Japanese yen carry trade unwinds and markets meltdown. Was a week to top up uranium - not much else.

Portfolio News

In a week where S&P 500 dropped 2.1% and Europe dropped 2.2%, my pension portfolio dropped 3.9%. Why so much? The portfolios are somewhat contrarian and heavily invested in things that fell hard - Japan stocks down 6.2%, Europe stocks (not UK and Switzerland) down 5.4% and a big hit in uranium - more about that below. De Grey Mining (DEG..AX) did go up making for positives in part of the ASX portfolios not holding uranium.

Big movers of the week were Appen Limited (APX.AX) (73.9%), GTI Energy (GTR.AX) (33.3%), Kairos Minerals (KAI.AX) (22.2%), Heavy Minerals (HVY.AX) (21.2%), JDE Peet's (JDEP.AS) (15.7%), St Barbara Limited (SBM.AX) (11.9%), Titan Minerals (TTM.AX) (11.1%)

Smallest list of big movers for a long while with only 7 stocks and all but one listed on ASX. A few themes represented but nothing to celebrate - uranium (1 stock), battery materials (3 stocks), gold mining (1 stock). The encouraging stock is the top of the leaderboard on the back of solid results. Appen provides crowd sourced data analytics which was unravelling with improving AI tools and losing a key Google contract. They have found a way to resuscitate the models and margins and revenues are improving.

Market sell off in US started Friday after the jobs number came in a bit lower than expected. The headline writers would have one believe this is the signal for recession. They have forgotten about the better than expected GDP numbers last week and the Federal Reserve seeming to think inflation is neatly under control.

During the week I did post on X with these words -"more to this than meets the eye" - this chart

Yes - the Japense Yen strenghtened by 9.6% within two days of the Bank of Japan raising interest rates to 0.25% and saying they would reduce bond buying.

This was the trigger for the selloff - the negative and close to zero rates in Japan have been used for a massive carry trade. Borrow in yen and buy Japan stocks. Get a bit bolder and buy other stocks in other markets. Get a bit bolder and buy gold and silver and crypto. Change of rates - not a free trade anymore and Japanese yen strengthens by 10%, need 10% more US Dollars to pay back the loans. Bang. Sell time.

Crypto Busts

The collapse of stock markets played through to crypto markets more dramatically with Bitcoin price dropping a dramatic 25% and ending the week 23% lower.

Ethereum price was on the drift lower and then the selloff hit taking price down a 37% peak to trough range and ending the week 32% lower.

Aave (AAVEUSD) continued its road higher rising 15% and then the selling hit with drop from that peak of 31% undoing all of the last two weeks rises. Nothing was spared - one more chart - Solana (SOL) wiped out all the gains for July dropping over 40%

Now is the time to look at the crosses - example Litecoin (LTCETH) popping 18% in the big selloff and ending 7% higher on the week than Ethereum.

Uranium Holdings

Uranium market was already stumbling before the selloff came along. Cameco (CCJ) and Kazatomprom (KAP.IL) had scheduled announcements in the week. Cameco indicated that there were issues with their Inkai joint venture - higher costs and 21% lower production). That data saw a pop of $4 in the spot uranium price.

Kazatomprom indicated their 2024 production was up 6% in first half of 2024 and that they had enough sulphuric acid to raise production for full year by 5.7% - an extra 3.2 mlbs. The market read this as a "flooding the market" signal and sold off all uranium stocks. What is less clear is the majority of that production is heading to Russia and China and will not flood Western markets. Read this tweet for the details from John Quakes

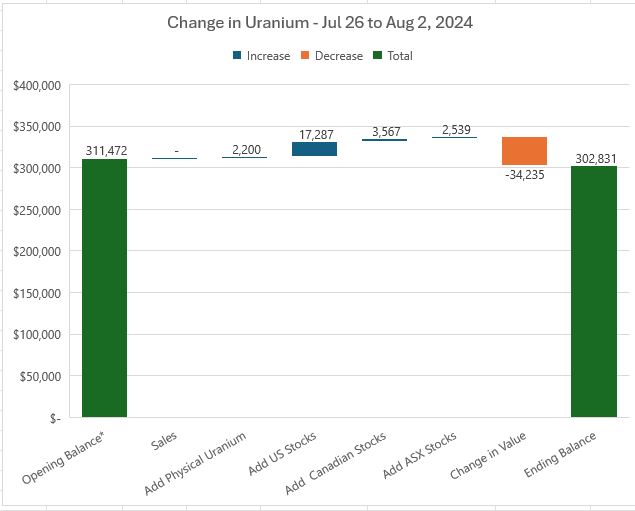

All of that made for some movement in my portfolio holdings - a few assignments and some bottom fishing. As it happens was nowhere near the bottom.

Now to the data - overall value dropped a staggering 11% - some of which will be on the assignment of Global X Uranium ETF (URA) which even after accounting for sold put premium was a bad losing start. Overall share of portfolios did not change at 14.8% as two of the ASX portfolios went up to balance out the bigger drop in uranium.

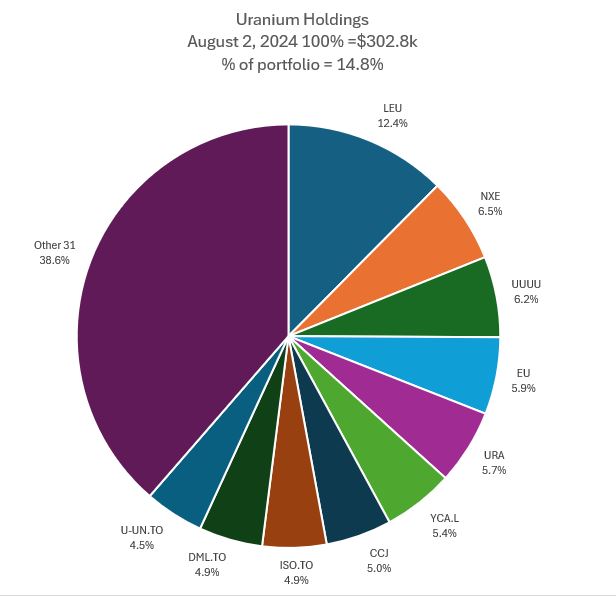

A fair bit of change in the mix of holdings. Energy Fuels goes up 4 places after the addition there. Global X Uranium ETF (URA) goes up 5 places after the assignment there. EnCore Energy (EU) drops one place to 4th, Cameco (CCJ) drops 3 places to 7th, Denison Mining (DML.TO) drops 4 to 9th and Sprott Physical Uranium ETF (U-UN.TO0 drops one to 10th. Share of Others goes up one percentage point with the adds made in explorers.

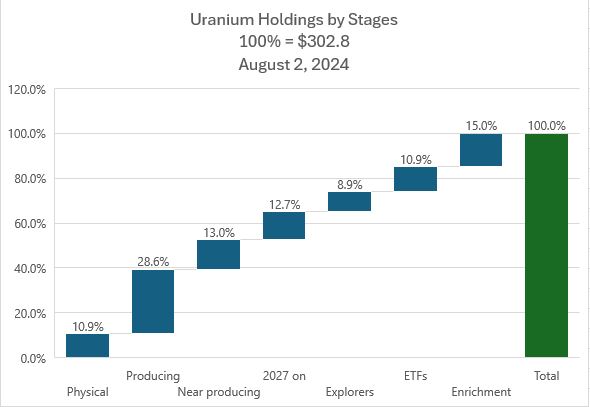

The holdings by stages shows quite some changes. ETF's are up 1.5 percentage points. Explorers are up by 1.6 percetnage points. Biggest faller were the enrichment stocks down 1.3 percentage points. Sure am pleased I started analysing holdings this way - much easier to invest strategically.

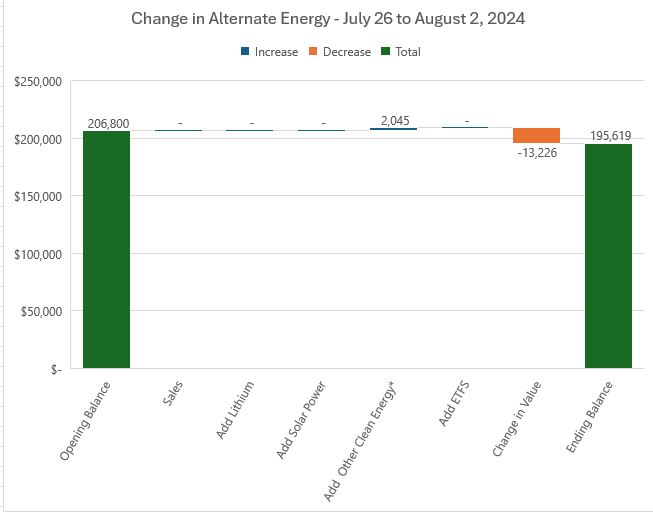

Alternate Energy Holdings

Alternate energy fared better than uranium with a 6.4% drop in valuation.

Additions made were small with one new venture in vanadium. Overall share of portfolio went down 0.4 points as the drop was bigger than portfolio drops.

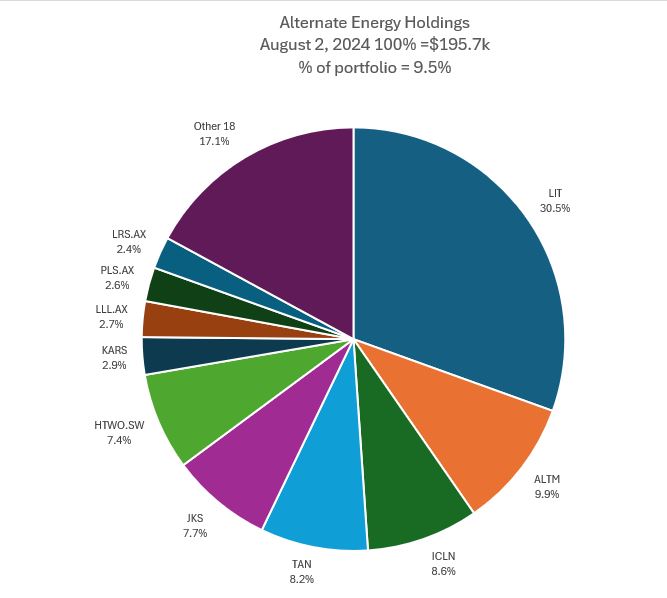

Mix of holdings sees the iShares Clean Energy ETF (ICLN) move up 2 places swapping spots with Jinko Solar (JKS). Everything else in top 10 is unchanged. Shares of others rises with the addition of one new stock - vanadium.

Bought

Uranium purchases in the week were in different frames of market. The early part of the week was about scaling into a few explorers and physical uranium on the back of a move up in spot prices and ahead of the Cameco (CCJ) and Kazatomprom (KAP.IL) announcements.

Atha Energy Corp (SASK.V): Uranium. Athabasca explorer.

Skyharbour Resources Ltd (SYH.V): Uranium. Athabasca explorer.

Uranium Royalty Corp (UROY): Uranium. The only pure play uranium royalty company - their words. Just happened to be in the week they closed the Churchrock Project, New Mexico, one of the largest and highest-grade undeveloped ISR uranium projects in the United States. Added a second parcel at the end of the week at a lower price. Wrote covered call for 1.4% premium with 18.8% price coverage. - cannot see price moving that far in two weeks.

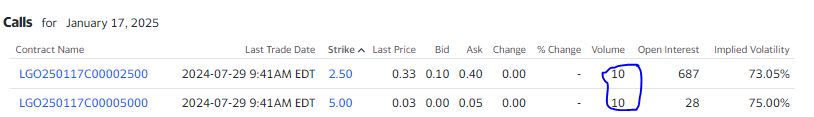

Largo Inc (LGO): Vanadium. Read a tweet highlighting changes in China standards for rebar steel pointing to increased demand for vanadium. Added a small parcel of stock and scaled in at the end of the week in the pension portfolio. Also added a January 2025 2.5/5 bull call spread. With a $0.30 net premium this offers 733% maximum profit potential for a 13% increase in price from $2.16 purchase level (Jul 29)

Let's look at the chart which shows the bought call (2.5) and breakeven as blue rays and the sold call (5) as a red ray with the expiry date the dotted green line on the right margin. Price needs to recover the 2nd half 2023 lost ground to reach the maximum. A move up similar to the last one (the blue arrow) will get it past breakeven. Two moves like that and the profit will be 300 or 400%.

Options chains for the day shows this was the market trade. There is no open interest and no sold put opportunity to fund the trade.

Global X Uranium ETF (URA): Uranium. Assigned on 2nd tranche of sold puts. Brekeven at $30.20 a 6.6% step above the $28.34 close (Jul 31) Wrote covered call for 0.16% premium with 4.3% price coverage.

Glencore plc (GLEN.L): Base Metals. Averaging down entry price in managed portfolio. Wrote covered call for 0.7% premium with 6.4% price coverage.

enCore Energy Corp (EU): Uranium. Scaling into managed profolio

Elixir Energy Limited (EXR.AX): Australian Gas. Share placement in personal portfolio.

With uranium markets taking a battering in US and Canada (Aug 1), the ASX followed suit - added $1000 parcels to 4 holdings in personal portfolio. This was the amount that each holding fell on the day - a sense of topping up. Criteria for choosing - in production or close to production with one exception.

Paladin Energy (PDN.AX): Uranium. Restarting production at Langer Heinrich in Namibia

Lotus Resources Limited (LOT.AX): Uranium. Restarting production at Kayelakeera, Malawi. Mine development Agreement was signed last week.

Boss Energy Limited (BOE.AX): Uranium. Starting production in Honeymoon, South Australia and also shareholder of Alta Mesa mill in Texas.

Elevate Uranium Ltd (EL8.AX): Uranium. The odd one out - low depth exploration at Koppies in Namibia. An averaging down trade.

Energy Fuels Inc (UUUU): Uranium. Assigned early on sold put leg of 10/15/7 call spread risk reversal in managed portfolio - going to be a hold for the long run with breakeven at $6.50 - 32% above $4.91 close (Aug 2). Some benefit will from the vanadium exposure.

Headlines like this adds to the risk - increased costs if they have to move the ore the long way around (if there is a long way around) or pay some sort of royalty.

Made similar additions in US and Canadian markets the day after the initial tumble (Aug 1)

CanAlaska Uranium Ltd (CVV.V): Uranium. Athabasca explorer

F3 Uranium Corp (FUU.V): Uranium. Athabasca explorer. Watched interview with Dev Randawha - CEO - what struck me is how measured the apprach - nothing wildcat about what they are doing.

Premier American Uranium (PUR.V): Uranium. US explorer building on Athabasca track record of the team

Sold

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Sold odd lot at 52 week high for 3.3% profit since June 2024. Odd lot arrived with change of multiples on credit spread around dividend time. Do remain exposed to the stock. This is a hydrogen investment but not included in the Alternate Energy analysis.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Johns Lyng Group Ltd (JLG.AX): Engineering Svcs. Dividend yield 1.60%. Two signals from the week before executed this week.

Chart shows this was a better entry one day later than the signal with price dropping back toward the lower Bollinger Band. Broker targets were added after the 1st entry - one gives scope for a good return - the other is small.

Australian Clinical Labs Ltd (ACL.AX): Healthcare. Dividend yield 4.50%.

Chart is frustrating. price did not hold the break of the previous downtrend (the blue ray). Price is having a second go at breaking up after breaking the next downtrend (trendline not shown)

Karoon Energy Ltd (KAR.AX): Oil and Gas. Dividend yield TBA%.

Price did spike after Karoon announced a change in capital returns policy with a commitment to returning franked dividends balance and/or share buy backs. Headline from Intelligent Investor - they liked the announcement. The company is pumping out free cash flow very strongly.

EBOS Group Ltd (EBO.AX): Healthcare. Dividend yield 3.10%. Averaging down entry price on news of new pharmacy stores opens.

Sold

Ricegrowers Ltd (SGLLV.AX): Food. Closed at target around 52 week high for 27.2% blended profit since August/December 2023/February 2024.

Chart shows massive spike in price after Sunrice bought Savour Life dog food business. Sale came after receiving the 40 cents a share special dividend too. Blue rays shows the entry points made along the way

Hedging Trades

Hecla Mining Company (HL): Silver Mining. Watched Triangle Investor interview with Peter Krauth who talked about the gold/silver ratio and projecting 10X potential for silver. With the Japanese Yen move this past week I was more interested in the hedging ponteial. Picked Hecla Mining as it has underpermed its peers relative to the Silver Futures.

Cryptocurrency

Thorchain (RUNEETH)

Chart shows price has bottomed and showing signs of breaking up with 20 day moving average (blue line) rising up through the 50 day (red line). Entry was below the last partial exit. Looking for one of those spikes.

Income Trades

Quiet week for covered calls with only seven written across 4 portfolios (UK 2 Europe 2 US 3)

Note: Calls written on Engie (ENGI.SA) for both August and September - safe enough with price well away from sold strikes.

Naked Puts

A few naked puts kicked down the road on the up days early in the week. Good thing too.

- Sprott Junior Uranium Miners ETF (URNJ): Uranium. 67% loss on buy back. 3.5% cash positive.

- Fiverr International Ltd. (FVRR): Internet Services. 67% profit on buy back.9.6% cash positive.

- NuScale Power Corporation (SMR): Nuclear technology. 131% loss on buy back. 30% cash positive.

- NexGen Energy Ltd. (NXE): Uranium. 77% loss on buy back. 29% cash positive.

Exercise spreadsheet is not working thanks to an Excel problem - flying a bit blind till that is fixed.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

Jul 29-August 2, 2024

Thanks for sharing this beautiful article.....

Most tokens and shares are bearish. Very bad times. When will the good times come?

Investing is about the long term. Note the number on this post #719 - been doing this for a while. Plenty of stuff to learn from - do a search on #tib and your favourite topic and see what has happened. That is how I learn from my mistakes