Selloff weeks are the weeks to be quiet and take on the assignments - Europe Banks and Uranium this week. Did add some ASX stocks

Portfolio News

In a week where S&P 500 rose 0.02% and Europe rose 0.2%, my pension portfolio dropped 2.15%. The drags were much the same as the week before - Japan, uranium, De Grey Mining (DEG.AX) down 6.9% and Marriott Vacations (VAC) down 9.2%. 76% drop in Sunpower (SPWR) did not help. Nor did a one day drop of 40% in Honey Badger Silver (TUF.V).

Big movers of the week were Beamtree Holdings (BMT.AX) (30.2%), Heavy Minerals (HVY.AX) (20.2%), The Trade Desk, (TTD) (19.5%), Condor Energy (CND.AX) (18.5%), Sumitomo Chemical Company (4005.T) (14.1%), CoreNickelCo (CNCO.CN) (12.5%), Zinc of Ireland (ZMI.AX) (11.1%)

2nd week in a row with only 7 stocks in the big movers list. All the moves are news or results based. Good to see one Japan stock in the list after the huge selloff at the end of the week before and Monday.

Markets started the week with a huge selloff as the Japanese carry trade unwound and the jobs number implications sank in. The Bank of Japan stepped back from the rises rhetoric and markets calmed down enough to recover what was sold off

https://edition.cnn.com/2024/08/09/investing/global-market-meltdown/index.html

Good summary of the events from CNN - not sensational for a change

The Bank of Japan story has some way to go as they wrestle how to get out of the unconventional mode they have been in for the past 10 years. Maybe, just maybe, all the carry trades got unwound enough for this to not happen again. The Japan Times article is worth reading.

https://www.japantimes.co.jp/business/2024/08/11/boj-policy-path-risks/

Crypto Recovers

Bitcoin price started to recover in late Sunday trading and moved up 10% on the week with a trough to peak range of 26%

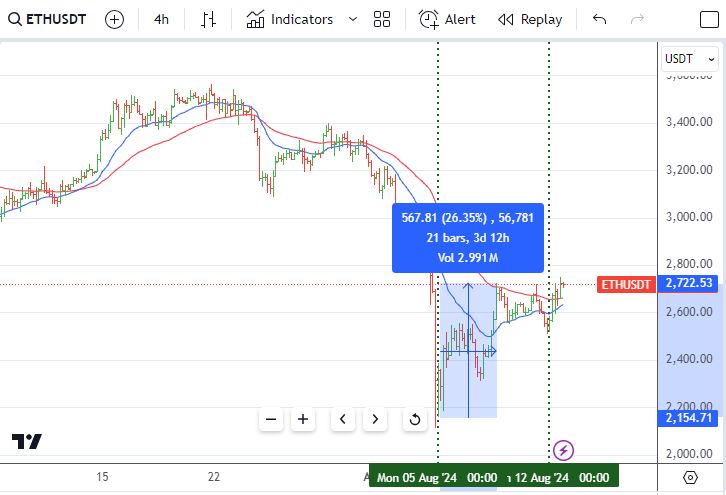

Ethereum price moved in much the same way with a 7.5% rise on the week and also a 26% trough to peak range.

The altcoins all moved about the same - a sample - Binance Coin rising 29% from the selloff lows

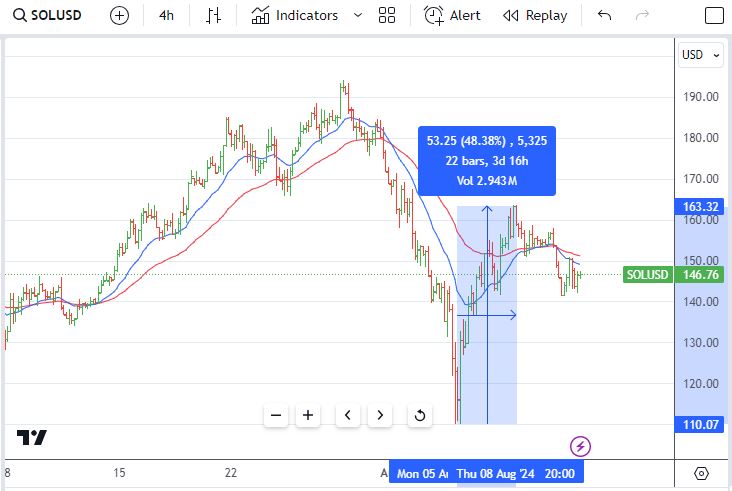

Solana (SOL) had a stronger move at one point being up 48% and ending 33% higher on the week

That move was not quite enough to take out 50% profit target on last entry (the blue ray) - got to 39%.

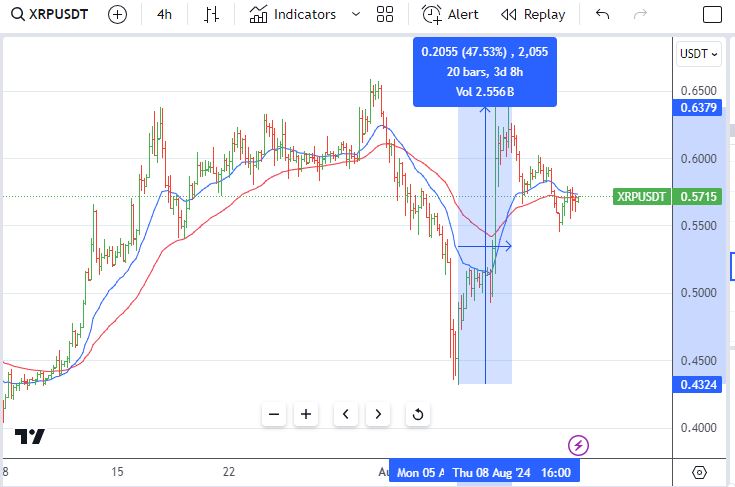

Ripple (XRP) also swung up 47% ending 33% higher as news swirls about the SEC case settlement.

Helium (HNTBTC) popped 64% on the back of big growth in Helium Mobile users

Stellar ((XLMETH) popped 33% before giving back half the gains.

Uranium Holdings

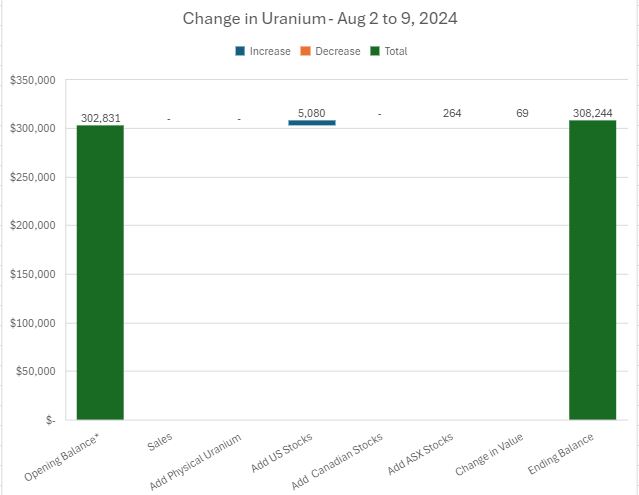

Made a few small aditions to uranium holdings to increase the amount invested - overall value was essentially the same for the week. Biggest change was share of portfolio jumped 0.7 percentage points to go over 15%

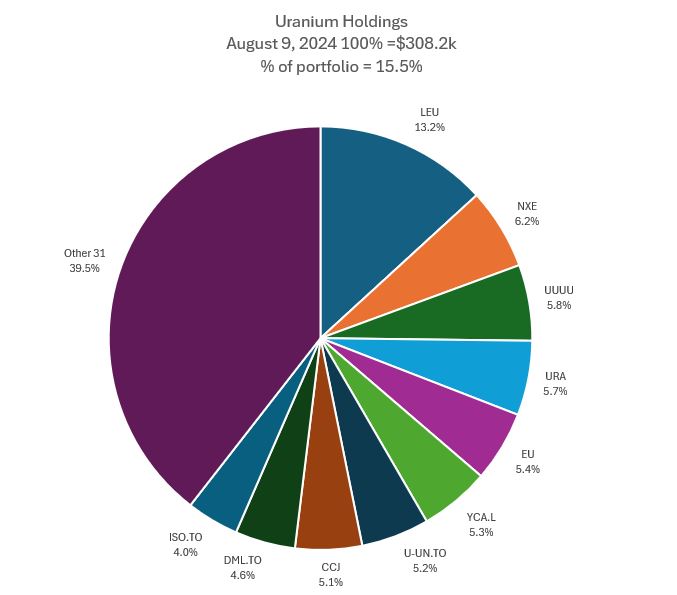

Mix changes with Global X Uranium (URA) swapping places with EnCore Energy (EU) after the add made. The spike in spot prices sees Sprott Physical Uranium Trust (U-UN.TO) rise 3 places. Dension Mines (DML.TO and IsoEnergy (ISO.TO) swap places. Share of Others rises just under 0ne percentage point

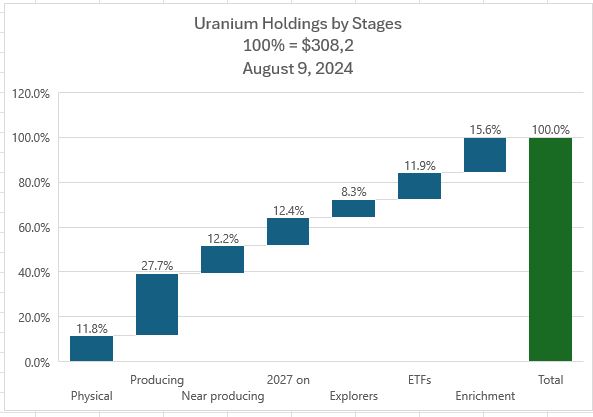

A few shifts in the stages chart with the share of Physical up nearly a point and the increase of ETF holding by a point. The key takeaway is the share linked to physical or production or near production is well over 50% especially given the share of the ETF's that are near production.

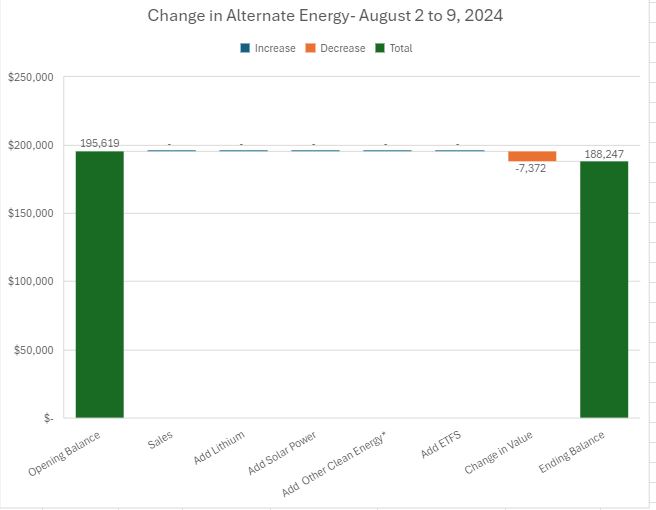

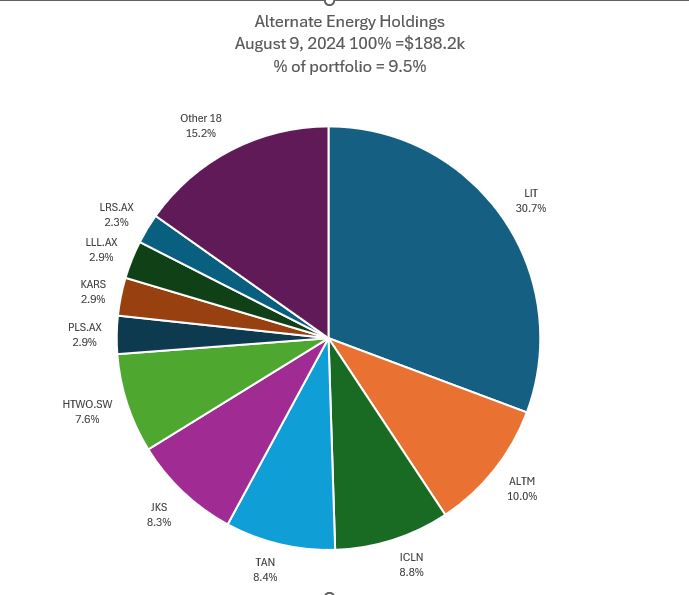

Alternate Energy Holdings

Overall value of alternate energy holdings drops 3.8% but share of portfolios stays consistent at 9.5%

With no sales or additions the mix of holdings changed on values only - Pilbara Minerals (PLS.AX) moves up 3 places. Share of Others drops nearly 2 percentage points.

Bought

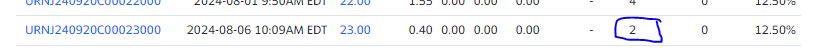

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Assigned early on sold put - breakeven at $21.90 on this trade is a massive 18% above the $18.57 close (Aug 6) making another hold for the very long term. Wrote covered call for 1.8% premium with 5% price coverage.

Options chain shows this was the market for the day - in time liquidity will improve in this options market.

Energy Fuels (UUUU): Uranium. Assigned early on sold put - breakeven at $6.47 a whopping 37% above the $4.70 open (Aug 7) making another hold for the long term.

Commerzbank AG (CBK.DE): German Bank. Assigned early on sold put - breakeven at €14.46 - 17% above €12.30 close (Aug 8). That feels like a stretch but entry was lower than the stock was assigned at in July. Breakeven in managed portfolio after 4 months of sold put writing - €13.94 - a little less of a stretch at 13.3% above.

Société Générale SA (GLE.PA): French Bank. Assigned early on sold put - breakeven at €23.49 - 15% above €20.42 close (Aug 8). These two bank entries are holds for the longer term on stocks that have lagged the Europe banking sector.

Sold

No sales

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Australian Finance Group Ltd (AFG.AX): Financial Services. Averaging down. Dividend yield 6.60%

Chart shows price breaking downtrend and rolling into 2nd cycle higher. Maybe this time it will hold the break - trade does average down entry price

DEXUS Property Group (DXS.AX): Property. Dividend yield 7.00%

Chart is a weekly chart shows price has been on a slow drift downwards with the latest entry the lowest price achieved so far. The broad idea is the chart is bottoming out and price will move higher as soon as the first rate cut arrives. Aim for this holding is to exit at breakeven.

Hedging Trades

The Technology Select Sector SPDR Fund (XLK): US Technology. With price opening at $205.45 (Aug 7) and trading higher rolled the ratio portion of 217.5/212.5 ratio put spread to 210 strike Sept 13 expiry.

Did not share a chart when the trade was opened in July. The chart shows the bought put (217.5) as a red ray and the sold put (212.5) as a dotted red ray wth expiry the first green vertical line. With the big selloff, price dropped below that sold put level opening up the risk of being assigned the contracts in the ratio. This trade then pushes the ratio part down (210) and out in time. Will not be surprised to see price trading above that 210 level before September expiry - if not, quite happy to enter at that level as it is just above the cycle low around 205.

Hecla Mining Company (HL): Silver Mining. Scaled into holding as a hedging opportunity. Wrote covered call for 2.04% premium with 22.7% price coverage. Must say I do like being paid to hedge.

Income Trades

Quiet week for covered calls writing with only 4 written across 4 portfolios, all US 4

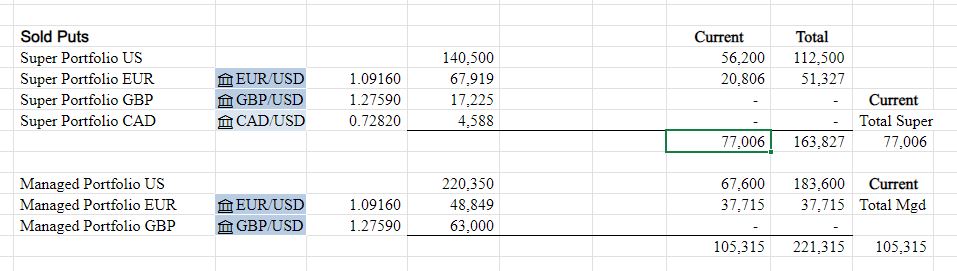

Naked Puts

A busier week for kicking the can down the road on sold puts. The approach here is to choose up days to move the chance of assignment out a month - am happy to own any of the stocks when there is sufficient margin in the accounts to make the purchases

- The Technology Select Sector SPDR Fund (XLK): US Technology. 485% loss on buyback. 15.6% cash positive.

- Centrus Energy Corp. (LEU): Uranium Enrichment. 37% profit on buyback. 47% cash positive.

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. 193% loss on buyback. 13.2% cash positive.

- DHL Group (DPWA.DU): Europe Logisitics. 383% loss on buyback. 11.5% cash positive.

- Société Générale SA (GLE.PA): French Bank. 470% loss on buyback. 4.6% cash positive.

- NexGen Energy Ltd. (NXE): Uranium. 212% loss on buyback. 37% cash positive.

- NexGen Energy Ltd. (NXE): Uranium. 154% loss on buyback. 157% cash positive.

Credit Spreads

No spreads active as margin is tight. Exercise risk for the current month is under the required levels and things are shaping that will let the few outstanding go to assignment.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

August 5-9, 2024

👏 Keep Up the good work on Hive ♦️ 👏

❤️ @idayrus suggested sagarkothari88 to upvote your post ❤️

🙏 Don't forget to Support Back 🙏

#hive #posh