After getting 100% gains in several coins last month, one would ponder, is this all? This is actually quite a lot. Is this just the beginning, or is it over?

Bitcoin is almost at $100k. And everyone will be kicking themselves that they didn't buy (or buy more at $50,000)

Is bitcoin going to $250k? $500k? or a million? this bull market?

XRP has gone from 50¢ all the way past $2.50 in less than a month.

- And if XRP launches its stable coin, it could explode higher,

- And if XRP gets a spot ETF, it could explode higher,

- And if XRP is really the backbone that BRICS is going to use, it could explode higher.

That's a lot of higher.

But, what if i tell you that is still small potatoes?

Where are we in adoption?

Are we too late to be getting into crypto?

To analayze this, lets compare the market cap of bitcoin to gold and to derivatives.

| Commodity | Market Cap |

|---|---|

| Derivatives | 3,000.0 trillion dollars |

| M3 money supply | 21.0 trillion dollars |

| Gold | 18.0 trillion dollars |

| Bitcoin | 1.9 trillion dollars |

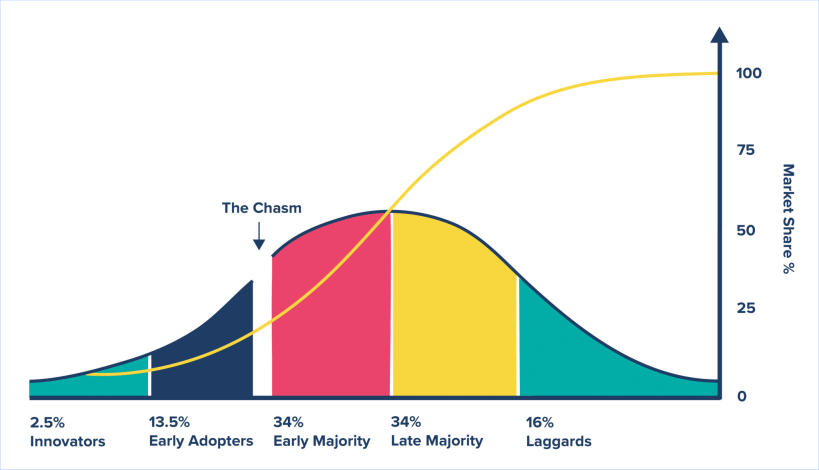

If we take bitcoin as percentage of M3 (or, what portion of the market is bitcoin), we are only at about 9%, which is just getting into "early adopters." (as shown on the graph above)

From this perspective, we are still very early to the party.

And although we may not get as big of gains (as bitcoin going from $100 to $100,000), we will see huge gains, and much less volatility and much less risk. (and a lot less wait)

There is only 21 Million Bitcoin

And the ETFs bought up a huge chunk of that.

The amount of bitcoin on exchanges is reported as extremely low.

And we haven't even hit the frenzy to buy period of the this bull market phase.

There is a very real possibility that there will be times when no bitcoin is available for sale. And, what will happen to the price at those times? Basically, the price just ratchets up through the order book.

We have price predictions of around $250,000 for bitcoin this bull run.

And that is assuming normal market action, and normal inflows of money.

But, if we hit that wall where no one wants to sell at current price, the price just spikes up.

Instead of just $250k, we might see $1M next summer. Or, we see no bitcoin market. No one sells bitcoin for cash anymore. And no one advertises how much they gave for a bitcoin.

Add on top of this, that countries are now buying bitcoin. Trump has said that America will start buying bitcoin. This is going to put a lot of upward pressure on the price. Countries will just spend however much they need to, to get the bitcoin.

Bitcoin is going to go UP ! The question is when. Is it 2025 or 2029?

What in the world is XRP doing?

XRP is not one coin. It has a portion that retail investors have been trading around, and it has a portion that central banks are holding and waiting.

So, there are two prices, and two predictions, and two prediction algorithms.

We are looking at the retail speculation on what XRP will do. And, it will go up. There is a lot of fan boys. FTC lawsuit has just ended. Ripple is launching a stable coin. The sky's the limit.

The banks are going to start using XRP to transfer money around the world, and exchange currencies, in a cross border payment situation (without the intermediary currency). And, the banks have probably already agreed on an amount XRP is worth in these exchanges.

There are a lot of people talking about both of these situations. Ripple is selling straight out of escrow to banks.

So, what will happen to the price? The answer is, we don't know.

- Whatever ripple/banks sets the price at, is what XRP on exchanges will instantly jump to. Because, if it is lower on exchanges, the banks will buy up everything.

- There will be two markets. One for banks, and one for retail investors. Ripple decides to segregate the XRP.

- and if they do so, the retail XRP may go to ZERO.

The banks need XRP's price to be much higher to do the transactions they will want to do on that chain. It is a matter of throughput. And people have calculated it, and figure an initial price of $25, then $50, then $100, and of course, everyone on X is saying $10,000 per.

Soooo, there is huge gains to be made in XRP, and there is a coming point where retail XRP will go to zero. (and maybe Ripple goes to zero too) Don't get Greedy.

The options now appear to be:

- Crypto adoption with bitcoin's price going higher than some nation's GDP

- Mad Max / nuclear Armageddon.

And option #1 means that almost anything you own today, will be enough to retire on given time.

Even the bitcoin you got from a faucet.

The amount you will have will be, for the most part, more than you can spend. Your crypto holdings go to being enough to buy a house and comfortably live, and then, rather quickly, going to be more than you can easily spend.

And here, we have a lot of people talking about using their bitcoin for collateral on a loan. The loan being used to pay living expenses. And then, you pay off the loan, with a new loan, because your bitcoin is worth even more. And so, never actually spend your bitcoin. However, this only works while there is fiat currency. Once that is gone, no one is going to give a bitcoin loan on bitcoin.

Things are going to be start moving a lot faster in the crypto space. (of course, i could be wrong about the start of this, and we have another 3 years of consolidation, until the insanity starts again in 2029.) So, make plans for your crypto wealth.

Practice thoughts of being rich. Make sure you change your poor thoughts into rich thoughts. Read the Millionaire Next Door to comprehend how you don't really have to show your wealth.

Of course, none of this is financial advice, and i really do not expect this to happen linearly.

It is slowly at first, and then the financial system disappears inside a week.

We will see a problem with the bond market in Paris, or someplace, and then a week later, you won't be able to pull money out of the ATM, except maybe $50 at a time.

I had to come back to this a little later. At the end of the day for myself I have never liked XRP because it wasn't what crypto was about to me but then in 2017 I did say screw it and got on the rocket for some gains and hit the eject. Then had a bag before the SEC lawsuit and got rid of most of it like I was saying earlier.

I will say this. The XRP Army is strong. I don't fully understand why that is but the market has spoken. The price predictions of $589 or $10,000 and all that. I don't know about all that. I can see a clear path to $3. And then $5 or $10 isn't really that wild in some respects consider it is repressed and people FOMO and we see a similar god candle like we saw with DOGE in 2021. Pretty crazy overall.

I said in another post that we actually needed Ripple Labs in the fight against the SEC along with Coinbase, Gemini, Kraken, Bittrex, and Richard Heart. Bittrex being the fallen one. It brought enough attention that now 18 states have sued the SEC and Gary Ginsler because of all the lawsuits they filed. So while I didn't like what XRP was and really is we needed it to be there. Brad is actually a corporate finance looking guy so the old guard could identify with him more when they were under brutal attack.

I hate XRP, because it is so banksterish, but it looks like its going to be used as the backbone of new bankster. So, lots of upside.

I hatez what Gary did. However, i bet it was all scripted.

As in, if XRP lost, they would have had complete legal definition about compliance. They would be the only "compliant" crypto. Which may have been a bigger win.

But, i don't know. I do not know whether to take profit, or to just hold on because its going much higher.

I would almost hedge your bets with a little bit of it to other stuff like ICP. The parabolic move XRP just made is so insane. It can't keep that up indefinitely but maybe it cools and shoots to $5. It really is hard saying but even if you skimmed 10% of it to something that hasn't made it's major move yet could be one idea.