Uranium markets got news events. They chose the good. Cannot help but keep bottom fishing in uranium as stocks rise.

Portfolio News

In a week where S&P 500 rose 0.96% and Europe rose 1.62%, my pension portfolio rose a stonking 3.09%. The heavy lifting came from uranium (up 6.8% - stocks only - not options trades which addeded too.) and alternate energy (up 8.5%). A few of the big moves will not be realised as they have covered calls that could be assigned next week (e.g., QuantumScame (QS), NuScalePower (SMR), Sunrun (RUN)) - there will be a few naked puts added for those.

Big movers of the week were Solis Minerals (SLM.AX) (91.9%), QuantumScape Corporation (QS) (63.4%), 88 Energy (88E.AX) (50%), Sunrun (RUN) (40.9%), Earths Energy (EE1.AX) (30.8%), SunPower Corporation (SPWR) (29.3%), Stem (STEM) (27.4%), Solid Power (SLDP) (27.2%), NuScale Power Corporation (SMR) (25.5%), Aurora Cannabis (ACB.TO) (24.7%), 3D Systems Corporation (DDD) (24.1%), Standard Uranium (22.7%), Lifeist Wellness (LFST.V) (21%), ChargePoint Holdings (CHPT) (20.2%), Quantum Graphite (QGL.AX) (19.6%), Centrus Energy (LEU) (17.9%), Skyharbour Resources (SKY.V) (16%), CanAlaska Uranium (CVV.V) (15.5%), Peninsula Energy (PEN.AX) (15%), HoneyBadger Silver (TUF.V) (15%), Uranium Royalty Corp. (UROY) (14.8%), Terra Uranium (T92.AX) (14.5%), St Barbara (SBM.AX) (14.3%), Red 5 (RED.AX) (13.3%), Stuhini Exploration (STU.V) (13.3%), Uranium Energy Corp. (UEC) (12.6%), Energy Fuels (UUUU) (12%), Norwegian Cruise Line Holdings (NCLH) (11.7%), Invesco Solar ETF (TAN) (11.2%), Kairos Minerals (KAI.AX) (11.1%), Lotus Resources (LOT.AX) (10.6%), Global Atomic Corporation (GLO.TO) (10.6%), Premier American Uranium (PUR.V) (10.5%), Pan American Silver (PAAS) (10.3%)

Another big week with 34 stocks on the big movers list. 3 big themes stand out - uranium (12 stocks), alternate energy (7 stocks), gold/silver mining (5 stocks). Cannabis makes an appearance again (2 stocks). Leaderboard honours goes to a lithium explorer turned copper explorer dragging price up above the last options exercise level

Was heading for a quiet week with eyes focused on inflation data and bank earnings starting at the end of the week. The uranium news from Kazakhstan and the Advance Act signing gave commodity stocks a lift. And the soft inflation report plus Jerome Powell commentary gave impetus for a bit of a rotation from the big tech stocks into the Dow and also small caps - looking for a September rate cut. Do not be surprised to see this continuing.

Crypto Recovers

Bitcoin price pushed higher all week finishing the week 9.8% with a trough to peak range of 14.2%

Ethereum price pushed a little harder ending the week 13.8% higher with a trough to peak range 0f 16.4%

The altcoins took the momentum of the last week recovery and pushed ahead a lot harder - a few samples

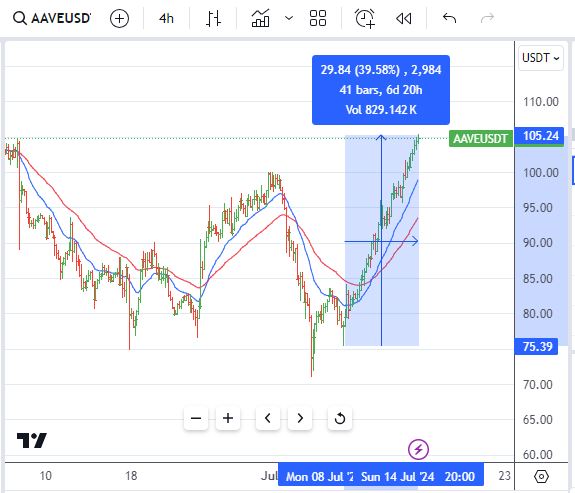

Aave (AAVE), the lending protocol up 39%

Cardanao (ADA), a top 10 coin, up 35%

Stellar (XLM) up 32%

And even old SEC scapegoat, Ripple (XRP) up 40% but giving away a little

Uranium Holdings

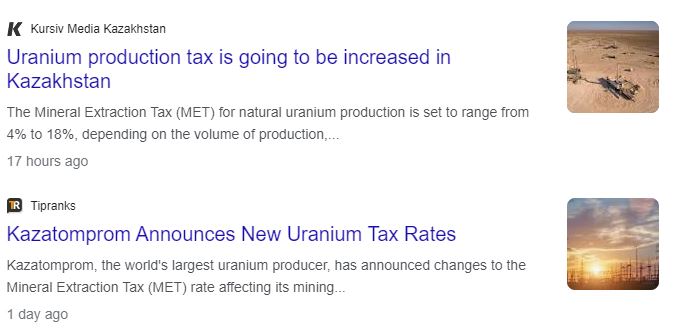

News of the week was release of new Mineral Extraction Tax protocol in Kazakhstan - rate will be volume driven and not marginal rate driven at difference volume levels. This has a direct hit on costs for Kazatomprom which has to play into long term contract negotiations for deliveries after the next rates kick in

https://kz.kursiv.media/en/2024-07-10/uranium-production-tax-is-going-to-be-increased-in-kazakhstan/

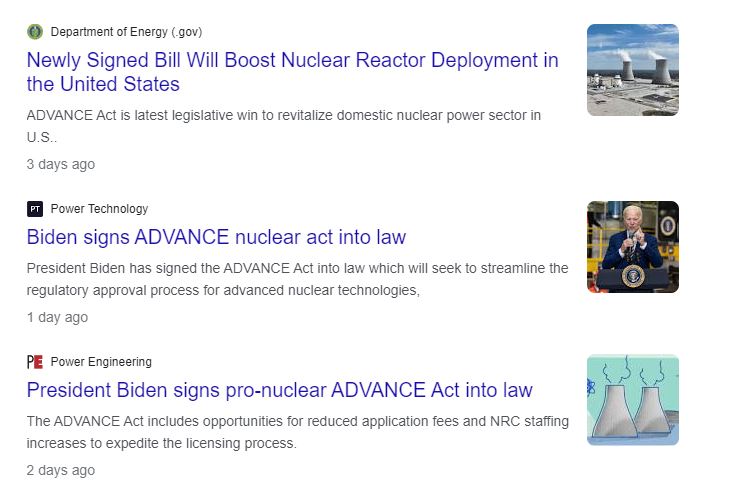

Next news item later in the week was the signing of the Advance Act into law. This expedites licensing processes for alternate energy deployment - not just nuclear.

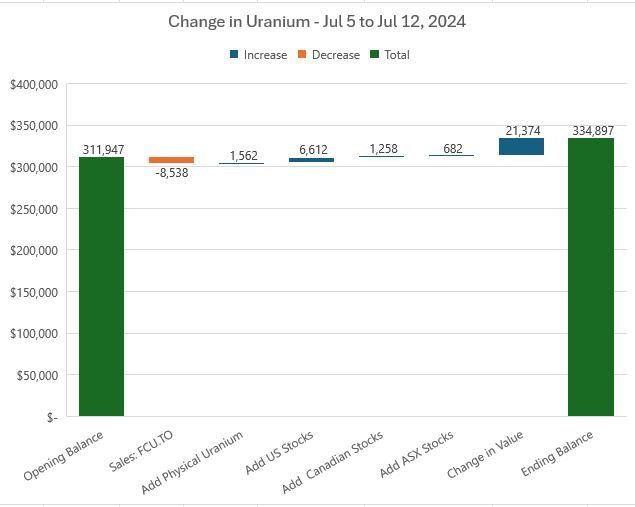

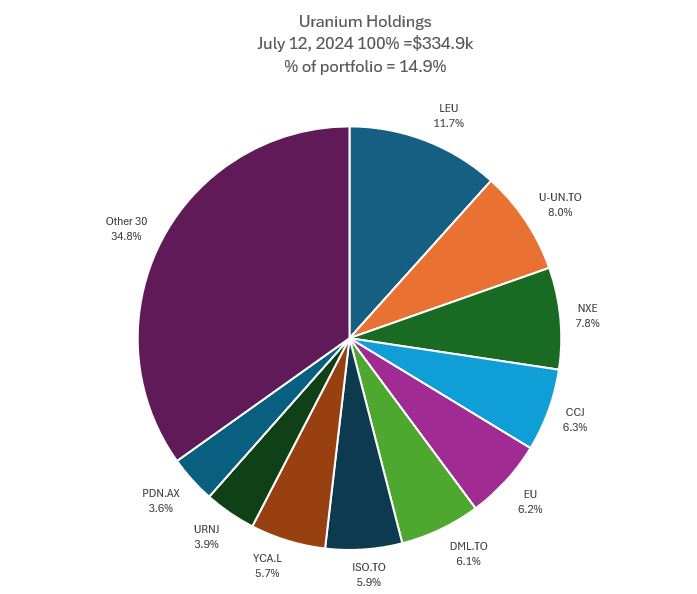

The two sets of news woke up uranium stocks (spot price did not move with no volume). The impact in my portfolios was a 6.8% increase in valuation and a step up to just under 15% of portfolio value. There was one sale (in two portfolios) and a few additions across all market sectors

Mix of holdings changed with Cameco (CCJ) rising 4 places (added stock and value rise) and Paladin Resources (PDN.AX) comes into Top 10 replacing Kazatomprom (KAP.IL). The share of Others drops just shy of 2 points with the sale of Fission Uranium (FCU.TO)

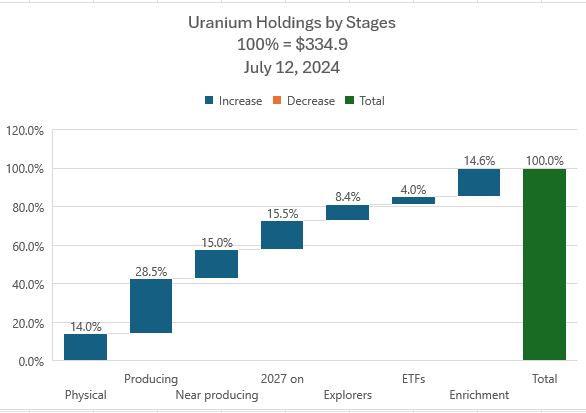

Did use the stages to production chart prepared last week to guide the additions to the portfolios - adding at physical (up 0.2 points) and producing ends (up 2 whole points) of the spectrum. 2027 onwards cadre dropped 2.8 points. Big value increases were in enrichment (especially Centrus (LEU)).

Alternate Energy

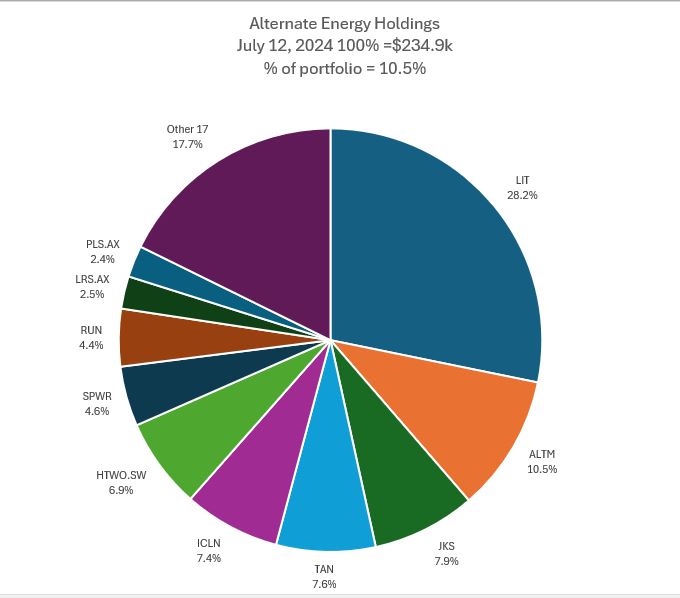

Alternate Energy stocks moved ahead too - some of the Advance Act mechanisms might help. More likely driver is the potential for lower interest rates

Valuation in my portfolios were up 8.5% (note there are no nuclear technology stocks in this collection - rise would be way more). Will aim to do charts the same way - sources of change and the mix of holdings. Forgot to download the sources of change chart - value went 8.5% and two adds one in lithium and one in hydrogen.

The mix of stocks saw a few changes. With rise in value of solar stocks the Invesco Solar ETF (TAN) rose one place displacing the Clean Energy ETF (ICLN). Overall percentage of holding rose nearly one point to 10.5% with the relative weighting of lithium falling compared with solar. Next week will also do the categories as there are clues to shift in emphasis.

Bought

Lightbridge Corporation (LTBR): Nuclear Technology. With price opening at $4.00 and trading higher (Jul 8), deployed part of proceeds of Nano Nuclear (NNE) sale below on short term speculative 5 strike call option. Chose to fund it next day by selling 7.5 strike call and matching with 2.5 strike put sold in June. With net premium on the 5/7.5 bull call spread of $0.40, this offers maximum profit potential of 525% for a 87.5% move in price. The sold put jumps the maximum profit potential to 1767% with 37.5% price protection. Price needs to move 25% for the call spread to go in-the-money. Later in the week added another August expiry 5 strike call

The Kazakhstan tax news had me reaching for more uranium stocks - using the stages of production chart created last week, the focus was on producing and near producing and physical inventory with a few explorers tossed in to get to 10% holding there.

Cameco Corporation (CCJ): Uranium. Cameo is producing but it is also an integrated nuclear buisness likely to beenfit from the Advance Act moves. Wrote covered call for 0.79% premium with 6% price coverage.

Peninsula Energy Limited (PEN.AX): Uranium. Pending order below last exit price hit in personal portfolio. Producer with mostly US assets scaling up from 2025 onwards.

Premier American Uranium (PUR.V): Uranium. Doubled position size in pension portfolio on day Kazatomprom news broke as price did not move in tandem with all the other uranium stocks. Explorer in US

Atha Energy Corp (SASK.V): Uranium. Athabasca explorer - a takeover candidate - my view.

Ur-Energy Inc (URG): Uranium. US based developer coming on stream from 2025 using exisiting facilities

Yellow Cake plc (YCA.L): Uranium. Discount to net asset value widened to nearly 15% makes this a cheaper way to buy physical uranium. Yellow Cake has a delivery contract from Kazatomprom at what are now compeling prices. There is capital raise risk ahead

Energy Fuels (UUUU): Uranium.Took the chance with the uptick in prices to add an options trade on Energy Fuels. They are producing in Pinyon Plain and will flow into production at Nichols Ranch in 2025 with some overlap of the two. Set up an October expiry 7/8/5 call spread risk reversal. With net premiu of $0.18, call spread offers 455% maximum profit potential for a 34.7% move in price from $5.94 open. The sold put fully funds the bought premium and has 15.8% price coverage.

Let's look at the chart which shows the bought call (7), as blue ray and the sold call (8) as a red ray and the sold put (5) as a dotted red ray with the expiry date the dotted green line on the right margin. The sold put is well below the last lows. The price scenario is the middle blue arrow which does not quite get the trade to the maximum. However if price moves as hard as the August 2023 move the maximum is achievable.

Lanthanein Resources (LNR.AX): Lithium. With stock making big movers list last week added to holding to average down entry price. For resource stocks like this, I invest $1000 at a time and view it as an options type trade.

HelloFresh SE (HFG.DE): Restaurants. HelloFresh has been in the doldrums and then appeared on big movers list with a move taking it above covered call strike. Bought a new parcel to replace stock likely to be assigned.

Chart shows the collapse in price from late 2023 highs and then a bottoming out formation over the last few weeks. Plenty upside if they can fix their North American business challenges. The left hand trend line is where the original tranche was bought.

CanAlaska Uranium Ltd (CVV.V): Uranium. With sale of Baytex Energy (BTE) in small managed portfolio deployed proceeds in two uranium stocks - scaling in

Uranium Energy Corp (UEC): Uranium. As for CanAlaska above. Wrote covered call for 4.2% premium with 4.2% price coverage- a bit tight

CleanSpark (CLSK): Bitcoin Mining. Drop in Bitcoin price dragged price down below sold put strike (18) - got assigned. With Bitcoin price showing a bit of life this week, added another tranche to scale in entry and average down entry price. Breakeven on the total tranche after sold put premium is $15.76, an 0.6% discount to $15.85 close (Jul 12). Did write covered calls on two strikes - one for 6.5% and the other for 10.4% with price coverage of 9.2% and 6.5%. Next cycle will combine into a single contract (if the lower strike holding does not get assigned - I think it will).

CleanSpark has outperformed Bitcoin since the current bull rally started in 2023. Looking back to the cycle high the performance gap is 16 percentage points. Kind of itching to get back to Bitcoin mining as that is where my journey started when Bitcoin was $319.

Sold

NANO Nuclear Energy (NNE): Nuclear Technology. Sold small parcel to remove half capital invested - locks in 523% profit since May 2024 (not quite 6 weeks).

Fission Uranium Corp (FCU.TO): Uranium. Pending order to sell at implied value of Paladin Resources (PDN.AX) bid hit for 106.3% blended profit in personal portfolio since June/July/August 2023. More modest 25% blended profit since March/April 2024 in managed portfolio. Have learned over the years to take the cash in merger situations rather than waiting out for a better offer.

Baytex Energy Corp (BTE): US Oil. Pending order in small managed portfolio hit for 10% blended profit since July 2023/January 2024. Averaging down helped as first tranche was breakeven. Income trades added another 50% to profit. Stock screen idea with low stock pricing.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Bank of Queensland Ltd (BOQ.AX): Bank. Dividend yield 6.10%. Topped up again as entry price as lower than the previous one - do like to keep the trades at least a month apart.

Chart shows price has been trading in a band above the $5.75 level for all of 2024. Balancing act as markets eye up rate cuts - improved loan losses vs declining net interest income. The averaging down offers an exit point heading back to the 2023 highs - maybe at 15% target.

TPG Telecom Ltd (TPG.AX): Telecom. Dividend yield 3.80%

Sold

Lendlease Group (LLC.AX): Property. Read a detailed report in Intelligent Investor in June when price was $5.56 which suggested valuing the business on book value rather than earnings.

Put in place at the time (Jun 17) a sell order at a discount to book value. That was taken up this week for 25.7% blended loss since February/August/December 2023. Exit was quite a bit higer than the article time price.

Cryptocurrency

Took advantage of the buying momentum that emerged last week in a few altcoins

Polkadot (DOTBTC) Chart shows price making a reversal after a long downtrend and confirming a higher high. Looks like 20 day moving average (blue line) will cross the 50 day (red line)

Solana (SOLETH) Used the SOLBTC chart as signal for buying more Solana. Price has bounced off short term support and the moving averages are crossing over (blue line rises above red line). Bought selling ETH.

Income Trades

Quiet week with only 7 covered calls written (UK 2 US 5)

Naked Puts

Kicked the can down the road on a few naked puts on stocsk am happy to purchase but not this month.

- Volkswagen AG (VOW.DE): Europe Automotive. 6.4% loss on buy back. 9.1% cash positive.

- Centrus Energy Corp. (LEU): Uranium Enrichment. 9.7% profit on buy back. 35.9% cash positive.

- Invesco Solar ETF (TAN): Solar Power. 182% loss on buy back. 1% cash positive - market thinks the downside is over

- Sprott Junior Uranium Miners ETF (URNJ): Uranium. 19.8% loss on buy back. 21% cash positive.

Sold puts on stocks likely to go to assignment on covered calls and as positioning trades for lower entry prices. .

- NexGen Energy Ltd. (NXE): Uranium. 6.5% Return 28.6% Coverage

- NuScale Power Corporation (SMR): Nuclear Technology. 3% Return 15.7% Coverage

- Rolls Royce plc (RR.L): Defense/Aerospace. 0.9% Return 28.6% Coverage

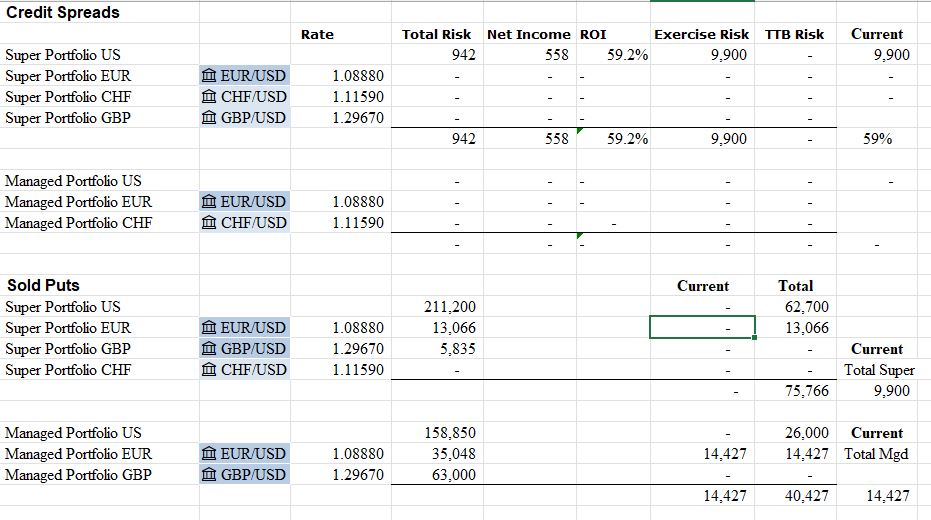

Credit Spreads

Global X Uranium ETF (URA): Uranium. Made adjustments on July expiry 33/28 credit spread. Aim was to sell the bought put (28) to recover some premium and kick the sold put (33) down the road a month. Got a few buttons pressed wrong and landed up with a calendar credit spread with sold put (33) for August expiry and bought put (28) for July expiry. Did make 54.1% profit on buy back. 11.6% cash positive on the roll out. Late night trading has a price

All the work pushing sold puts out in time has bought current exercise risk down solidly - total risk is within margin levels. Should markets stay in current shape there will be quite a few covered calls assigned at next options expiry - pressure comes right off then.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

Jul 8-12, 2024

Nice, just sold FCU too, the premium was a bonus. Been looking at SGML for lithium, low cost producers are where it's at. LIRC is interesting too the EV / BV is quite attractive and there's a solid pipeline.

Selling fcu.to was part of the plan before the bid - at 52 week high. Want to reduce the number of explorers in favour of producers and near producers.

Lithium sector has become a long run game because of over capacity. The smart way in this current market is to lean toward the salt brine producers as they can scale down more easily and then turn back on. BV and EV is becoming an enigma as the publicity game swings about. Will look at LIRC.

Wow brother, it's impressive how uranium and alternate energy sectors saw such strong gains last week. The market movements were quite strategic.

It is a big game - not pretty this week - but it is a long game - 2030 long

wow, 6 more years 🤔😳😳😳😳😳

#hive #posh