A crunch week for markets at the end of the US summer holidays. Focused on raising capital to manage exercise risk for weeks like this

Portfolio News

In a week where S&P 500 dropped 4.14% and Europe dropped 3.64%, my pension portfolio dropped a larger 4.89%. The drags were across the board with quite a few stocks droppng over 24% - e.g., nuclear technology, electic vehicle charging, Bitcoin mining, battery technology, helium exploration, base metal and lithium mining, silver exploration, Canadian uranium exploration

Big movers of the week were Lifeist Wellness (LFST.V) (11.1%), Articore Group (ATG.AX) (10.7%).

Not seen a week like that for a while - only two stocks on this list. Going to need some products from one of them to soothe the nerves.

Markets started the new month and continued the nerves about big tech from the week before. And then along came the US jobs number which was a little softer than expected. Normally, the market would view this as more positive than negative as it signals the Federal Reserve is more likely to cut rates in September and maybe closer to the 50 basis points than not.

There is a reason for the "sell in May and come back in October". All the experienced investors and investment managers are on holidays. The young people left behind cannot calm their clients and panic comes along. Just got to hope Jerome Powell can calm the nerves when the Fed meeting begins on September 17 - the quiet period ahead of the meeting has started.

Crypto Stumbles

Bitcoin price pushed higher to start the week and then fell over ending the week 4% lower with a peak to trough range of 11.9%. Good to see price imprving in the new week in line with US market mood.

Ethereum price move was a bit more subdued ending the week down 5.4% with a peak to trough range of 16.2%. Mood in the new week was also more subdued

Cardano (ADA) found some buyers with a it of a spoon shaed week ending 3% up.

Some light in the gloom - Aave (AAVE) up nearly 20% and still going

A few more like that - Avax (AVAX)

Helium keeps going with a move of 29%

Something put a rocket under Quantum (QNT) up 29%

Uniswap too (UNI)

Uranium Holdings

Market has been holding its breath ahead of the World Nuclear Symposium which brings together uranium buyers and aspiring producers. My X feed has been filled with commentary and speculation. Well there were no startling revelations about contracts and no movement in uranium prices. There was a lot of talk about future demand from AI and China plans fo the very long term.

Some of this has to do with a broader commodities selloff this week, but a broader malaise around the uranium spot price also appears to be setting in.

https://www.energyintel.com/00000191-c86b-d88e-a7fd-e97b18cc0000

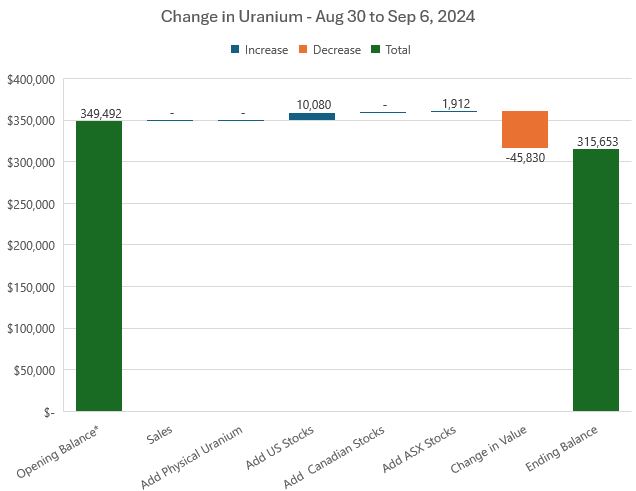

Uranium holdings dropped 13% in value of which 8% came from the mark to market of Sprott Junior Uranium Miners (URNJ) - see below. This is now the time for the long hold

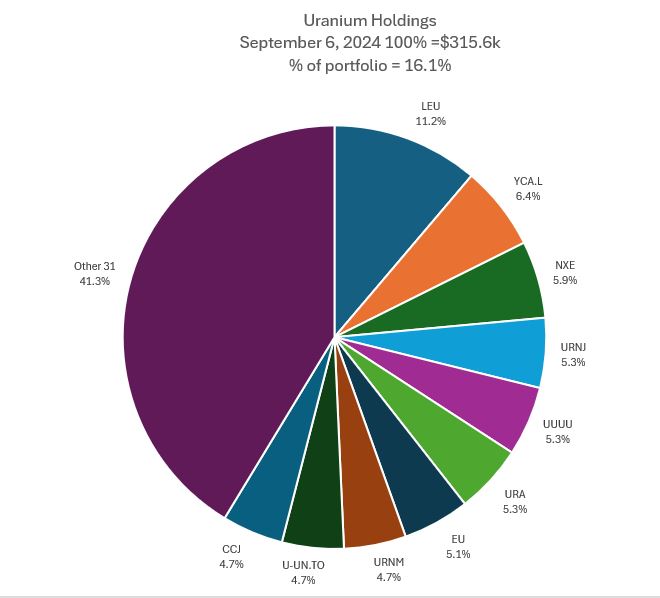

Mix of holdings changed with uranium as a share dropping to 16.1%. That 13% drop in valuation was way bigger than the drops in the portfolios. The addition of Sprott Junior Uranium Miners (URNJ) jumps it into the Top 10 at position 4. EnCore Energy (EU) swaps places lower with Global X Uranium ETF (URA). Cameco (CCJ) drops two places and Denison Mines (DML.TO) is pushed out of the Top 10. The shape is getting the way maybe to invsest in the sector - stop trying to pick winners and rely on the ETF's and the physical uranium holdings.

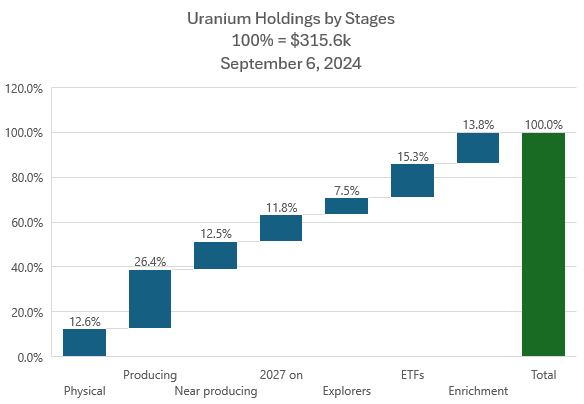

Biggest change in the uranium by stages holdings is a nearly 2 percentage points jump in ETF's. I did some analysis last week of the two Sprott ETF's holdings to map where they are in terms of physical, producing and so on. Will dig those out and do the detail next week

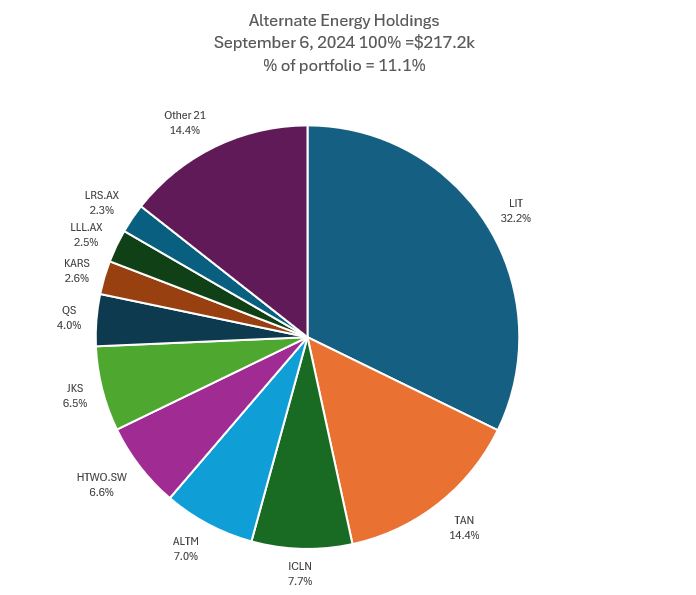

Alternate Energy Holdings

There were no changes in alternate energy holdings this week. BUT there was an ugly 8.9% drop in valuation. That fall came right across the board as market fear went into all the commodity sectors. Share of the portfolio also dropped from 11.2% to 11.1%

Quite a few moves in positions with the iShares Clean Energy ETF (ICLN) going up one place and displacing Arcadium Lithium (ALTM), who announced plans to put their Mt Caitlin mine into care and maintenance. The L&G Hydrogen ETF (HTWO.ETF) also went up one place displacing Jinko Solar (JKS). The KraneShares Electric Vehicles ETF (KARS) went up one place displacing Latin Resources (LRS.AX) which drops to 10th place. Their is a thread emerging here - the ETF's are holding ground better than the individual stocks - a lesson in there for upcoming sales (invest the proceeds in the ETFs)

Bought

Took some action to average down entry prices in uranium sector. Taking a different tack for this - focus on enrichment, producing and near producing. Sense is that the supply deficit is going to come as a crunch and anyone able to deliver is going to jump in value.

Silex Systems Ltd (SLX.AX): Uranium Enrichment. Big jump in SWU's and a pop in price - chart is still diabolical

Peninsula Energy Limited (PEN.AX): Uranium. Released update reiterating that progress to reopening Lance Project in Wyoming are on schedule for Q4 2024. A good chance to average down and scale in the holding.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Assigned early on a sold put which was part of a call spread risk reversal. Can no longer say the call spread was a free trade as there is some way to go to recover the mark to market situation. Breakeven after a few losing rolls of the sold put is $25.20 a far cry from the $16.83 close (Sep 6). Invested for the very long haul on this - maybe what I will be doing is as individual stocks get to breakeven, close out and rely on the ETF holdings.

Sold

FMC Corporation (FMC): Food Products. Sold to raise capital to cover margin risk for 1.7% blended loss since March/July 2024. Income trades covered the capital loss 3.9 times. Stock screen idea which was running OK until the last two weeks market selloff. .

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Auto Invest

Keeping this going as a model of dollar cost averaging - $400 across the uranium counters with $160 on the ETF and $60 each on the others. $200 split equally for the index ETF's

Global X Uranium ETF (ATOM.AX): Uranium.

Elevate Uranium Ltd (EL8.AX): Uranium.

Terra Uranium Ltd (T92.AX): Uranium.

Silex Systems Ltd (SLX.AX): Uranium Enrichment.

Global Uranium and Enrichment Ltd (GUE.AX): Uranium.

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Distributions Yield 3.5%

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index Distributions Yield 1.6%

Top Ups

Orora Limited (ORA.AX): Packaging. Orora announce sale of North American Packaging business which pops price onto stock screens. Averages entry price a little. What the deal does is free up capital to reduce debt and ramp up canning plant in Queensland. Dividend yield 4.00% - new tranche did not meet the ex date.

Chart shows price has broken the last short downtrend and pushed higher on earnings with the plant sale adding another pop. Trade averages down entry price but did miss the ex dividend date. Get back to the previous highs and exit time.

Mirvac Group (MGR.AX): Property. Dividend Yield 4.40%

Chart shows price has dropped down to support level (red line) drawn in after the last trade (left hand blue ray) and bounced back. Trade averages down entry price a little. There is not quite enough headroom to make the 25% profit target at the 52 week high (green ray). Needs to break out the top of those highs. A rate cute from Reserve Bank Australia will help (no longer meeting every month)

Hedging Trades

The Technology Select Sector SPDR Fund (XLK): US Technology. With price opening at $208.16 (Sep 5) and trading higher at start of trade rolled out September 13 expiry 210 strike sold put to October 11 at same strike. What this does is leave a 215/210 diagonal put spread (one week difference in expiry) and a naked October 210 strike put. Am thinking the market will recover the minute the Federal Reserve decides to cut rates. If not, will be buying at 210

Income Trades

Covered Calls

Need to raise some capital in pension portfolio to manage exercise risk. This requires closing out covered calls and then selling stock.

DHL Group (DPWA.DU): Europe Logistics. Closed out covered call and naked put (price getting a bit close to exercise strike) - locks in 262% net profit (mostly from the sold put) to be able to sell the stock holding. Out of patience with the stock and Europe.

FMC Corporation (FMC): Food Products. 47.2% profit on buying back the covered call to be able to sell the stock

Naked Puts

A few new sold puts at prices lower than current price

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 10% and 12% Coverage -4% - makes for a good net entry level if they get assigned.

- Engie SA (ENGI.PA): French Utility. Return 1% and 12% Coverage 0.2% - buying cover for an uncovered sold call below the current market level

Rolled a few sold puts to reduce Septmebr expiry risk.

- NexGen Energy (NXE): Uranium. 22.3% Profit on buy back. 26.7% cash positive

- Fiverr International (FVRR): Internet Services. 56% Profit on buy back. 29% cash positive

- NuScale Power Corporation (SMR): Nuclear Technology. 36% Loss on buy back. 8% cash positive

- Technology Select Sector SPDR Fund (XLK): US Technology. 66.8% profit on buyback. 86.3% cash positive

Credit Spreads

None open

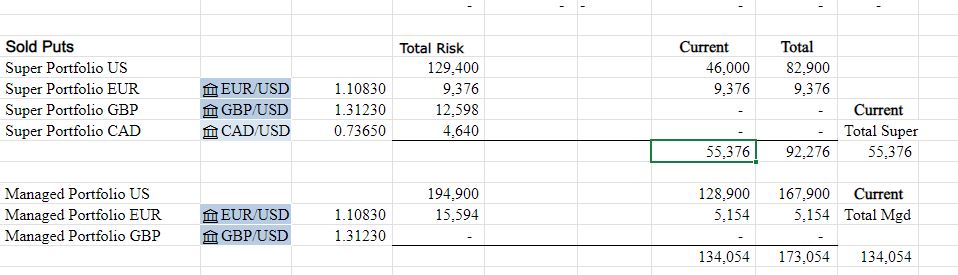

Exercise risk in pension portfolio is reduced enough. Some big exposure in managed and personal portfolio from Technology Select Sector SPDR Fund (XLK). Will fix that next week and hope market rises to lift the water.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

September 2-6, 2024

#hive #posh

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Good thing the week’s trades made more than $0.15.

I write these posts to document what I do and to teach. Seems that I am the pupil.

So sad that nobody else is writing like this