With markets nervous ahead of the Jackson Hole Summit, I stayed away most of the time - even chose not to write covered calls in one portfolio. I did do some scaling in and replaced a few stocks especially in alternate energy and banking.

Portfolio News

In a week where S&P 500 dropped 3.99% and Europe dropped 4.04%, my pension portfolio dropped only 0.78%. After the large amount of assignments last week, this portfolio is less invested in mainstream markets and is leaning more on a few big themes that did not get hit hard - alternate energy, electric vehicles and components, rising interest rates. And for a change gold and silver mining went against the market direction - up this week.

The managed portfolio also dropped less than the markets at only 1.57%.

Big movers of the week were Cue Energy Resources (CUE.AX) (+16.4%), Pilbara Minerals (PLS.AX) (+16.4%), Livent Corporation (LTHM) (+15.12%), ProShares UltraPro Short QQQ (SQQQ) (+14.2%), Cameco Corporation (CCJ) (+13.9%), Allkem (AKE.AX) (+12.7%), Magellan Global Fund (MGF.AX) (+12.2%), Paladin Energy (PDN.AX) (+11.3%), Direxion Daily Real Estate Bear 3X Shares (DRV) (+11.3%), Global X Uranium ETF (URA) (+10.9%), KraneShares CSI China Internet ETF (KWEB) (+10.7%), Beamtree Holdings (BMT.AX) (+10.7%), Honey Badger Silver (TUF.V) (+10%)

Most obvious theme in this list are the lithium suppliers (3 stocks) and alternate energy with 3 uranium holdings showing. Cue Energy move is on the back of drill well results in Australia and Indonesia. No surprise to see the short ETFs in this list.

The headlines always bring interesting perspectives. For CNN, stocks sank yet for CNBC it was a rout. That tells me a lot how the two media organisations are leaning - one favouring the Administration and one a bit less keen. And for Cointelegraph it is time to hit back at all the pundits that slayed crypto in its own crash.

The story is all about inflation - can central banks fix it is a theme for 3 different articles

The Federal Reserve won’t be able to curb inflationary pressures because they are rooted in expansionary fiscal policy,

If the monetary tightening is not supported by the expectation of appropriate fiscal adjustments, the deterioration of fiscal imbalances leads to even higher inflationary pressure

Nuclear power will not go away as the world struggles with rising natural gas prices following the conflict in Ukraine. Interesting article in Wall Street Journal ([free link](free link))

Crypto booms

Bitcoin price tested the underside of the uptrend line a few times and then failed at the same time the US markets fell over finishing the week 7% lower with a peak to trough range of 10%

Ethereum could not continue the momentum around The Merge and also turned over with a peak to trough range of 17%

EOS continued last week's move with another 53% spike finishing up 26% vs Bitcoin

HIVE, which is my largest crypto holding just tracked quietly higher in a channel (on the 4 hour chart)

One more riser for the week in my portfolios was IoTeX (IOTX) up 34% at one stage vs ETH.

There were a few other rises in the top ten coins (LTC, XRP)

Bought

Barclays Group plc (BARC.L): UK Bank. Replaced stock assigned at 1.7% discount to assigned price. Had the stock not been assigned early, there would have been no assignment BUT I did lose the dividend. Wrote covered call for 1.5% premium with 4.7% price coverage. The covered call premium is bigger than the dividend. Dividend yield 3.83%

Cameco Corporation (CCJ): Uranium. Scaling in after seeing uranium stocks in the big movers list - check the Wall Street article above. Wrote covered call for 1.6% premium with 13.2% price coverage.

Invesco Agriculture ETF (CCJ): Agriculture. Scaling in as price continues the reverse in trend off support

Loop Industries, Inc (LOOP): Recycling. Loop Industries focuses on depolymerizing waste polyethylene terephthalate (PET) plastics and polyester fibers into base building blocks. Investing in early stage technology is challenging. A quick look at the chart shows the challenge from my early stage investments in mid 2021. The first parcel was a modest 100 shares, with the next two averaging tranches the same size.

There was a chance to take profits over 45% - missed doing that and was back averaging down in early 2022, this time doubling position size. This latest tranche is at least bought after the downtrend was broken and price made a higher high. Options market is not very liquid for writing income trades but profits from those are at 10% of the overall cost base invested = a 6% annual dividend return on a stock that does not pay dividends.

Mastercard Incorporated (MA): Payment Services. Scaling in on a down day. I had been doing relative analysis on the online payments companies and noted that Mastercard just plugged away steadily from month to month as something of a defensive investment. I will quietly build the holding to 100 shares and then start writing income trades. Dividend yield 0.59%

The chart shows the competition from new style payments companies going back to the cycle high in Q1 2021. Mastercard is outperforming comfortably. Visa (V) chart is similar and dividend yield is a little higher but at a $200 ticker price, I can get to 100 shares faster. I might well switch to that.

Nordic American Tankers (NAT): Oil Shipping. Replaced stock assigned at 8.2% premium to assigned price to average down holding on remaining parcel. Wrote covered call for 2.96% premium with 10.9% price coverage.

Solid Power was DCRC (SLDP): Battery Technology. Scaling in. Wrote covered call for 2.24% premium with 12.3% price coverage. The averaging down story looks a little more sound than Loop Industries with only one purchase looking like a falling knife story. The last two purchases are based on the bounce off support and a break of the downtrend.

Income trades have been a strong contributor at 16% of oriiginal capital cost.

Sunpower (SWPWR): Solar Power. Replaced stock assigned at 23% premium to assigned price. Wrote covered call for 1.62% premium with 11.4% price coverage.

ABB Ltd (ABBN.SW): Europe Industrials. Replaced stock assigned at 1.97% discount to assigned price. I was in two minds about buying given the exposure to Europe but chose to add back on the basis of ABB's position in electric charging equipment.

In the managed portfolio, I was not going to replace the assigned stock but I have an open hedging put trade in place. I did replace the assigned stock at 1.7% discount to the assigned price. Sold a short term put option to keep funding the hedging put.

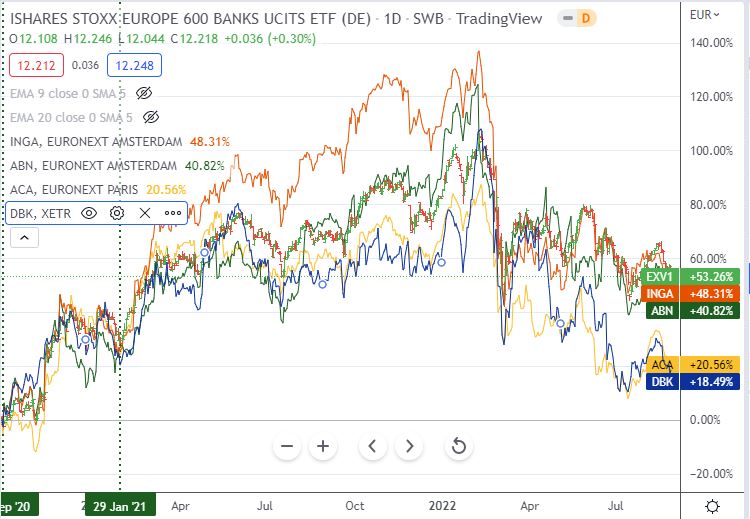

European Banks

Ran the comparative analysis across European Banks with the iShares STOXX Europe 600 Banks UCITS ETF (EXV1.DE) (the bars) from the cycle low in September 2020.

Used that analysis to decide which banks to scale in to and which to replace after last week's expiries. I picked the ones that are under-performing the sector. With returning profitability from rising interest rates, dividend yields are attractive.

Crédit Agricole S.A. (ACA.PA): French Bank. Replaced the assigned stock at 1.27% premium to assigned price. Dividend yield 11.52%

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Replaced the July assigned stock at 5.1% discount to assigned price and scaled in to round €10k holdings. Dividend yield 16.93%

ING Groep (INGA.AS): Dutch Bank. Scaled in to average down by 6.% from July purchase. Dividend yield 6.46%

Deutsche Bank AG (DBK.DE): German Bank. Scaled in in one portfolio. Dividend yield 2.45%.

ChargePoint Holdings (CHPT): Electric Vehicles. Replaced the assigned stock at 11% premium. Wrote covered call for 2.2% premium with 22.2% price coverage.

SPDR S&P Regional Banking ETF (KRE): US Regional Banks. 0.58% discount. Wrote covered call for 0.88% premium with 4.5% price coverage.

The Mosaic Company (MOS): US Fertilizer. Ran stock screen and this came up on Price Earnings screen (PE below 10 and price making a one month high. Wrote covered call for 2.8% premium with 5.3% price coverage.

News that the Canadian government has set targets to reduce fertiliser usage by 30% in short order will not help share price. Dividend yield 0.99%.

AMN Healthcare Services (AMN): US Healthcare. Replaced July assigned stock at 1.9% discount to assigned price. The Inflation Reduction Act should benefit this aged healthcare provider through reduced prescriptions drugs costs. An AAPlus idea.

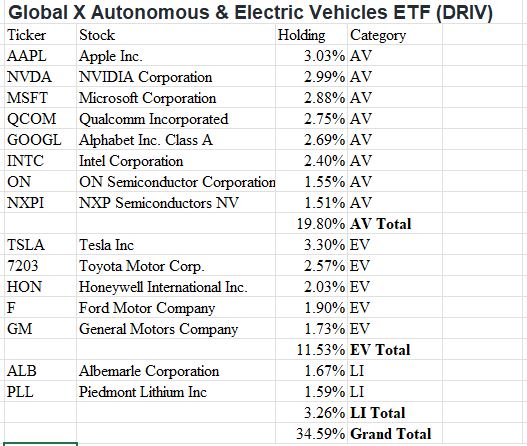

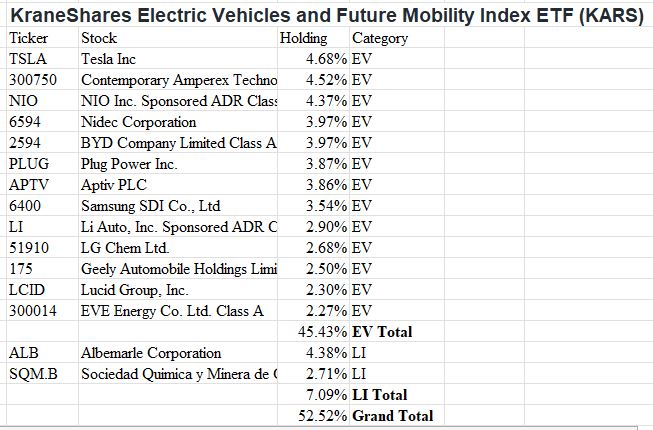

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. Following the assignment of stock in Global X Autonomous & Electric Vehicles ETF (DRIV), I switched my investment to this ETF as it does not cover autonomous vehicles - I really want to focus investing on suppliers that will benefit from the Inflation Reduction Act credits. I did the analysis afterwards - first table is DRIV top 15 holdings split into categories. I have lumped all the tech stocks into Autonomous Vehicles and separated put Lithium suppliers. This gives only 11% exposure (out of 34%) to pure electric vehicles and the components.

The table for KARS has just two categories - all the bits for charging and selling are included in EV and LI is shown separately.

There is a gap in the analysis - I have only looked at top 15 holdings. DRIV does cover a wide range of EV suppliers but with small holdings.

Sold

JinkoSolar Holding Co (JKS): Solar Power. With Inflation Reduction Act favouring US and US free trade suppliers, closed out holding in this Chinese supplier to focus on US or Canadian suppliers. Locked in 7.4% blended profit since June/July/December 2021. Investing in Jinko has not always been profitable since I started in June 2019 (net loss of $1621) but income trades have delivered massive returns ($16,200). This is the power of running income trades on stocks with high implied volatility - the art is to write with wider coverage.

Shorts

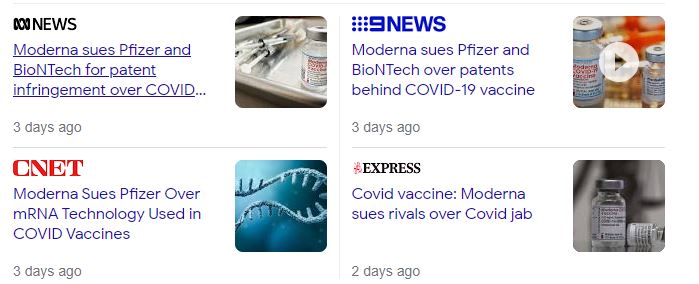

Pfizer Inc (PFE): US Pharmaceuticals. With price opening at $48.42, rolled out the short term, long puts from September to November. This implied selling the September expiry 50 strike put options for a small profit and setting up a new 47.5 strike September/November calendar put spread.

I am investing for the possibility of Pfizer becoming embroiled in a series of legal suits about the the Covid-19 gene therapy. The suit by Moderna will add to the pain. The short term trade is to buy a put option say 3 months out and fund it by selling shorter term put options - start with a calendar put spread and adjust as each short term expiry comes up. That way one is using time decay to fund the longer term put. As the bought put comes close to expiry push it out in time.

Let's review how the trade so far is looking. I started in March 2022 and am now in the 3rd rotation of the long put option (June, September and now November). The June rollover was at a loss - made a mistake and let it go to expiry. All other trades have been profitable and the net profit is a modest 5.4% of the initial spread premium. So the idea is working. In the same time though the share price has dropped 8.4% (adjusted for paying away the July dividend) - so shorting the stock would have worked better

The chart shows the new calendar put trade as a two coloured ray (red part is the sold put - blue part is the bought put)

[Means: Calendar Put Spread. Sell close dated put and buy long dated put at same strike. The premium on the short put funds the long put premium]

I converted the longer term trade from a January 24 40/30 bear put spread to a partial ratio put spread by selling another 30 strike put contract. I will be using any upticks in price to buy that back well before expiry. The ratio is 1.5.

News that Moderna is suing Pfizer for stealing MRNA secrets had me doubling up the short term 47.5 strike put options (Aug 26). A 2.25% drop on the day gave me reason to smile.

https://www.fool.com/investing/2022/08/28/could-this-move-by-moderna-cost-pfizer-billions

Hedging Trades

Invesco QQQ Trust (QQQ): Nasdaq Index. With price opening at $314.12 (Aug 23), put in place a 300/290 ratio put spread. This offers coverage for a price drop between 4.8% and 8.3%. Week close of $307.44 (Aug 26), is a 2.7% drop safely covered. The trade has a positive net premium (i.e., better than cash neutral

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price opening at $111.49 (Aug 24) put in place a September expiry 110.5/108 ratio put spread. This provides protection for a drop between 0.89% and 3.2% and is cash neutral. Selloff on Friday (Aug 26) had all the scared money pouring back to Treasuries with a 1.9% move up from my trade time.

Deutsche Lufthansa AG (LHA.DE): German Airline. With price opening at €6.00 (Aug 26), sold the September expiry hedging put (5.6) to roll out further in time. To date the hedging trades have delivered a net positive premium of 2.8% of the underlying capital at risk = paying to hedge. The position is currently not hedged.

Cryptocurrency

No trades

Income Trades

52 covered calls written across all three portfolios (UK 3, Europe 12, US 37). This is half normal.

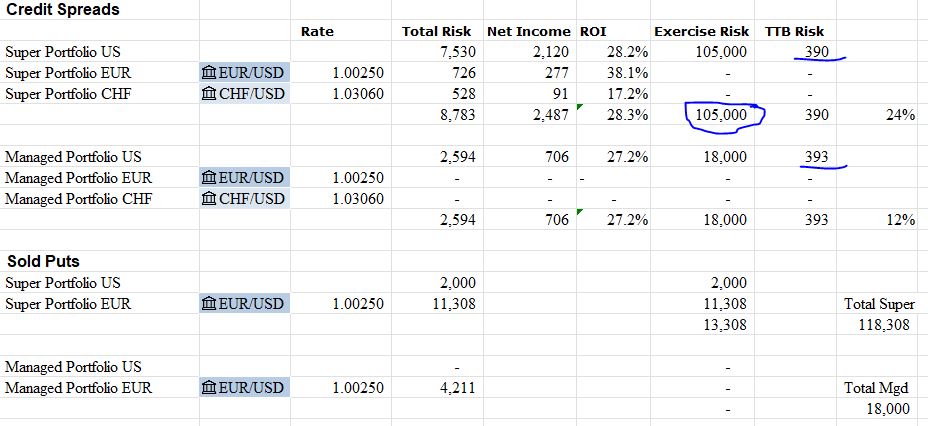

Credit Spreads

Set up a bunch of new credit spreads - some to continue from THE month before and some new.

Deere & Company (DE): Agricultural Equipment. 20.8% ROI with 4.1% coverage. AAPlus continuation.

Alerian MLP ETF (AMLP): US Oil. 25% ROI with 2.1% coverage. My idea to keep riding rising oil prices and gas potential in US mid-shale.

SolarEdge Technologies (SEDG): Solar Power. 27.4% ROI with 6.8% coverage. Inflation Reduction Act potential

United Rentals (URI): Equipment Leasing. 43.2% ROI with 0.7% coverage. AAPlus continuation.

Robinhood Markets (HOOD): Financial Markets. 16.3% ROI with 2% coverage. Waiting for the bounce in sentiment.

ABB Ltd (ABBN.SW): Europe Industrials. 17.2% ROI with 4.5% coverage.

Exercise risk on spreads took a spike in Monday trade (Aug 29) with United Rentals (URI). TTB risk is Amazon.com (AMZN). It is early days and there is enough cash to cover this.

Currency Trades

Quite a bit of to and fro from US Dollars to Euros to fund those bank stock purchases.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

August 22-26, 2022

Posted Using LeoFinance Beta

Great content, really enjoy reading about your investment journey

Thanks - I use it as my journal - is searchable so I can see what I was thinking at the time. Key is every post is tagged #tib - just add that to any search and you get my posts only

Awesome analysis and thanks for sharing