Since the beginning of 2024, the price of Bitcoin has risen from $40k to $100k, which has dramatically improved overall market sentiment.

This trend evokes memories of how the Bitcoin price rose from $5k to $19k in 2020, right before the colossal bull-run of 2021. Indeed, most signs are pointing to a promising 2025 for crypto.

That said, we always need to be paying attention to the monetary and fiscal happenings of traditional finance (TradFi), which still have the potential to cause sharp corrections or extended bear markets in the crypto world.

Recently, we have been seeing strange behavior in the bond markets.

Bonds In Disarray

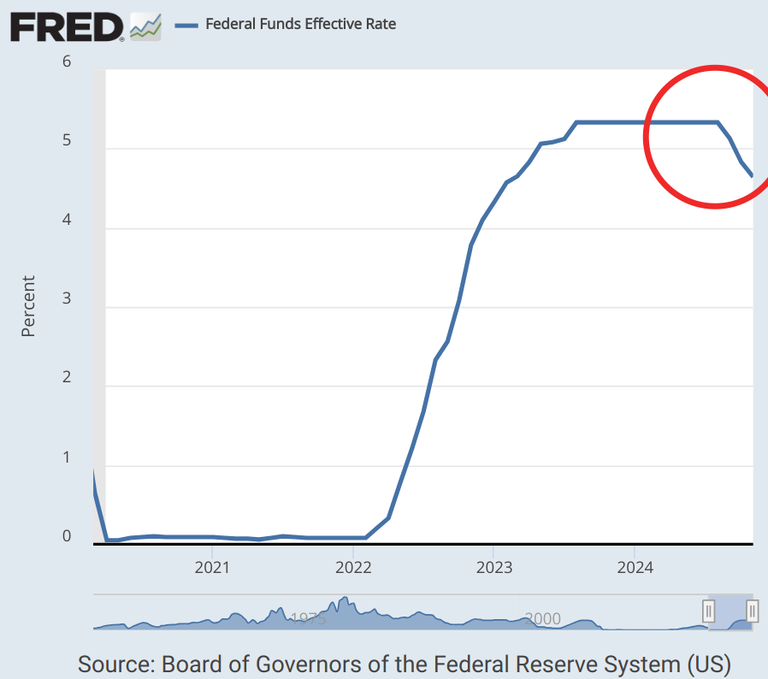

Since July, the Federal Reserve has been lowering short-term rates, pushing down the yields of all treasuries up to and including the 2 year note.

If you follow this link, you will see that US government debt comes in durations of months (short-term), and years (long-term).

Historically, when the Fed lowers short-term rates, long-term rates also fall at the same time. However, this time around, long-term rates have actually been rising as the Fed has been lowering short-term rates.

What is causing long-term rates to rise as short-term rates fall?

Persistent Inflation

Recall that inflation had been on the rise since a return to 0% interest rates (ZIRP) and the covid-related government handouts of 2020 and 2021. Despite the Fed raising short-term rates all the way to 5.25% in August 2023, inflation continues to run hot, above the official 2% target.

Although the Fed is claiming inflation has dropped to 3% from 9%, there are still countless TikTok videos being made by people on the ground who are complaining about rising prices. Even the official inflation numbers (if you can trust them) indicate that prices are on the rise again. How does this impact bond investors?

Consider that if inflation is actually 3% (as the government claims it to be), then a 4% interest rate would only beat inflation by 1%. When inflation increases, investors demand higher and higher rates of return on their capital in order to beat rising prices.

The Fed could raise interest rates to fight this inflation, but that would make servicing a $36 trillion debt even more challenging. This is one of the primary reasons investors had been expecting a return to lower interest rates, but they were in for a shock at the latest Fed meeting.

Less Cuts Than Expected

The market had been expecting four more interest rate cuts in 2025, but Fed chairman Powell announced that they are now only forecasting two. Ultimately, this will result in less liquidity (money printing) overall, and let some air out of the Everything Bubble. The news caused a sharp sell-off in the stock and crypto markets.

However, regardless of the reduction of rates cuts, the fact remains that lower interest rates will increase liquidity in the financial system. This will cause more inflation, and more demand from bond investors for higher interest rates.

If higher long-term rates persist, the central banks could do another round of Quantitative Easing (QE) to calm investors. Such action would inject massive amounts of liquidity into the financial system, sending the stock and crypto markets to the moon again (relative to the dollar), but would also cause inflation to skyrocket.

The other possibility is that the powers that be will allow the stock market to crash in 2025, so that money is funneled out of equities into the bond market. This would for sure crash the crypto markets as well.

Peak Centralization?

The markets have become increasingly less free, and more dependent on the Fed's announcements since the 1987 Black Friday event when Greenspan came to the rescue, and even more so since the 2008 financial crisis when Bernanke launched ZIRP and QE. With each year that passes, the central bankers have a tighter grip on the "markets".

What did these financiers not see coming, though? Bitcoin and crypto. In other words, free-market money that cannot be manipulated by a central authority (if engineered properly). As more and more people opt for cryptocurrencies over fiat in their daily lives, the grip the bankers have on the population will loosen.

Until next time...

In the meantime, we are still at the mercy of the banksters and the masses who react to their every statement, which means you should create for yourself a cushion by allocating a portion of your portfolio to stablecoins.

For now, we can remain cautiously optimistic about the crypto markets, while keeping in mind that traditional finance is skating on thin ice, and could fall into panic mode at any moment. These shocks in TradFi will continue to affect cryptocurrencies, until the world turns its back on fiat and recognizes crypto as a better form of money.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Are Decentralized Blockchains The Solution To Flawed Economic Data?

- Why Fair Token Distribution Is Crucial To Effective Blockchain Governance

- Why A Paradigm Shift In Finance Is Inevitable And Coming Sooner Rather Than Later