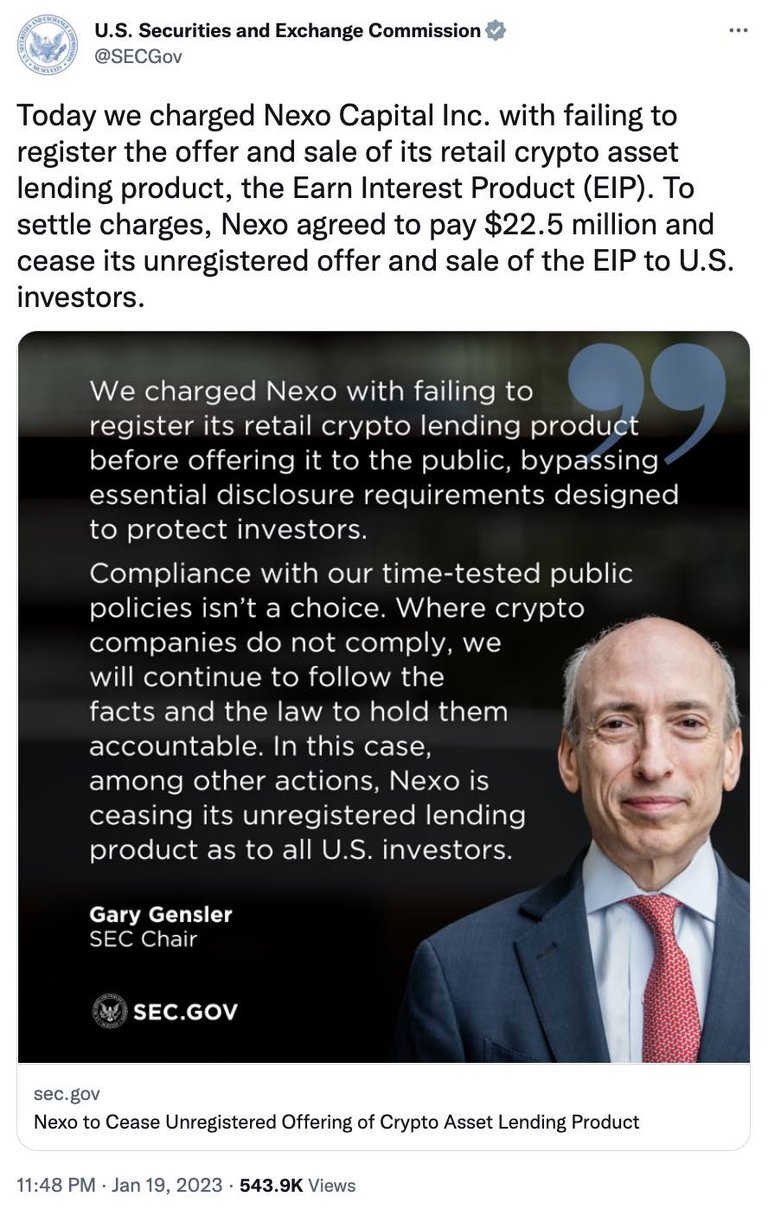

The United States Securities and Exchange Commission (SEC) has accused crypto lending platform, Nexo, of offering and selling unregistered securities. According to the SEC, Nexo had failed to register with the institution prior to offering its crypto lending product. As a result of the accusations, Nexo has agreed to terminate its "Earn" program and pay a fine of $22.5 million, in addition to another $22.5 million (totalling $45 million) to reach a settlement with regulatory authorities. The SEC has stated that the offering and sale of the Nexo "Earn" product did not qualify for exemption from registration. SEC Chairman Gary Gensler has said, "We have charged Nexo with failing to register its crypto lending product before offering it to the public, sidestepping essential disclosure requirements designed to protect investors. Compliance with our time-tested public policies is not optional."

In September of 2022, various states in the United States, including California, Vermont, Oklahoma, South Carolina, Kentucky, and Maryland, filed legal actions against the company, claiming that Nexo's "Earn" offering was an unregistered "security." At the same time, Nexo announced that it would be taking ownership in the American bank Summit National Bank, located in Wyoming. However, as regulators increased their enforcement efforts, following the failure of multiple crypto companies including Celsius and FTX. In December of 2022, Nexo announced that it would be shutting down its activities in the United States after reaching an impasse with regulatory authorities. "We are pleased with this unified resolution that clearly puts an end to all speculations about Nexo's connections with the United States," said Nexo co-founder Antoni Trenchev in a statement. "We can now focus on what we do best: creating uninterrupted financial solutions for our worldwide audience."