For years we have been giving our data away for free to web 2.0 companies like Google, Facebook, and Twitter. These tech giants then claim ownership of our data, sell it to third-parties, and possibly feed it into secret AI algorithms.

Moreover, until recently, there has been no compensation whatsoever to the users who have been providing this data to these big tech companies.

Although platforms like Twitter/X have started to offer ad revenue sharing to their users, the sign-up process entails the friction of KYC and linking bank accounts (which excludes the unbanked and those without government ID from participating).

Elon Musk himself keeps posting on X that America is bankrupt and that the US dollar is about to fail, but nonetheless continues to pay his users in dollars and refuses to accept cryptocurrency payments for premium memberships.

Web 3.0 can fix this.

Web 3.0

Back in 2016, a blockchain-based social media platform called Steem was launched that allowed users to earn crypto rewards for creating and curating content.

Unfortunately, due to an unethical attack on the network in 2020, the blockchain was split into two, and the more decentralized HIVE platform emerged.

Like Steem, Hive allows you to earn cryptocurrency for posting, commenting on, and curating content. No KYC is required, and the banks can be totally avoided, as you are paid directly and automatically by the blockchain.

Where The Money Comes From

Similar to how the Bitcoin network is constantly producing more Bitcoins, the Hive blockchain is also constantly producing new HIVE tokens. The current supply of HIVE is 456,972,225, and its inflation rate drops by 0.5% every year until it reaches 1%.

The newly minted HIVE tokens are distributed automatically by the network as follows:

- 65% goes towards content creation (50% to authors and 50% to curators). This is known as the reward pool.

- 15% goes to users who have chosen to power up (stake) their HIVE tokens, as a reward for their commitment to the project.

- 10% goes to the Hive witnesses - the decentralized, community-run nodes that validate transactions and produce new blocks.

- 10% is allocated to the Hive fund, where users can submit proposals for funding. The stakeholders (people who have staked their HIVE) then vote on them.

HIVE / HP / HBD

Before delving deeper into exactly how rewards are allocated, a few terms need to be defined:

- Liquid HIVE - HIVE tokens that can be immediately transferred between accounts, or sent to an exchange to trade for other cryptocurrencies/fiat.

- Hive Power (HP) - Liquid HIVE that has been powered up (or staked), meaning that it cannot be transferred (unless it is powered down, in which case the tokens are gradually released over a 13 week time period)

- Hive Backed Dollar (HBD) - An algorithmic stablecoin pegged to the US dollar that is backed by the value of HIVE.

Creators vs Curators

When you submit a post or a comment to HIVE, a seven day voting period commences in which the users (curators) can either upvote or downvote you.

The greater the amount of HP a curator has, the greater influence they have on distributing the reward pool to the content creators.

For example, if your post is liked by someone who has 50,000 HP, you will receive a much greater portion of the reward pool than if your post is liked by someone who only has 10 HP.

At the end of the 7 day window, 50% of the earned rewards are made claimable to you, and the other 50% is distributed proportionally to the curators who upvoted your post.

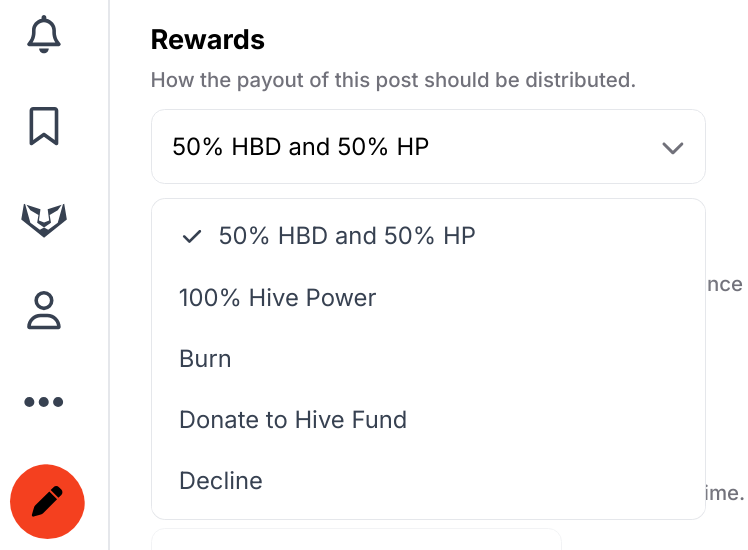

As the author, your reward will be split into 50% Hive Power and 50% HBD, unless you choose to receive all in HP before submitting your post.

Earning on InLeo

Originally called Leo Finance, InLeo is a community on the HIVE blockchain that started out focused on financial topics, but has since expanded to a broader range of topics.

Notably, InLeo founded the concept of short-form content on the HIVE blockchain, where users can communicate Twitter-style, and receive rewards for their posts.

The InLeo community is powered by the LEO token, which sits atop the HIVE blockchain (like how an ERC20 token sits atop the Ethereum blockchain).

Similar to HIVE, the LEO token is deflationary, and it will be emitted block by block over the next ~32 years, until it reaches a maximum supply of 50 million.

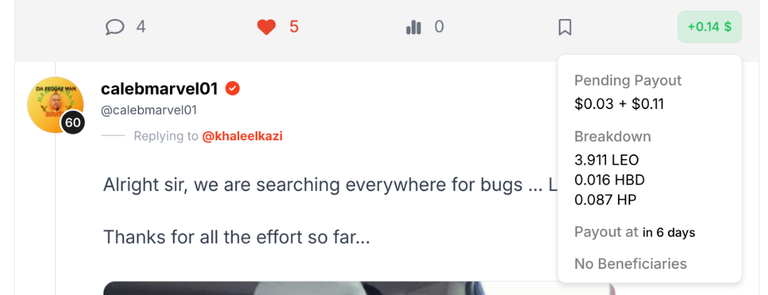

In addition to earning HP, posting to InLeo earns you LEO tokens as well, which can be powered up (staked) to increase your influence in the InLeo community.

Like HIVE, the LEO rewards pool is distributed based on upvotes, and the more LEO power you have staked, the greater portion of the LEO rewards pool you have the power to allocate.

The Dollar Value

In case you're still wondering why HIVE or LEO have any (dollar) value at all, you should be aware that both of these tokens are traded on exchanges for bitcoin and stablecoins, where their dollar value becomes established.

Until next time...

Instead of feeding your data into big tech and receiving no compensation for your data, make your way over to the world of web 3.0 where people are rewarded for their work, and the data is democratized.

No only will you be compensated for your contributions and efforts, but your content will stay permanently on the blockchain, free of cancellation or censorship.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Resources

Hive Whitepaper [1]

InLeo Tokenomics [2]

Images Courtesy of Venice AI[3]

Posted Using InLeo Alpha

Nice one! Lots of good info for newbies here!

Thanks! Your feedback is appreciated.

Well, I learned a lot from this. Thanks! I'm a bit confused before from some terms and such and now this blog is a bit simpler.

https://jryze.me/hive/

This is a little dated, but it is accurate for when it was written.

Thanks!

I'm glad to hear that.