Options expiry last time around helped a lot in raising cash - perfect time to be sitting out of markets or cherry picking a few things. Did get a bit behind in doing the income trades - caught up a few.

Portfolio News

In a week where S&P 500 dropped 3.22% and Europe dropped 3.67%, my pension portfolio rose dropped a more modest 1.90%. Europe and UK portfolios ended positive with heavy lifting from the banks, especially Commerzbank (CBK.DE) up 9.1%. Alternate energy was mostly positive in US portfolio with Cameco Corp (CCJ) up 8.3%. And the hedging trades were called on for work.

Big movers of the week were Castillo Copper (CCZ.AX) (+14.3%), ProShares UltraPro Short QQQ (SQQQ) (+12.8%), Direxion Daily Real Estate Bear 3X Shares (DRV) (+12.6%), Eneti Inc. (NETI) (+12.3%), McMillan Shakespeare (MMS.AX) (+12.1%)

The themes are short this time - one copper company, one mining services company, bulk shipping and two shorts. The shorts had the week.

The market went into a whiplash week - a strong jobs report soon evaporated into another day of selling. It is becoming clear that the Federal Reserve is going back to its inflation mandate. A tight job market is not on its side as that just pushes wages higher.

The inflation bogey may be softening but it is still a bogey at those levels above 8%

And Japan sees the lowest yen level for 24 years - work the Bank of Japan could not do on its own.

The Fed action is driving a strong dollar and all BoJ is doing is keeping Japan rates low - money leaves Japan to go to US. I am sure pleased I hedged my Japan portfolio with a long USDJPY position - it is making good money.

Crypto drifts

Bitcoin price got compressed into a tight flag formation with a 5% peak to trough range and dropping only 2.7% on the week.

Ethereum wanted to move higher with a 10% range from open to peak finishing the week up - The Merge does not appear to be priced in yet

Mover of the week was Atom up 28% vs BTC

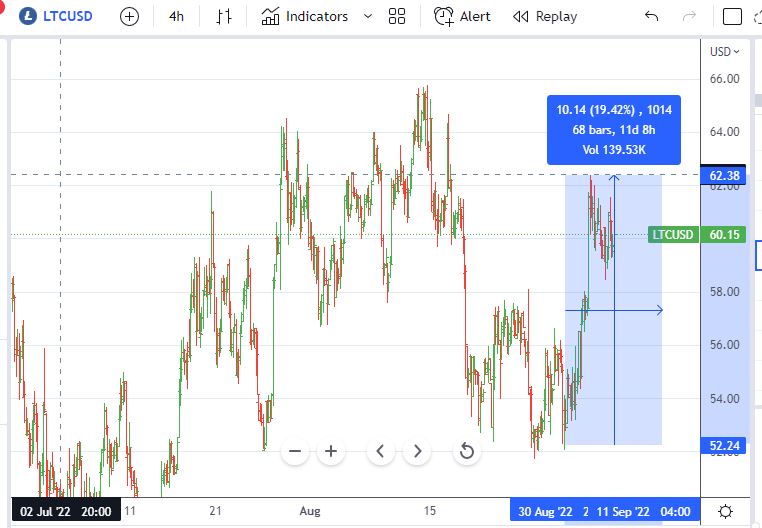

A few of the other Top 10 coins moved too - ADA, LTC and MATIC

Bought

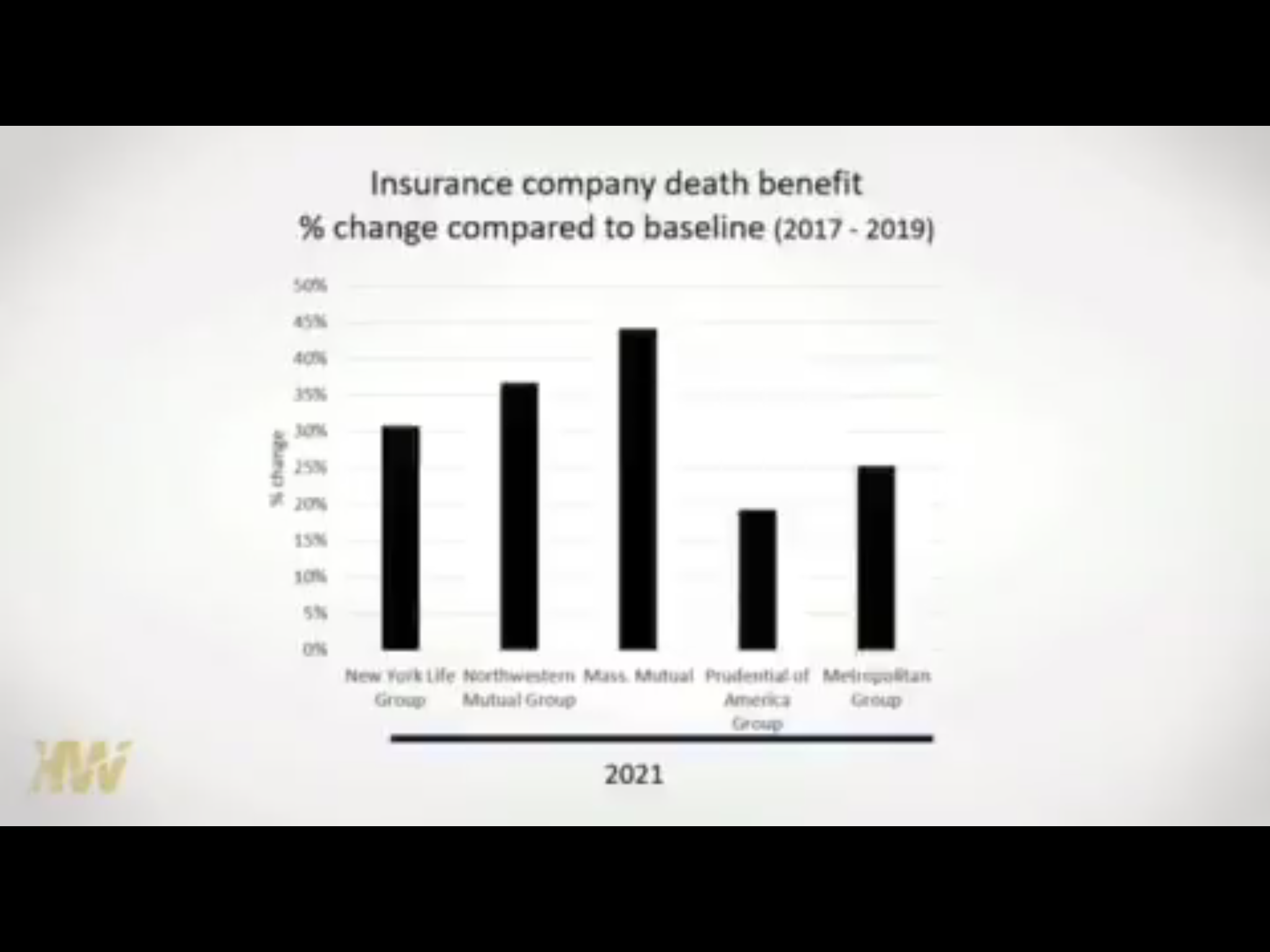

Aegon NV (AGN.AS): Dutch Insurance. Replaced portion of stock assigned at 0.11% discount to assigned price. Dividend yield 5%. I did see a report from US showing disturbing rises in death claims across 5 US insurance companies - this is prompting me to reconsider investments in life assurance.

Note: not sure of the source of the image - I hacked it out of a video with Peter McCullough

Centrica plc (CNA.L). UK Utility. Used a down day to average down entry price well below last assigned price. Natural gas prices are not going down for a while yet. Dividend yield 2.42%. Wrote covered call for 2.6% premium with 2.5% price coverage. The risk here is the UK government caps prices that can be charged to customers.

American Eagle Outfitters (AEO): US Retail. Averaged down entry price. Dividend yield 5.74%. Original idea was a Jim Cramer idea that turned over with major supply chain issues amongst other things and covid-19 lockdowns. I used income trades to work through the collapse which have dragged back 11.# of the initial capital costs (18 trades with only one naked put). This averaging down trade is based on price bouncing off the lows and breaking the downtrend.

Of note is AEO have invested heavily in supply chain improvements including buying two supply chain companies in 2021. Maybe this can help drive improved performance. 2022 finances look a whole lot better than 2021 with a return to profitability.

https://www.fastcompany.com/90776756/supply-chain-success-story

Banco Bilbao Vizcaya Argentaria, S.A. (BBVA.MC): Spanish Bank. Replacing stock assigned at 1.27% discount to assigned price. Wrote covered call for 0.9% premium with 8% price coverage. Dividend yield 8.32%

Carrefour SA (CA.PA): French Supermarket. Averaging down. Wrote covered call for 0.53% premium with 6.4% price coverage. Dividend yield 3.16%.

AXA SA (CS.PA): French Insurance. Replacing stock assigned at 0.8% premium to assigned price. Dividend yield 6.55%.

ChargePoint Holdings (CHPT): Electric Vehicles. Replacing stock assigned at 0.5% discount to assigned price. Wrote covered call for 1.94% premium with 27.4% price coverage.

Barrick Gold Corporation (GOLD): Gold Mining. Averaging down. Wrote covered call for 0.71% premium with 10% price coverage. Dividend yield 5.37%.

iShares Global Clean Energy ETF (ICLN): Alternate Energy. Replacing and scaling in at 6.3% premium to assigned price. Dividend yield 1.2%.

Nordic American Tankers (NAT): Oil Shipping. Replacing stock assigned at 3.5% premium to assigned price. Dividend yield 2.88%.

Yamana Gold (AUY): Gold Mining. Used down day to average down entry price in one portfolio and to get to standard position size. Dividend yield 2.82%

Global X Lithium ETF (LIT): Lithium. Scaling in. Dividend yield 0.28%. The charts shows price making higher highers and higher lows since the Inflation Reduction Act deal was made. Current entry looks a bit like a falling knife.

Loop Industries (LOOP): Specialty Chemicals. Averaging down.

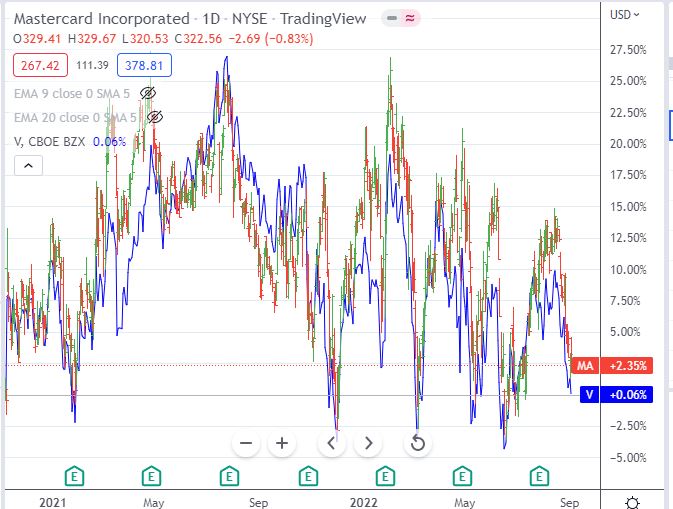

Visa Inc (V): Payment Services. Started the process of switching from Visa to Mastercard (MA) as it has a lower ticker price and I can get to 100 shares more readily. Bought a small parcel. Will wait for a few up days to see the Mastercard shares. Also set up a September credit spread offering 25.6% ROI with 1.4% price coverage.

The chart comparison going back to Covid lows in 2020 show the two stocks are essentially the same.

Clear Secure, Inc (YOU): Internet Technology. Clear Secure provides member-centric secure identity platform in the United States. AAPlus added this to their Bullpen and are waiting for an entry level lower than the level I bought in at. What I liked is rapidly growing revenues and low debt levels - always good in a newish business. Wrote covered call for 2.16% premium with 8% price coverage. Also added a September credit spread offering 16.4% ROI with 3.2% price coverage. ROI is low as the gaps between strikes are at $2.50 = a bit wide - but it is for two weeks open.

The chart shows why AAPlus want to wait until around the $20 mark as there is solid support around those levels. I am figuring the income trades will soon give me an entry breakeven about that level. The bought ide of the credit spread is below that support level at $17.50

Nokia Oyj (NOK): Network Equipment. With price opening at $4.82 (Aug 29), averaged down entry price on January 2023 5 strike call option in the small managed portfolio. I am keen to claw back some upside from the initial position.

Sold

Commerzbank AG (CBK.DE): German Bank. Assigned on covered call for 13.5% profit since July 2022.

Hedging Trades

Deutsche Lufthansa AG (LHA.DE): German Airline. With price opening at 5.88, set up a new September/December 5.6 strike calendar put spread to hedge my holding. The model is to keep rolling over and selling the short term puts until the premium is fully funded. The last series reduced cost base on the stock by 0.61 - just over 10% of the current price. That said, the series before did not work as well but is covered by the covered calls written in that time.

[Means: Calendar Put Spread. Sell close dated put and buy long dated put at same strike. The premium on the short put funds the long put premium]

Quick look at the chart shows price has been trading down to the level of the calendar put 4 times including at the start of the Ukraine War. I am figuring that level will hold OR it will be a good point to enter again.

Cryptocurrency

Hive (BTCHIVE): Read a Hive blog post highlighting a timing coincidence on HIVE trading - spike at the start of each month. Easy way to test - buy $100 worth of HIVE and set a 40% profit target. Worst case - transfer Hive back to wallet and power it up.

Income Trades

26 covered calls written across the portfolios (UK 2 Europe 10 US 14) with 3 expiring and one assigned. 2 naked puts written (Europe 1 US 1)

Naked Puts

Utilities Select Sector SPDR Fund (XLU): US Utilities. With price opening at $75.32, sold a 73 strike naked put. I am short the stock and use the naked puts to reduce the risk. To date, the premium income is covering the current loss situation - the stock does not want to go down when the markets go down - everybody dives for the safety of the high dividend yields in utility stocks.

Nokia Oyj (NOK): Network Equipment. Have had good success writing naked puts on Nokia as price tends to move in a quite narrow band and trading costs are not too bad and ticker is low. In the pension portfolio, naked put income has been enough to buy nearly 100 shares and never once been assigned (8 trades). In one other portfolio, trades have generated enough income to buy over 300 shares. Quick look at the chart shows an important support line at $4.56 - the naked put strike is below that.

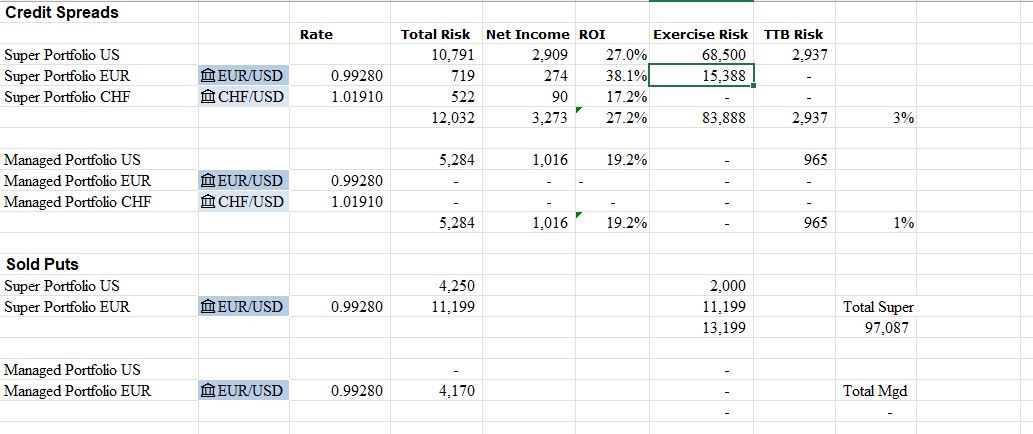

Credit Spreads

7 credit spreads set up all US with average ROI of 27.2% in pension portfolio and 19.2% in the managed portfolios. Exercise risk is quite high in the pension portfolio given the down markets last week. This is inside the margin boundaries in the account. TTB risk drops the expected ROIs to single figures but there are still two weeks to go.

Summary report includes Monday trade in Europe (Sep 5)

Currency Trades

Sold US Dollars to buy British Pounds to pay a life assurance premium. Citibank Australia was sold to National Australia Bank and no longer support easy transfers between Citibank accounts - so I have to send money to UK to pay my US-based life policy premiums (in US Dollars)

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

August 29 - September 2, 2022

Posted Using LeoFinance Beta

Another interesting read, it helps a more novice investor by giving me plenty of things to consider and avenues to explore.

Which options trading platform do you use if you don't mind me asking.

Thanks. Interactive Brokers as it gives low commissions and access to global markets. Hit me up if you would like a referral - we both win

I will check what they offer to UK residents and I certainly will grab a referral. I'm very much still in the learning phase with options and for a change I'm heeding the warnings to not rush in.

The technical aspects are one thing but getting a feel for pricing is going to take a while longer I feel.

It always feels nice if prices are progressing because that's actually the aim of majority in Crypto to benefit from it.