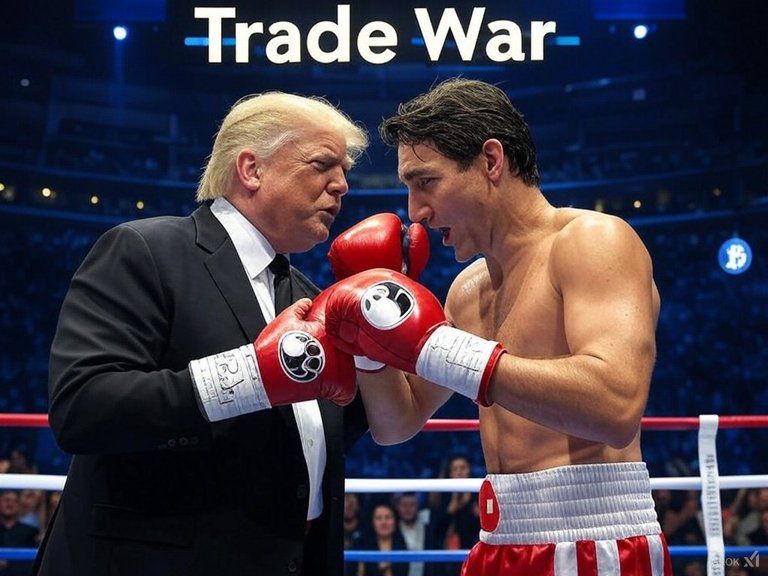

Newly elected US president Donald Trump has announced fresh tariffs against Canada, Mexico, and China, and he is threatening to impose them on the European Union as well.

While Chinese imports will be taxed at 10%, those from Canada and Mexico will be levied at 25%. As a result, frustrated Canucks are booing the American national anthem at hockey games, and relations are worsening between the two countries.

Considering that roughly 75% of Canadian exports go to the United States, Canadians are feeling betrayed, angry, and worried that these new taxes could throw the Canadian economy into a recession.

Interestingly, while Trump has been applying these tariffs, he has been promoting Bitcoin/crypto at the same time. Does he not realize that the very cryptocurrencies he is advocating for could be used to evade both national tariffs, and sanctions as well?

State vs. Individual

We have already seen countries like Russia preparing to side-step the sanctions placed on them by the West. This includes a combination of a new BRICS payment system, in addition to the use of permissionless cryptocurrencies.

Ironically, government endorsement of cryptocurrency will actually weaken the state in the long-run. How so?

If engineered properly, cryptocurrency transactions completely transcend national borders, and cannot be stopped, nor taxed. For example, an individual living in Argentina could make a payment to a seller in Mexico using a cryptocurrency to dodge any sanctions or tariffs that may have been imposed by either state.

At the end of the day, is this a good thing, or a bad thing?

It's worth asking the question, who actually benefits from the imposition of sanctions and tariffs on international businesses? Is it the citizens, the business owners, or the powerful elite?

Our Future Economy

Cryptocurrencies were designed to eliminate the middle-men, while empowering free trade among individuals and small businesses. Cryptocurrencies reduce the friction of payments, and increase their efficiency. They also prevent the rent-seeking middle-man from extracting taxes or tariffs on a transaction.

Of course, it will take time for the world to adjust to a new crypto-based economy, where individuals and small businesses are free to trade with one another without any interference from the state, but I believe this is our inevitable destination, as more individuals and small businesses discover the advantages of using crypto.

Until next time...

As nation-states impose more financial rules, regulations, and censorship on both citizens and trading partners alike, the transition from a debt-based fiat system to a trustless, crypto-powered economy will likely accelerate.

That said, the transition will require the combined action of numerous international grassroots movements that work to eliminate the traditional middle-men and foster worldwide peer-to-peer transactions.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Will Traditional Nation States Survive As Crypto Adoption Takes Off?

- Maxi Meltdown: The Challenge Of A National "Digital Asset" Reserve

Posted Using INLEO