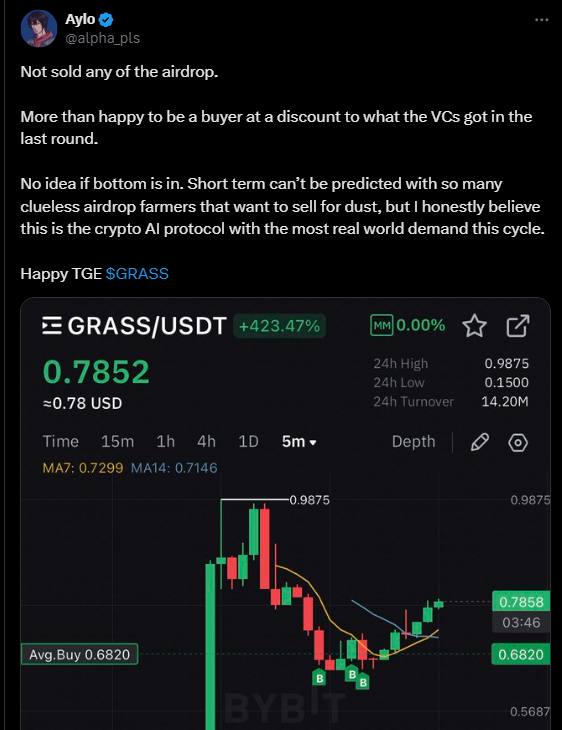

Nevertheless, $GRASS launched around $0.7, and after a short initial dump, it started to climb to $1.15. I had this moment of hesitation and FOMO as I sold 50% at $0.74 but then remembered why I was bullish on $GRASS in the first place and re-entered the position at $0.78.

While I was pretty pleased to see it go higher from here, I decided to sell some again but this time at $1.02.

This morning the price of $GRASS was down quite a bit and I recognized a support level near $0.8 and made a buy. So after this back-and-forth trading, I'm left with a little more $GRASS than what I received from the airdrop.

Good trades? I believe so but the market can always outsmart you so you don't want to use the whole amount to trade an asset because if it surges you might not be able to re-enter and if drops, you might get stuck for a long time before you can sell for profit.

With $GRASS I went from 50% to 25% and plan to lower it from there if the price goes up a lot.

Swinging Relaxed

There is an interesting side to trading with airdrop rewards. I for one feel a bit more loose and relaxed when trading with airdropped assets as it feels like, if not free, but some sort of "bonus money" or as if I was trading with someone else's assets.

This has reflected on my trading in a positive way as I'm making more sharp decisions and don't hesitate as much as I would normally do. Still, we don't want to forget the basics of swing trading and patience is the most important one.

The price might very well fall a lot from where it's standing now but a good thing about swing trading is you can leave it hanging there waiting for another surge while shifting your focus to other assets. All you need is patience and to be systematic. I mark down every trade I make and go through past trades daily to see if something stands out as a potential buy or sell.

Trading vs. Staking

My trading idea with $GRASS is simple: just keep on trading with 25% of the total amount, sell when it's at the top, and buy the dips. This will lead to getting either more stables or more $GRASS(hopefully more both). Either way, it's a win if you believe $GRASS will do well future.

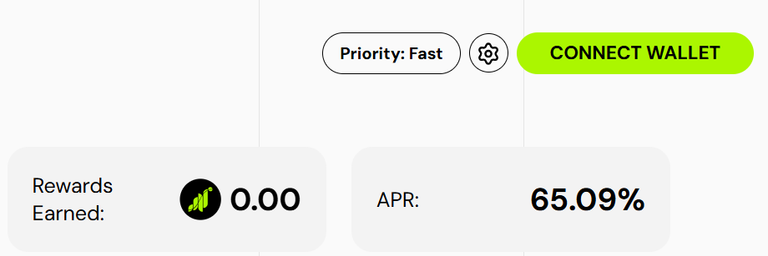

There's also another way of making your $GRASS work for you and that is staking.

The APR here looks very good but it's still early as $GRASS was launched on Monday so the APR percentage is coming down fast. It was about 400% just yesterday and I believe it will eventually fall somewhere around 10%.

However, staking is always, well mostly, a better idea than just holding tokens idle in the wallet but I've calculated that with a couple of successful swing trades, I will be making much more $GRASS than I would with staking. This is good to keep in mind and do some comparison before deciding whether to stake or trade as in many cases you'd have to lock your tokens for a certain time. For Grass, the unstaking lasts 7 days.

Dune Claim Analytics

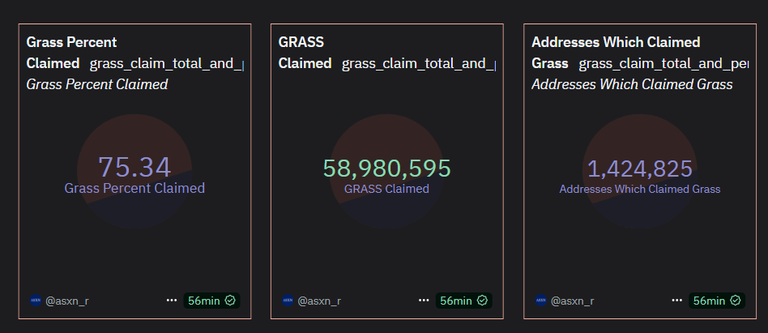

There's a lot of noise surrounding $GRASS right now on Crypto Twitter which is understandable as it's a freshly launched token. I try to filter out the loudest noises and keep focusing on real data. Just today I found this cool Dune dashboard displaying interesting $GRASS claiming and staking data.

Here we can see that only 75% of the airdropped tokens have been claimed so the conclusion is that volatility is still expected as there might be big whales there without any intention to hold.

Then again, I've been chatting with many users saying their country has been geo-blocked which sounds unfair because apparently, Grass hadn't been mentioning this beforehand, at least not clearly enough. So, since it's been two days from TGE, could it be that most of the remaining 25% is unclaimable because it was "mined" by geo-blocked users? There's still time until January to claim those but what happens to unclaimed $GRASS? That's a good question.

I believe $GRASS volatility will settle down a bit once the initial hype/drama has passed and airdrop hunters have dumped and moved on.

If my trading strategy should fail and the $GRASS price would fall way below my trading range, I can honestly say that I would add more at lower levels. In my opinion, $GRASS isn't something to pass during a bull market where AI & DePIN sectors are trending.

Thank you for reading!

DISCLAIMERS:

🟢 Grass season 2 is now ongoing so if you want to try passive farming, here is my referral link: Grass.

TON mini-apps I'm currently playing:

🔹 Blum - play mini-game and complete tasks to earn Blum points (pre-market trading live on Whales Market!)

🔹 Wizzwoods - cool strategy game (Berachain + Tabi)

🔹 TON Station - very simple farming game with a lot of potential

🔹 Agent 301 - perhaps the next $DOGS

🔹 Human Protocol - well-made mini-app with a prediction game. Use your points to bet on US elections, sports, etc.

Posted Using InLeo Alpha